Tencent shares could reach new high on upbeat first-quarter earnings

Tencent Holdings, the world’s largest video game company by revenue, is widely anticipated to report an upbeat financial performance in the first quarter, which could propel the Chinese internet giant’s share price to a record high this week.

Shares of Tencent were the most heavily traded on Friday when they hit a high of HK$259.20 before closing at HK$258.20 to settle on a total market value of HK$2.4 trillion.

The Shenzhen-based company, which will report its financial results for the quarter to March on Wednesday, is projected to post a net profit of 13.5 billion yuan (US$2 billion) on revenue of 46.1 billion yuan, according to the consensus estimate from a Bloomberg survey of analysts.

As a blue chip in the Hong Kong bourse, Tencent could provide a renewed boost this week for the Hang Seng Index, which closed at a 21-month high of 25,156.34 points on Friday, if it delivers a strong quarterly report.

Several brokerages, including Citibank, JPMorgan and Macquarie, last week raised their target price for Tencent’s shares in anticipation of its buoyant first-quarter results.

“Thanks to the strength of [smartphone game] Honour of Kings, growing commercial payment transactions and likely solid growth momentum of its cloud business, we expect Tencent to report another upbeat quarter,” said Alicia Yap, the head of regional internet research at Citi Research in Hong Kong. “Earnings could also be boosted slightly from the Supercell dividend.”

The Honour of Kings role-playing game was mainland China’s top-grossing mobile game title last year, achieving a domestic record of more than 50 million daily active user accounts as of December 31.

It remained the country’s top mobile game on Apple’s iOS platform in the first quarter, according to data from Citi and applications business research service App Annie.

“Honour of Kings ... also became the global No 1 game by revenue on iOS for the first time in March,” Yap said.

Tencent paid US$8.6 billion in June last year to acquire up to an 84 per cent stake in Finnish mobile game developer Supercell, which reported disbursing dividends totalling €909 million (US$993.3 million) at the end of last year.

Citi has a rosy HK$302 target price for Tencent’s shares, but its estimate on the firm’s latest quarterly financial results are lower than the market consensus.

It forecast Tencent’s first-quarter net profit would increase about 36 per cent to 12.5 billion yuan from a year earlier. Revenue is predicted to grow 41 per cent to 45.1 billion yuan.

Yap said strong cash revenue from Honour of Kings “helps to support overall gaming and earnings growth, which will allow [Tencent] to have more flexibility and leverage to invest and expand into the enterprise cloud business and further support the infrastructure payment business”.

Citi estimated Tencent’s value-added service business, which includes games, rose 21.3 per cent year on year to 30.3 billion yuan while advertising jumped 46 per cent to 6.9 billion yuan.

Other revenue, which includes that from the cloud computing business, grew 240 per cent to 7.9 billion yuan.

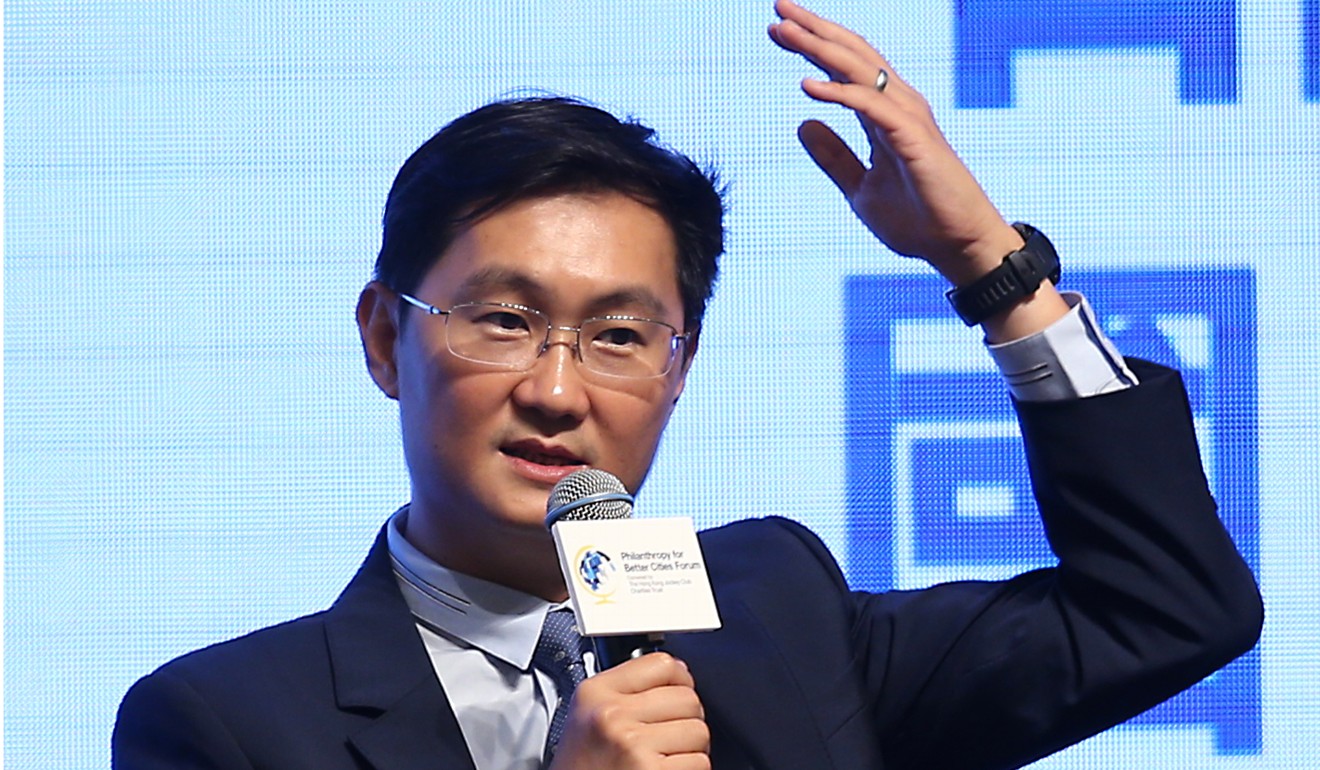

Pony Ma Huateng, Tencent’s chairman and chief executive, said in March that the firm would invest heavily in cutting-edge technologies such as security, cloud, big data and artificial intelligence “to position us for the next wave of growth”.