Beijing may talk about a tighter grip, but money keeps flowing out of the country

The People’s Bank of China’s accounting methods belie claims that foreign exchange reserves are rising and capital outflows easing

Beijing is expected to maintain a tight grip on capital outflows despite foreign exchange reserves rising for a fifth straight month in June, analysts said.

SCMP, July 11

Here is a little secret about how the People’s Bank of China treats foreign reserves at home in its own books.

It calls them foreign assets, it expresses them only in yuan and not in US dollar terms as it does the separate foreign reserves entry and, most of all, it shows them at the original cost of acquisition, not at current market values as it does for foreign reserves.

Fortunately, with a drawdown in reserves and a somewhat weaker US dollar this has now become only about US$190 billion or about 60 times capital. No, they never rushed to tell you about all this.

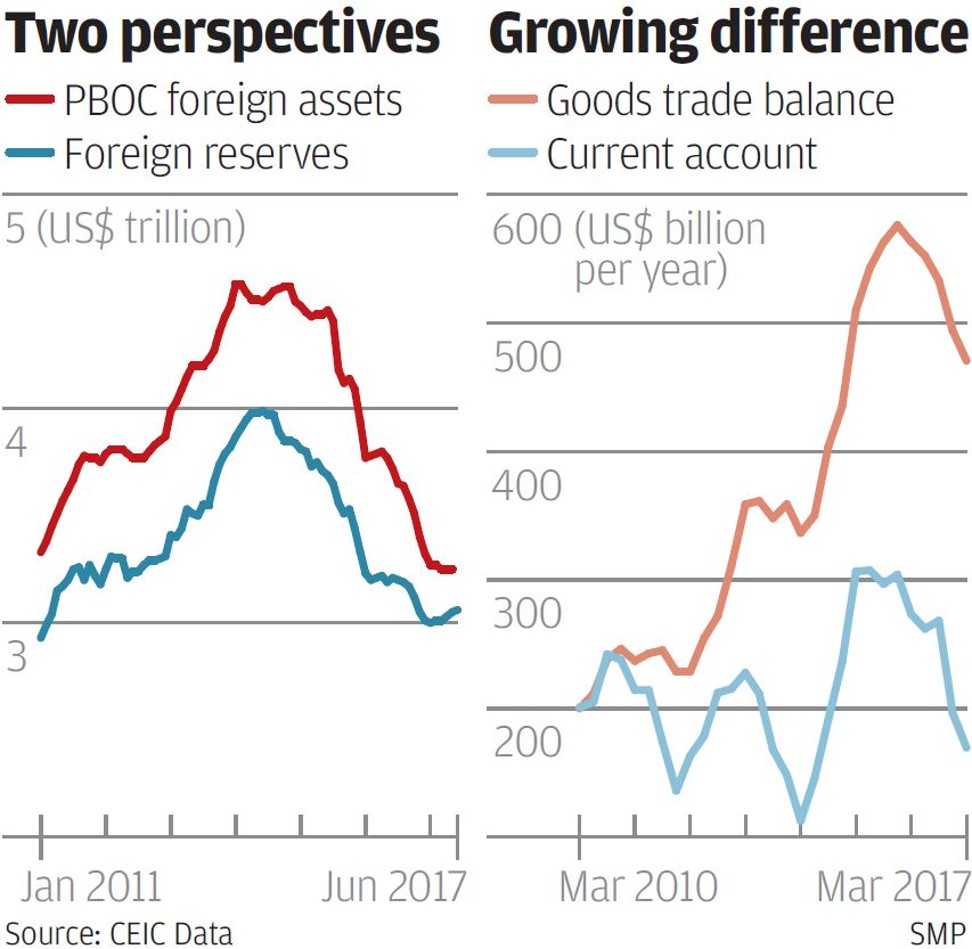

But the reason I tell you now is that the contrast between these two accounting treatments also allows me to tell you that, as the first chart shows, foreign reserves have not really risen for the last five months, not as in a return to a build-up of reserves.

All that has happened is that the reserves have risen in US dollar terms because their non-US dollar components have risen in dollar terms with a weaker dollar. I know this because the PBOC’s yuan accounts continue to show foreign assets declining. It’s slow but it’s still down.

Even this, however, does not tell you the full story about capital outflows. The reserves are only a balancing item on the balance of payments.

Thus if the current account, which represents trade transactions, shows a US$170 billion net inflow and the capital account, which represents investment transactions, shows a US$170 billion outflow, the two will be balanced and that balancing item of foreign reserves will not change.

But there will still have been that US$170 billion capital outflow despite the tight grip exerted by the authorities. And this is what has transpired over the last year, right to that US$170 billion number.

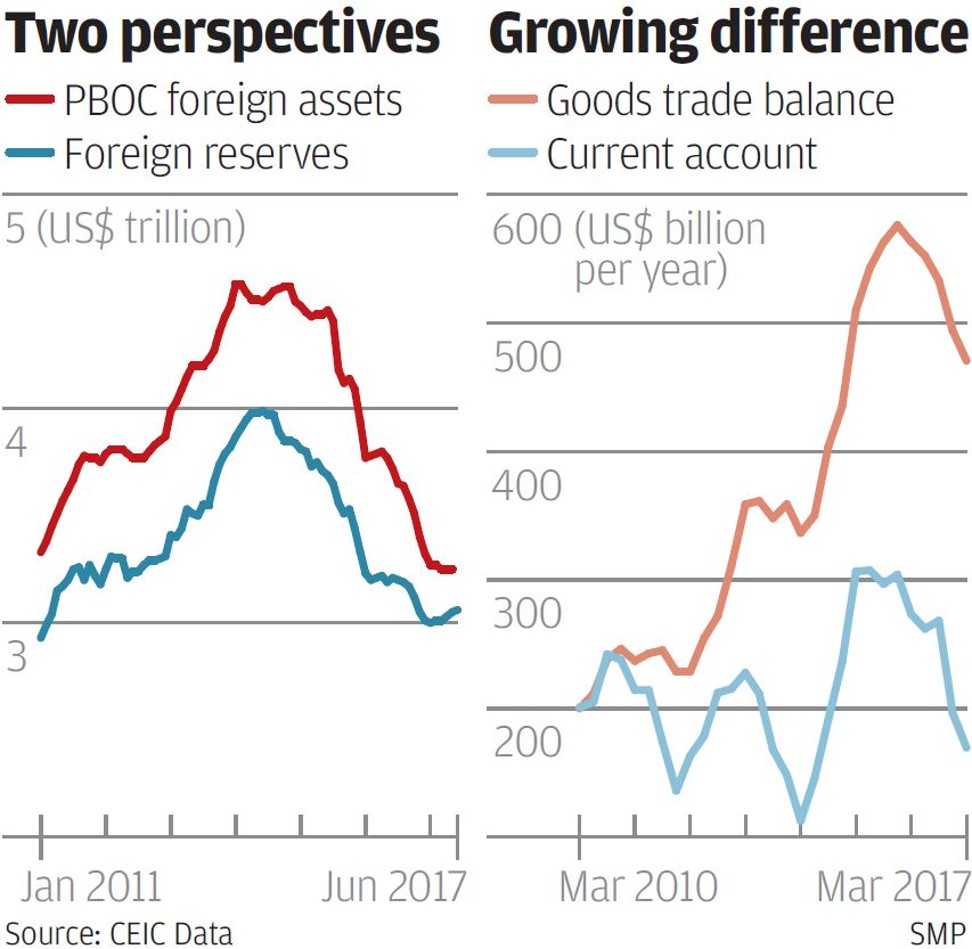

In fact, it is probably more than this. The second chart shows you that the current account and merchandise trade balances were equal in early 2010. Since then other trade components of the current account have gone into deficit so that the current account surplus is now barely a third of the trade surplus.

Two trends are notable here. For one, mainland tourist spending per person has unaccountably doubled over the last five years. I suspect that at least US$100 billion a year of this is people stashing, rather than spending, money abroad.

There was also a big plunge in net unrequited transfers over the last five years. I would guess about US$40 billion of this is undeclared capital flow.

Thus the exodus continues, slower, but still flowing out.