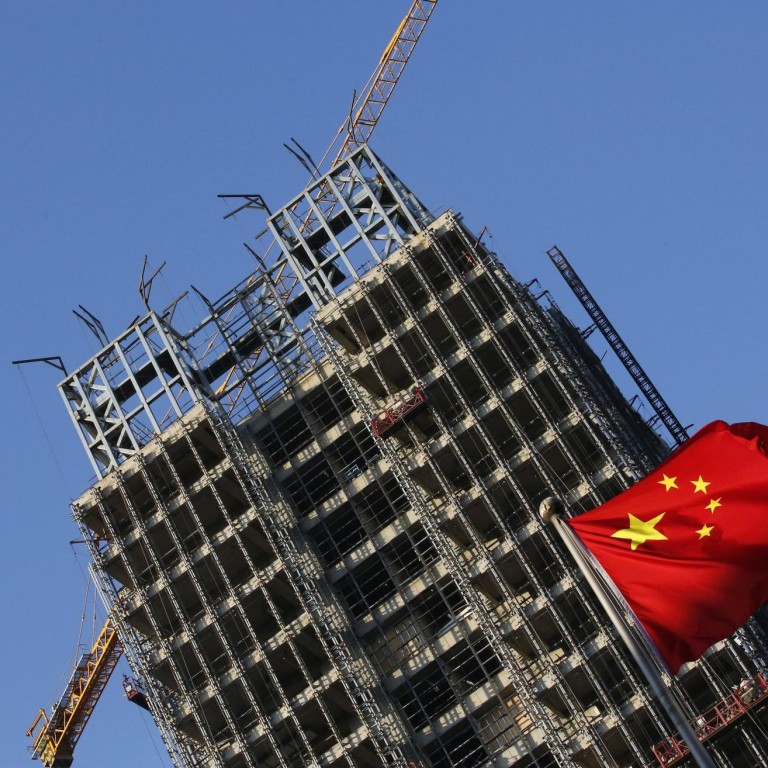

Chinese developers double dollar bond sales

Move reflects the government will tolerate a sustained boom in the property sector

Mainland developers' sales of dollar bonds more than doubled this year, reflecting confidence that the government will tolerate a sustained property boom as home prices climb at the fastest pace since January 2011.

The companies sold US$17.88 billion of the notes by October 20, up from about US$8 billion for the whole of last year, according to Moody's Investors Service.

The average yield on mainland issuers' dollar debt was 4.42 per cent this year, less than the 5.51 per cent in the previous five years, the HSBC Asian US Dollar Bond Index shows.

That compares with an average of 6.03 per cent for yuan-denominated corporate bonds included in the Bank of America Merrill Lynch China Corporate Index.

Hui Ka-yan's Evergrande Real Estate, the mainland's biggest homebuilder by sales, was among issuers this month as the Federal Reserve considers cutting stimulus that drove down borrowing costs in the United States.

Appetite is being backed by Moody's rating upgrades and data showing housing prices in the four biggest cities rose at least 16 per cent in September.

"Going into November and December, we expect fund-raising activities by rated developers to continue," said Kaven Tsang, a Hong Kong-based senior analyst at Moody's.

"Contracted sales improved, as reflected in their interim results, so bond investors have become more interested."

China Vanke, the country's biggest listed developer by market value, said sales in the first 10 months of this year totalled 145.85 billion yuan (HK$185.6 billion), exceeding its last full-year revenue of 141.2 billion yuan. Evergrande's contracted sales in the period climbed 25 per cent to 91.3 billion yuan.

Evergrande, rated B1 by Moody's, issued US$500 million of bonds at 8.75 per cent due in 2018 on November 6 to refinance existing debt, after selling US$1 billion of five-year securities at the same rate on October 30.

Greenland Hong Kong last month sold US$700 million of notes due in 2016 at 4.75 per cent to refinance current borrowings and fund projects.

Greenland was one of seven property firms that received an upgrade from Moody's this year. That compares with four last year and is the most since at least 2008.

The mainland has restricted developers from issuing domestic bonds since 2010 as part of efforts to curb property price gains, while the central bank reported a measure of new onshore credit yesterday that fell short of estimates. At least US$21 billion of notes and loans are estimated to mature before the end of next year.

"It's difficult to get government approval for selling local bonds, except for affordable-home projects," said Dai Fang, a property analyst at Zheshang Securities in Shanghai.

The cost of issuing dollar bonds was also often lower than yuan loans, Dai said.