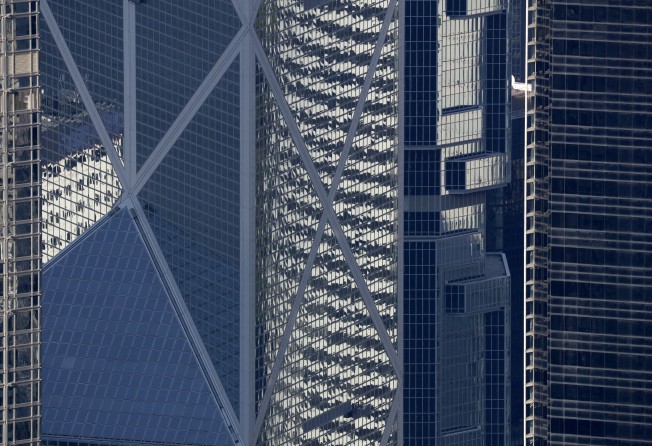

Mainland firms keep Central rents as world’s highest

As Chinese firms like HNA Group expand in Central, MNCs are likely to start to think more about decentralising, says property consultancy

Office rents in Central remain the world’s most expensive, thanks to demand from mainland Chinese companies which pushed them to a record high in the second quarter of this year.

Average rents for the period stood at US$16.2 (HK$139.2) per square foot in greater Central, compared to US$12.4 per sq ft in London’s West End, and a mere US$9.1 per sq ft in Tokyo’s CBD, according to the latest research from property consultancy Cushman & Wakefield.

Greater Central includes Admiralty, Central and Sheung Wan districts on the northern edge of Hong Kong Island.

The record highs were a result of unabated demand from mainland Chinese firms seeking prime office space in Hong Kong.

“Commitments by PRC companies monopolised Q2. The strength of demand will support further growth in rents in the second half of 2017, meaning we shall see more record highs in Greater Central and other core areas,” said Keith Hemshall, Cushman & Wakefield’s head of office services, Hong Kong.

Highly acquisitive conglomerate HNA group was among the mainland firms involved, and took out a lease on 93,600 sq ft of office space in Central’s Three Exchange Square.

The conglomerate is used to contributing to record high prices in Hong Kong’s housing market. It has also spent more than any other developer on purchasing packages of land at Hong Kong’s former airport, Kai Tak.

Meanwhile, asset manager Huarong took out a lease on 18,700 sq ft of office space in Admiralty’s Three Pacific Place.

Cushman & Wakefield said that they anticipated that rising rents would further drive the move by some other MNCs to look to relocate some staff out from Hong Kong Island’s core districts.

“Given Hong Kong core office rents are now the most expensive in the world and are set for further growth in H2, the pace of decentralisation will increase further as the rental gap between Greater Central and non-core areas such as Hong Kong East continues to widen,” said John Siu, Cushman & Wakefield’s managing director, Hong Kong.

“We expect more MNCs to consider relocating to quality business space in non-core areas this year.”

Rents in greater Central in the three months to the end of June were 1.8 per cent higher than the three months to the end of March, and 5.4 per cent higher than the second quarter of 2016.