Developer faces murky future

Awaiting trial in Macau on corruption charges, property tycoon Joseph Lau Luen-hung's firm Chinese Estates has an uncertain year ahead

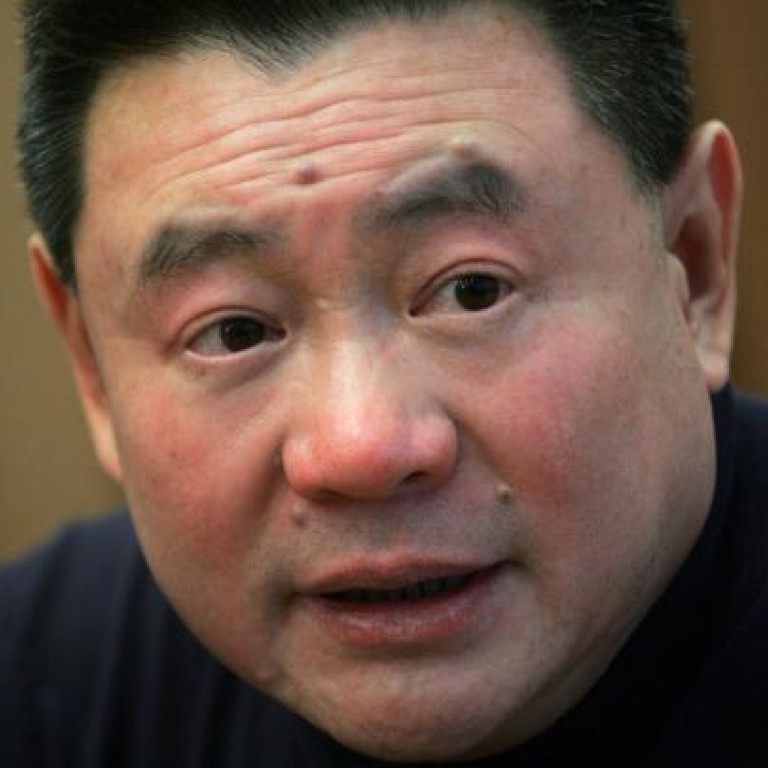

This has not been a good year for Hong Kong property tycoon Joseph Lau Luen-hung.

Chinese Estates, one of Hong Kong's oldest developers, was established by the late tycoon Fung Ping-shan. Lau took control of the Hong Kong-listed company in 1986 when he acquired a 43 per cent stake in the developer through his listed ceiling fan maker Evergo.

Lau then proceeded to turn the developer into more of an investment company. But at the end of 2002, Chinese Estates re-entered the local real estate market by buying the well-known Tung Ying Building in Tsim Sha Tsui for HK$1.16 billion. Lau subsequently redeveloped the site into a high-profile shopping complex called The One in 2010.

In the meantime, Lau, who now controls 75 per cent of Chinese Estates and seldom holds press conferences for his business endeavours, started to meet with dozens of reporters to strengthen media relations ahead of a plan to launch more than 2,500 flats in Hong Kong worth up to HK$6 billion in 2003 and 2004.

The firm posted a profit in 2003, following three years of losses that were partly caused by a downturn in the property market, and it has stayed in the black in recent years.

In Hong Kong, Chinese Estates teamed up with major property developers such as Sino Land and Nan Fung Development to build large-scale residential projects and renovate some of Chinese Estates' shopping centres.

The company also began to venture into the residential market in Macau, where in mid-2006 it announced a venture with a local investor to buy a residential site for HK$1.4 billion and planned to build up to 25 high-end residential towers in a complex to be called La Scala. It also acquired development sites in Sichuan province's Chengdu in November that year.

In March, Chinese Estates launched the first sales phase of La Scala. Demand was strong, with 302 flats sold at an average price of HK$7,500 per square foot by the end of June. The developer expected to generate a profit of more than HK$20 billion if all the flats - 4,000 units from four phases - were sold.

La Scala was seen to be the main driver of the firm's results over the next few years, starting from when the first phase was to be finished in 2014.

But just a month later, in April, Lau's name surfaced at the third corruption trial of Macau's former secretary for transport and public works, Ao Man-long, who is now serving a lengthy jail sentence in Macau.

According to a filing with the Hong Kong stock exchange in June, Chinese Estates had taken deposits related to La Scala of HK$383.1 million on sales totalling HK$3.83 billion.

But in August and September, Macau's government declared the land sale to Chinese Estates to be invalid. The company has appealed against the ruling in court. If the government decision prevails, Chinese Estates will not only lose the land but also its investment in La Scala.

Chinese Estates has been selling non-core assets to raise cash, including the sale of its 62 per cent stake for HK$561 million in Hong Kong-listed Chi Cheung Investment, which owns warehouses and has 50 car parking spaces it leases out in Hung Hom.

It also sold a 49 per cent interest in a mainland residential project in Jiangsu province in recent months. The company has so far generated more than HK$5 billion from the disposals. According to a company statement in August, Chinese Estates had HK$24.6 billion in debt at the end of June, with HK$14.69 billion due to be repaid within one year.

The stock is thinly traded, and few analysts track the company these days. One who used to follow Chinese Estates said: "They are active in stock speculation, rather than property development. It's not a pure developer. It is difficult to forecast their result."

Chinese Estates is very much a family business. In 2006, Lau's son, Lau Ming-wai, joined Chinese Estates and became an executive director that year. Four years later, he was named vice-chairman.

Kenny Tang Sing-hing, general manager at financial planner AMTD, said that given the looming Macau trial, the "outlook is uncertain as the company may have to make provisions … and the amount is still a question".