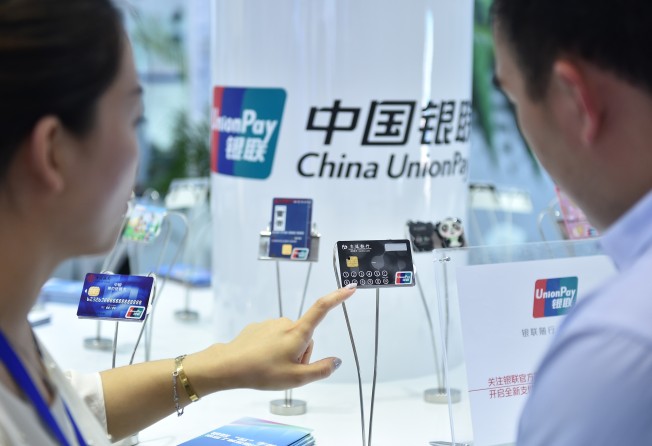

Jetco adds Unionpay card support to Hong Kong mobile payments platform

Mainland Chinese payment services provider Unionpay will partner with Hong Kong cash machine operator Jetco to provide tap-and-go mobile payments, the companies announced this week.

Speaking at an event in Hong Kong, Jetco chief executive Angus Choi said the company's Quickpass near-field communications (NFC) platform for contactless transactions will support Unionpay Quickpass credit cards later this year. The system currently supports Visa and Mastercard, enabling users to swipe their mobile phones to pay for goods and services.

Launched in early 2015, the "all-in-one SIM" works across various smartphone operating systems. Payments are currently capped at HK$500 per transaction.

Jetco and Unionpay are also building a remote mobile online payment service in Hong Kong which is set to launch later in the year. The service will allow users to conduct peer-to-peer transactions once they have linked their mobile phone number to their bank accounts.

To send money, the sender simply has to enter the recipient’s phone number in a mobile app and the transaction happens instantaneously.

When asked if the app would provide similar functions to Tenpay, which allows users to send money through the messaging app Wechat, Choi said that Jetco will offer “basic functions for now” but did not rule out including other more advanced features in the future.

“The trend on mobile payments is getting more … popular and if you compare to other countries [like China], there’s a lot of functionality on the mobile phone, in particular for mobile payments,” Choi said.

By providing the NFC platform, Choi said he hopes more banks will be encouraged to participate in mobile payments.

“[Since Jetco has provided this platform] the banks don’t need to invest, they can ride on this platform to enable the mobile payments service.”

In an interview with the Post this month, Choi said that Hong Kong is "lagging behind" in terms of mobile payments. "Market adoption is the challenge and also the key. Jetco will play a very active role to educate the consumer not only to use P2P but to use it in a secure way."

Mobile payments are already hugely popular in mainland China.

In 2014, Chinese mobile payment providers processed more than 6 trillion yuan (US$960 billion), five times the previous year's total, according to consultancy iResearch. The market is currently dominated by Alipay, which powers Alibaba's e-commerce platforms Taobao and Tmall, and Tenpay, which is used to process payments through Tencent's hugely popular mobile messaging app WeChat.

In April, Facebook and Xiaomi both separately announced that they would enter the mobile and online payments market. Facebook plans to allow its users to send money to each other through the app, while Xiaomi unveiled a mobile-wallet system that allows users to gain interest on money transferred to the digital wallet. Xiaomi has also partnered with Alibaba to allow wireless payments via its smart wristband.