Hong Kong home prices scale new peak, 20 years after 1997 record

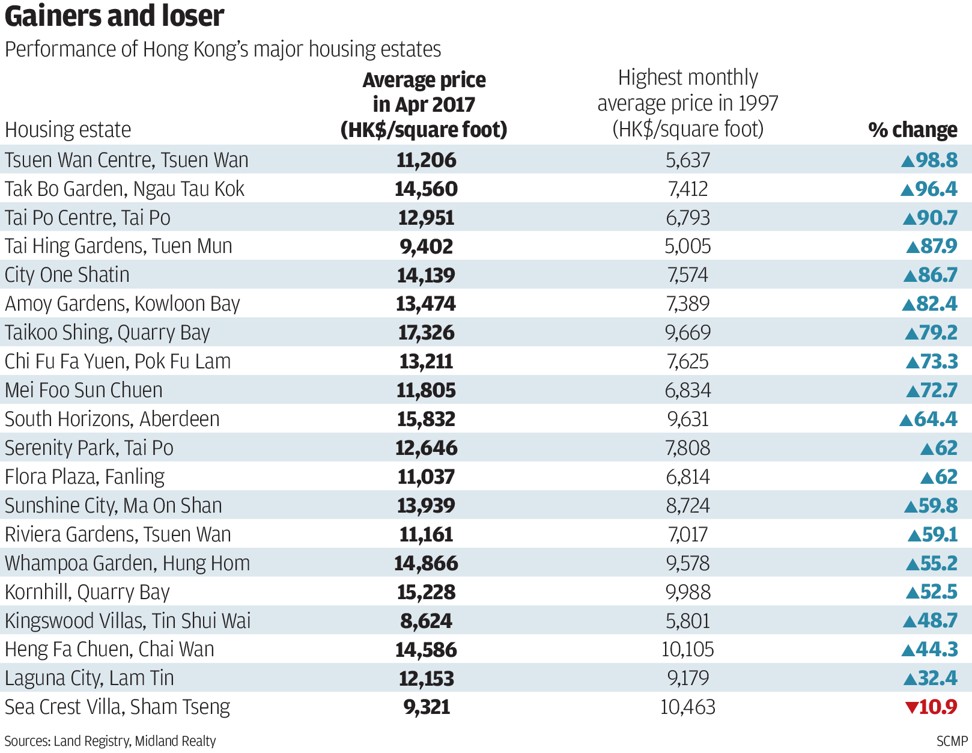

In 1997, a 451 square foot flat in City One Shatin – a housing estate popular with residents and investors alike – cost HK$3.06m, but that’s now doubled, according to data by Midland Realty

Hong Kong carries the dubious honour as the world’s least affordable city to own a home, but many property industry veterans still firmly believe they can do no wrong in buying a residence here.

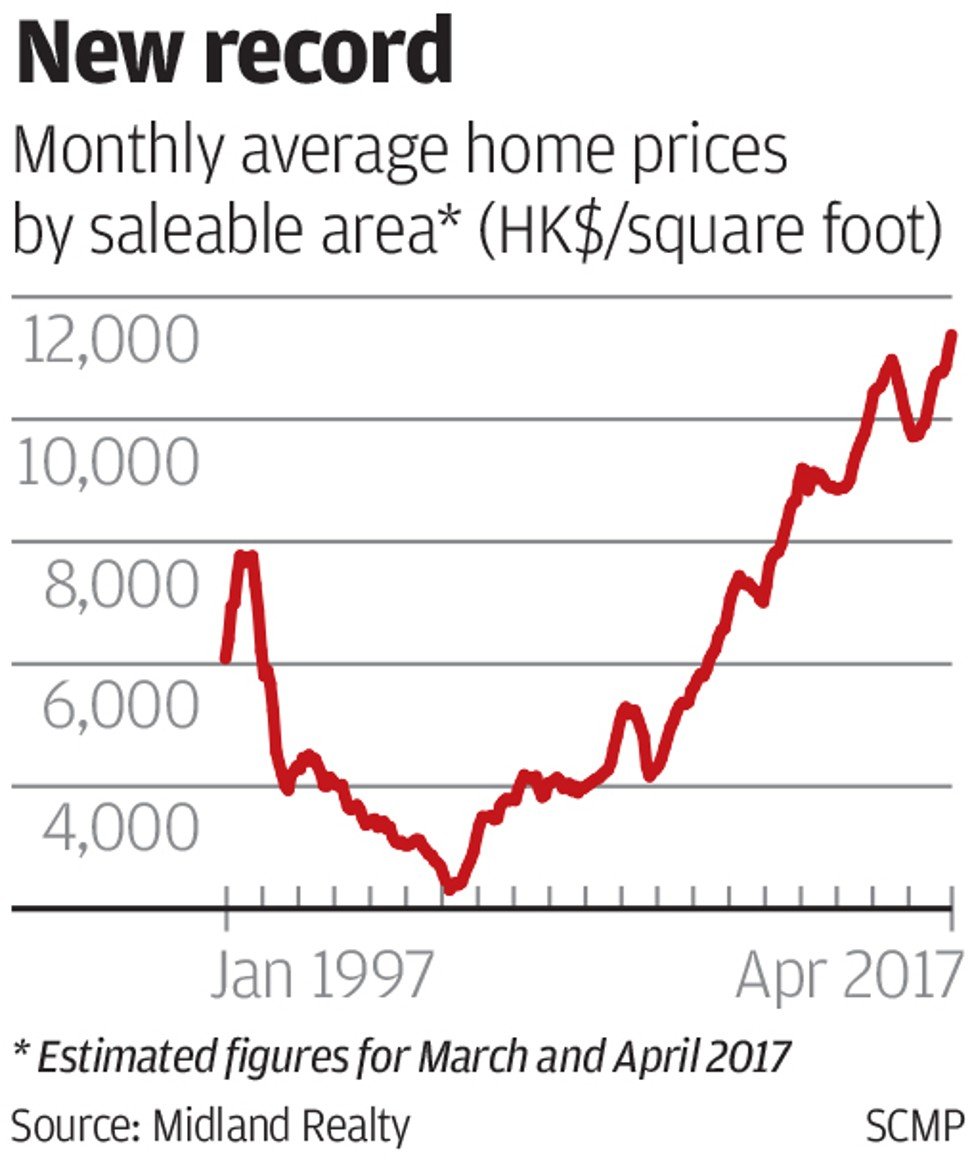

Home prices have surpassed their 1997 peak by 40 per cent, and this has prompted the government to roll out no fewer than three cooling measures in seven months, from a 15 per cent stamp duty to credit tightening. Thus far, they have done little to arrest the price surge.

“The government’s relative caution comes after some painful lessons from previous landslide declines in home prices” because the property market had taken it right on the chin during the worst days of the global economic crises, said Buggle Lau Ka-fai, chief analyst at Midland Realty.

Home prices plunged as much as 70 per cent during the 2003 severe acute respiratory syndrome (Sars) outbreak from their 1997 peak, saddling 105,697 homeowners with negative equity – where homes were worth less than their outstanding mortgages.

Watch: How Hong Kong housing has changed in 20 years

However, the rebounds had been equally sharp since then, due largely to economic stimulus measures by Beijing, including a relaxation in the number of individual mainland travellers to Hong Kong.

Cases of negative equity were effectively eliminated as of March, according to the Hong Kong Monetary Authority’s data.

With prices now back at a record, international property consultant JLL has revised its 2017 price growth forecast upwards, from zero to 5 per cent, to a range of 10 to 15 per cent.

Home prices have risen 3.5 per cent in the first quarter, said JLL research head Denis Ma.

But time was needed for the HKMA’s latest curbs to leave an impact. From June 1, the maximum limit on bank loans for a developer to buy a plot of land will be cut to 40 per cent of the site’s value, down from 50 per cent. The cap on loans for construction costs will be cut to 80 per cent from 100 per cent.

What a difference 20 years can make.

Back in 1997, a 451 sq ft apartment in City One Shatin – a housing estate popular with home seekers and investors – could be bought for HK$3.06 million, but that has now doubled, according to Midland’s data.

The capital appreciation of luxury homes was even more dramatic. The value of a 1,124 sq ft unit at Braemar Hill Mansions in North Point, which comes with a car parking space, has jumped 147 per cent from HK$8.4 million to HK$20.8 million since 1997.

“The records prove that buying property in Hong Kong for the long term promises handsome returns,” Lau said.

Home prices surged to an average of HK$11,376 per square foot in April, 47 per cent higher than June 1997, according to Midland, which tracks prices at housing estates, not considered luxury locations.

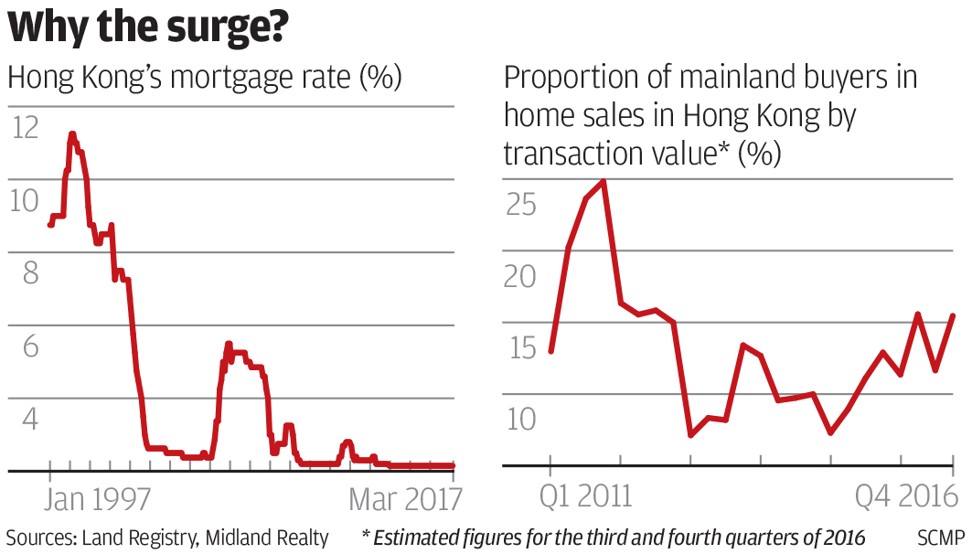

Prices have been driven by low interest rates, strong demand by mainlanders, and the tight supply of new apartments coming on to the market.

“I rented a small apartment instead of buying in the first few years,” he said.

Searching for his dream home with a sea view, he pounced in 2003 when home prices collapsed during the Sars outbreak.

Hung finally signed up for a 900 sq ft unit at Henderson Land Development’s Aegean Coast in So Kwun Wat, near the Hong Kong Gold Coast, for HK$3.6 million. His property is now worth HK$10 million.

“I now plan to cash in on that buy. After the sale, I can rent or buy a smaller apartment and keep the rest for spending,” he said.

Not everyone was a winner, however, and Karen Chan is one of the unlucky ones.

She paid HK$8.87 million for a three-bedroom, 700 sq ft flat in June 1997 at Sun Hung Kai Properties’ Sea Crest Villa in Sham Tseng.

Shortly after buying her first flat, prices plummeted 50 per cent as the Asian financial crisis hit a year later. Between 2002 and 2003, market sentiment went from bad to worse during Sars and the flat lost nearly 70 per cent of its value.

She decided not to rent the flat out after marrying in 2001, but still faced crippling monthly mortgage instalments of HK$30,000. Fortunately, her parents helped her repay the outstanding loan to avoid hefty interest charges, and she has repaid them.

The mortgage rate in 1998 was 11 per cent, compared with 2.15 per cent today, and Chan said her original HK$6 million loan would have cost her HK$13 million if rates had remained the same over the 20-year term she signed up for.

Today, flats of a similar size and location are going for about HK$7 million.

“Rising or falling prices don’t affect me, as I’m still living in the unit and won’t ever sell it,” Chan said, after falling in love with the flat at first sight 20 years ago. “I decided to buy on the spot because of the breathtaking views. It’s on a high floor overlooking Tsing Ma Bridge.

“I love my apartment, and the neighbourhood. But more importantly, the estate allows residents to keep dogs.”