Both sides will lose out if India tries to target Chinese companies

Businesses including major mobile phone manufacturers are at risk of being dragged into the border stand-off between the two nations

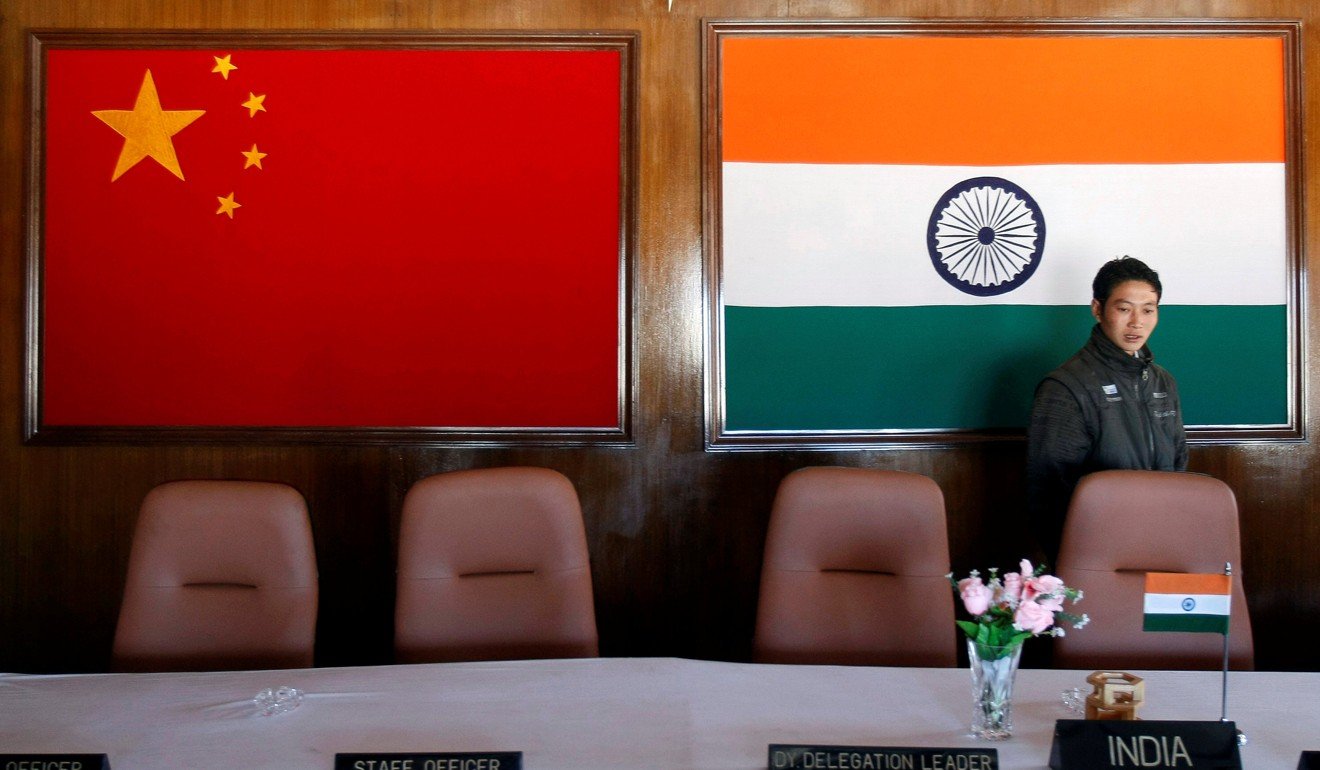

China and India’s border stand-off in the Himalayas is finally rippling down to businesses in the two countries.

Since last week, Chinese firms in India, especially mobile phone vendors, have faced a wave of scrutiny and questions from government bodies and the media.

According to a report in The Times of India newspaper, the Central Electricity Authority (CEA) is drafting a plan for India’s power stations and smart grid systems to protect against cyber attacks, including conditions that could make it difficult for Chinese companies to compete for contracts.

India’s ministry of electronics and information technology asked 21 smartphone makers, most of them Chinese, to provide details about their “safety and security practices, architecture frameworks, guidelines and standards”.

Considering the rampant data leakage across India, the regulators’ concerns about mobile phone makers are not groundless.

However, the recent move has been compounded by the fierce competition between Indian manufacturers and Chinese ones.

In the first quarter of this year, Chinese mobile phone manufacturers’ market share in India was about 51 per cent. Chinese brands, including Xiaomi, Vivo and Oppo, are beating Indian brands.

The Indian media have said that Chinese smartphone players are squeezing out domestic mobile manufacturers.

Until only four years ago, home-grown brands had dominated the Indian market. However, they are now struggling under Chinese competition. It is not hard to understand that such a situation has increased their resentment towards Chinese brands and heightened the appeal of protectionism.

Early this April Narendra Bansal, the founder of Intex, an Indian mobile vendor, appealed for “anti-dumping duties” on Chinese handsets, similar to those imposed on low-priced steel imports from the country.

However, Indian Prime Minister Narendra Modi, sent out a different signal. Less than a week before Bansal’s criticism of Chinese mobile brands, Modi met Lei Jun, the founder of Xiaomi to welcome Chinese investment in his Made in India plan to boost manufacturing in the country.

India’s top policymakers seem know better than many of their compatriots that protectionist measures will not help Indian local brands to compete against Chinese opposition.

This June, Vivo beat Pepsi to acquire another five years’ sponsorship of the Indian Premier League, the most popular cricket league in the world, at a cost of US$330 million. Similarly, Oppo has hired a number of Indian film stars to help promote its products – meaning Chinese firms have managed to leverage two of Indian’s cultural icons – cricket and Bollywood.

When the Indian media comes to analyse the success of Chinese mobile companies, it is likely to attribute it to competitive pricing and aggressive marketing. This is partly true, but the manufacturing supply chain matters more.

This March I visited the office of Zhang Jianbing, a Chinese businessman, in the centre of Shenzhen, a major Chinese manufacturing centre.

He had lived in India for years, helping Indian mobile phone brands to find the right factories in Shenzhen.

“China is the hub of mobile phone manufacture with a full supply chain. It is impossible for mobile phone makers to find a more ideal place. Indian brands completely rely on our manufacturing supply chain here. Most of them do not have their capacity to design and produce by themselves. That’s the very reason why their markets are being eaten by ours,” Zhang told me.

In other words, even if Chinese brands are driven out of Indian market, the ultimate winners will not be local brands.

It is more likely that other foreign brands, such as Samsung, will profit from this conflict.

Given the increasing economic links between China and India, the hostility against Chinese enterprises will lead to other issues. Although India’s trade deficit with China is widening, India’s economic presence in China is growing very fast.

Dangal, a Bollywood blockbuster and symbol of India’s growing soft power in China, has collected over US$190 million at box office there – the first time that a Bollywood blockbuster has done better at the Chinese box office than in its home market.

Chinese youths are longing for more Bollywood movies.

Besides, very few Indians are aware that a dozen of Indian companies also are operating very successfully in China. One example is Infosys, an Indian outsourcing company, which employs more than 3,000 people in Shanghai.

In addition, it is worth studying what happened in March when South Korea announced it was going to deploy the THAAD missile defence system in the face of the North Korean threat. Infuriated China imposed unofficial sanctions against South Korean enterprises. The measure did little to further China’s goals and only served to undermine its credibility as a responsible force.

In a global context, China and India are interdependent. The policymakers of both nations should figure out a way to avoid a lose-lose situation.

Hu Jianlong is an entrepreneur and a freelance writer based in Bangalore, India. Hu was a Fulbright/ Humphrey Fellow in 2015-2016