Why not peg MTR fares to the price of its shares?

The public "pays" for the MTR by allowing them to build on top of stations ... Should they benefit from the profit with reduced MTR fares?

E-mail from a friend

The vexed question of fare levels on the Mass Transit Railway raised itself again last week, with the government saying it would review the MTR's fare adjustment mechanism.

The word 'review' in this context means pushing fares down, not up, in case you didn't know, and it's the MTR's own fault for pushing net profits past the HK$10 billion mark last year.

But I'm not sure I buy my friend's suggestion that the grant to the MTR of profitable development rights over its stations is a reason to reduce fares. These rights were granted to pay for the rail lines' construction, which sets the MTR on an even basis with other public transport operators.

We don't charge bus companies for using the roads. These roads were built at public expense but bus companies get them free. We thus also give the MTR its physical infrastructure for free through land grants.

In fact, we haven't always been this kind to the MTR. We have hung around its neck that financial dead goose, the Airport Express. They hide just how much money it loses, but it's a lot. We also forced the MTR to swallow the Kowloon-Canton Railway on disadvantageous terms and we burden it with new projects like the South Island Line, which do not really have the population catchments to justify a metro system. It all costs us money. What we have at issue in this review is whether the MTR makes enough money from fare revenues to cover its recurrent expenses and give a decent return to its minority shareholders. Yes, I know it was a silly idea to float this thing on the stock market, but that's water under the bridge now.

The mechanism is a crude one that has been applied to all public transport companies. It limits fare increases to a 50/50 mix of changes in the consumer price index and changes in wage levels for transport workers less a very small percentage for improvements in productivity.

It doesn't fit the MTR. The corporation doesn't buy consumer goods, and wages amount to only 32 per cent of its recurrent costs. Meanwhile, factors not accounted for in this mechanism - such as energy prices, imported capital goods prices and interest rates - account for more than half of costs. That's a square peg in a round hole. Far better would have been to regulate fares by limiting profits to a percentage of fixed investment as is done with the power utilities. But this approach also has its loud critics and is therefore politically unacceptable. It would be so anyway, as the MTR is less profitable than the power utilities, with a return on equity of only 8.5 per cent on transport operations, which would indicate that a fare increase is in order. We can't have that from a government initiated fare review.

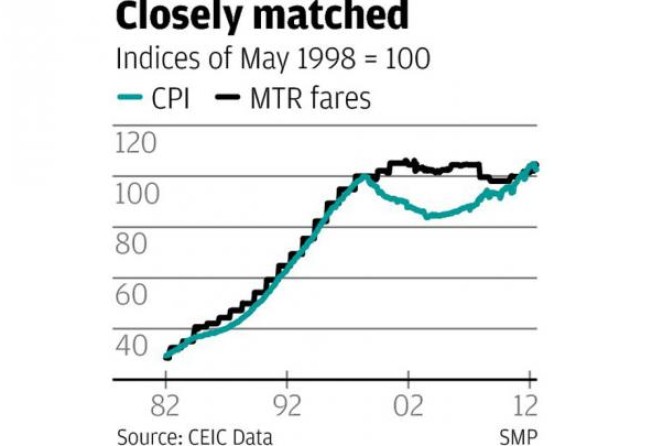

In fact, there is really no satisfactory solution. All one can say is that past ways of doing things have matched MTR fares closely to the general trend of the CPI, as the chart shows.

This is at least still better than the government's current suggestion of setting fares on the basis of "public affordability and acceptability", which is double talk for squeezing them juiceless. It's a bad idea because mispricing transport is a sure recipe for transport chaos.

Here's my solution: we shall pretend we have a mechanism, but we shall actually set fares by reference to the MTR's share price. Stronger than the Hang Seng Index and we cut fares, weaker and we raise them.