How John Tsang's 'cooling' measures turned up the heat on the poor

Unknown to most, proposed tax measures had quietly but steadily deflated the bubble that was threatening to push property prices to sky-high levels after Financial Secretary John Tsang Chun-wah's announcement to rein in the market.

South China Morning Post, February 21

I'm not quite so sure. This needs a little refinement and we start with the pictures, as so often in these matters of supply, demand and price.

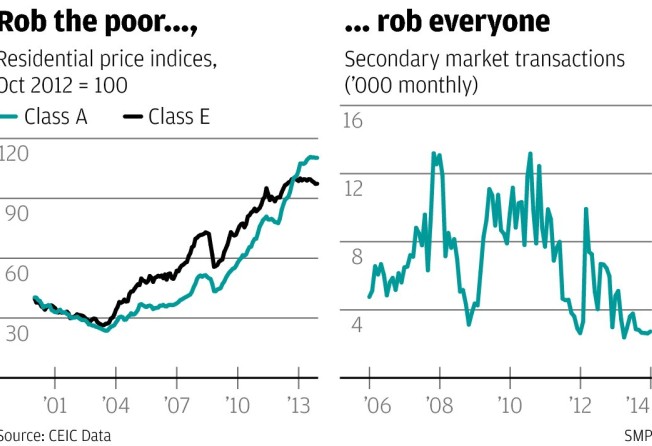

The government publishes an official residential property price index, which is further broken down into five categories, from Class A for flats of less than 40 square metres to Class E for flats of over 160 square metres. The first chart shows these two rebased to a value of 100 for October 2012, when Mr Tsang introduced the first extra stamp duty.

But the measures obviously did little to restrain prices for small flats. These continued to shoot up. Since late 2007 they have risen by about 150 per cent while prices for the largest flats have gone up by only about 50 per cent.

And while it is true that more recently prices for small flats have flattened out (ed: Sad one, Jake), this has been a general international trend. It shows up elsewhere in Asia, in most US cities and in Europe, where really only London, that magnet to the world's big crooks, still has a booming property market.

This should not be surprising. Housing prices everywhere in recent years have been driven up not by shortages of supply but by ultra-low interest rates, a form of robbery pioneered by the US Federal Reserve Board for use on people who save money.

Now that the Fed is talking, very tentatively, of unwinding these easy money policies, housing prices everywhere show tentative signs of weakening. It is exactly what one would expect. John Tsang's measures have nothing to do with it.

What he has done with these measures, however, is take the heat in the market out from under the rich and put it under the poor. It is my belief that prices for those small flats would never have risen quite so strongly after October 2012 if he had not concentrated market attention there with stamp duties that restrained prices increases for the largest flats.

What he has also done, as the second chart shows, is slow down the pace of the market. The present extraordinarily low number of transactions is something we normally associate with a property collapse or financial crisis. This, more than price, is obviously what now has estate agents moaning.

I am not in sympathy. They have ruined enough neighbourhood shopping districts with their garish marketing outlets. But it does mean more trouble for you, and probably worse terms, should you need to move house.

John Tsang will still clap himself on the back, however. Government always succeeds in everything it does. Didn't you know?