China property prices seen rising further as investment growth slows

Could this be the breakout year for the mainland property market?

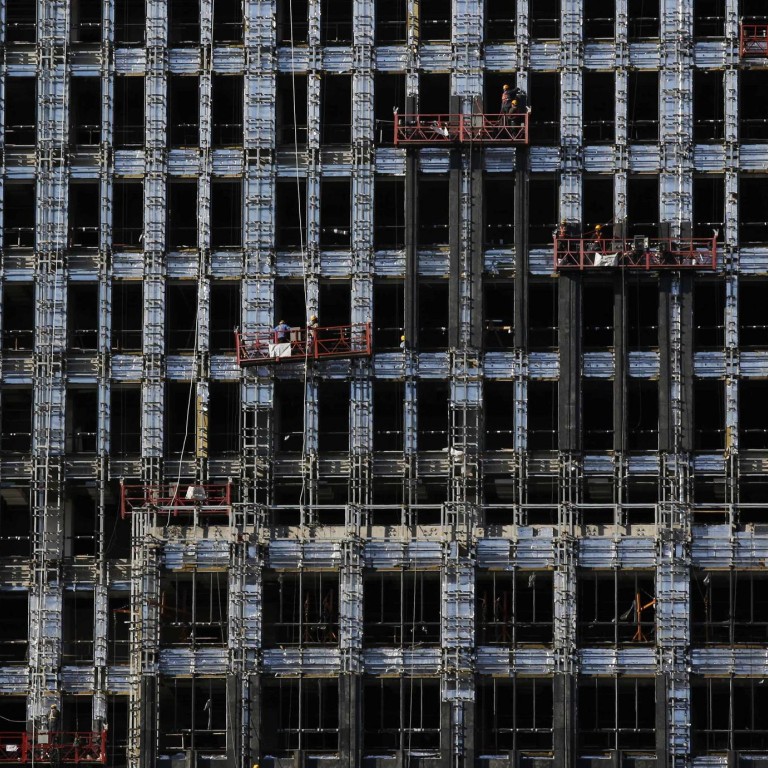

Analysts expect real estate investment growth, a key driver of the economy, will slow this year, even as home prices in top cities rise to unsustainable levels before a bursting of the asset bubble.

Eliza Liu, chief economist of CCB International Securities in Hong Kong, said real estate investment is losing steam and expects the sector's investment growth to fall to 15 per cent this year, a record low and a steep fall from 19.8 per cent last year.

"The bubble risks of the Chinese economy are mainly in the property sector now," she said. During this quarter, policymakers must decide how to deflate the housing bubble while also ensuring sufficient liquidity to boost the real economy. What actions they take will decide the performance of the economy for the rest of the year.

The property sector, with its much higher - though narrowing - profit margin, as compared with manufacturing and other industries, is a magnet for capital seeking quick returns. The result will be more rampant shadow banking and soaring home prices across the country.

Overall fixed-asset investment growth slowed to an 11-year low of 19.6 per cent last year, driving down growth in the broad economy to 7.7 per cent, the same as 2012 and the slowest pace of expansion since 1999.

Last year could well have marked the end of the free ride for mainland developers. Ratings agency Fitch expects growth in property sales will slow to 10 per cent this year from last year's 17.3 per cent. And the record high of more than 3 trillion yuan (HK$3.8 trillion) in land sale revenues for local governments last year is unlikely to be repeated this year, as property sales in small cities and even some provincial capitals has either stagnated or fallen. Land sale revenue, however, was dwarfed by local government debt, which totalled 17.9 trillion yuan at the end of June. Excluding interest payments and contingent liabilities, 2.3 trillion yuan of that debt pile matures this year.

"Where will all the money come from" to fund the expected 7.5 per cent GDP growth this year, Liu asked.

Wei Yao, China economist at Societe Generale in Hong Kong, said: "Further investment growth deceleration seems quite certain to us, which is, however, a necessary step towards a more balanced economy."

In a note to clients yesterday, Yao said: "Several borrowing channels have already started to cool, responding to tight liquidity conditions. Policymakers are poised to rein in shadow banking and cap local government debt growth."

Annual housing inflation eased last month. But analysts expect home prices in Beijing, Shanghai, Shenzhen and Guangzhou to climb beyond their current record levels as investors park wealth there, worried policies pushed by President Xi Jinping will further slow the economy as he tries to stabilise it.

Rosealea Yao, a senior analyst at GK Dragonomics in Beijing, said: "Short supply will keep driving up home prices in top cities, while the price fall in third- and fourth-tier cities will not be excessively rapid because of the urbanisation push."