Developers sell debt as home prices surge

Mainland developers market US dollar bonds on the back of property boom

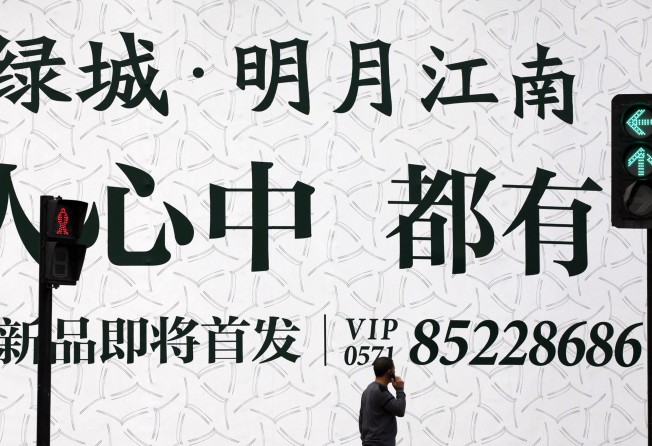

Developers Cifi Holdings Group and Greentown China are marketing US dollar-denominated bonds four months after selling debt as new home prices in Beijing, Shanghai, Guangzhou and Shenzhen surge.

Cifi, the Hong Kong-listed developer, is offering five-year debentures to yield about 9.25 per cent while Greentown is marketing subordinated perpetual securities at a yield of about 9.25 per cent also, people familiar with the matters said.

China South City Holdings, the logistics company in which Tencent said last week it would invest, is marketing five-year bonds to yield about the high 8 per cent area.

The cost of property in cities the government considers first tier is escalating in the absence of broader curbs. New home sales exceeded US$1 trillion for the first time last year, the National Bureau of Statistics said yesterday, after figures released last week showed new home prices climbed 20 per cent in Guangzhou and Shenzhen in December from a year earlier.

Premier Li Keqiang has not imposed additional nationwide measures to cool the market, instead leaving it up to individual cities to impose their own restrictions.

"Good reports from China's property sector are another plus to an overall positive story emerging from the country," said Steve Wang Wei, the Hong Kong-based head of fixed-income research at BOCI Securities. "Developers are the largest issuers out of China so we'd expect quite a few more to come to the dollar bond market."

Cifi and Greentown were two of the first companies in Asia to sell speculative-grade US currency bonds in September after a two-month junk issuance hiatus.

Cifi sold US$225 million of its notes due 2018 on September 11, while Greentown raised US$300 million selling 8 per cent bonds due 2019 five days later.

Mainland and Hong Kong-based borrowers sold a record 56 per cent of Asian offerings denominated in US dollars last year. Yuzhou Properties, which according to its website is the biggest developer in the coastal city of Xiamen, sold US$300 million of 8.625 per cent notes due 2019 on January 17.

Almost 90 per cent of the bonds went to investors in Asia while 60 per cent were placed with fund managers, said another source.