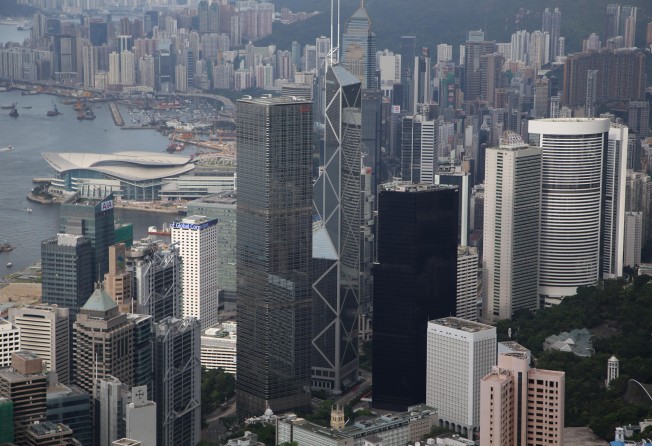

City's upper floor offices world's most expensive

Investors are willing to pay more than twice as much for offices on the upper floors of Hong Kong skyscrapers than for equivalent space in Manhattan, broker Knight Frank said.

Workspace at "nose bleed" level in skyscrapers, which commands the highest rent, is selling for US$69,222 per square metre in Hong Kong compared with US$42,283 in second-ranked Tokyo and US$25,740 in Manhattan, the London-based broker said in a report yesterday. Five of the 10 most expensive cities were in Asia-Pacific, it said.

"While Hong Kong and Tokyo are too far ahead to lose first and second place, I see some competition among Manhattan, London and Singapore in the coming year," James Roberts, head of commercial research at Knight Frank, wrote in the report.

Rents in Central, which has the world's second-most expensive office occupancy cost, will rise 15 per cent this year as demand from banks increases, Credit Suisse analysts led by Joyce Kwock forecast in January.

Meanwhile, rents outside the area are climbing faster as financial-services companies seek alternative locations, according to CBRE.

In Manhattan, financial companies are reducing their space needs or cutting costs and technology and media firms are favouring older buildings, limiting rent gains. JP Morgan Chase is moving about 2,000 employees to cheaper Brooklyn after reviewing its property holdings.

Singapore, the world's costliest city to live in, and London were the next most expensive locations - with skyscrapers valued at US$23,810 and US$23,767 per square metre respectively - and may swap places next year, Roberts said.

Office rents in Singapore rose 4.2 per cent in fourth quarter of last year, the biggest increase in the Asia Pacific region, according to broker Jones Lang LaSalle.

London had "renewed confidence thanks to better than expected economic growth and rising rents in the office market", Roberts said. "Given the economic uncertainty in emerging markets, in 2014 we will probably see some of the Asian cities slide down the table."

Sydney, Beijing, Shanghai, San Francisco and Moscow rounded out the top 10, with values ranging from US$18,392 to US$13,333 per square metre.