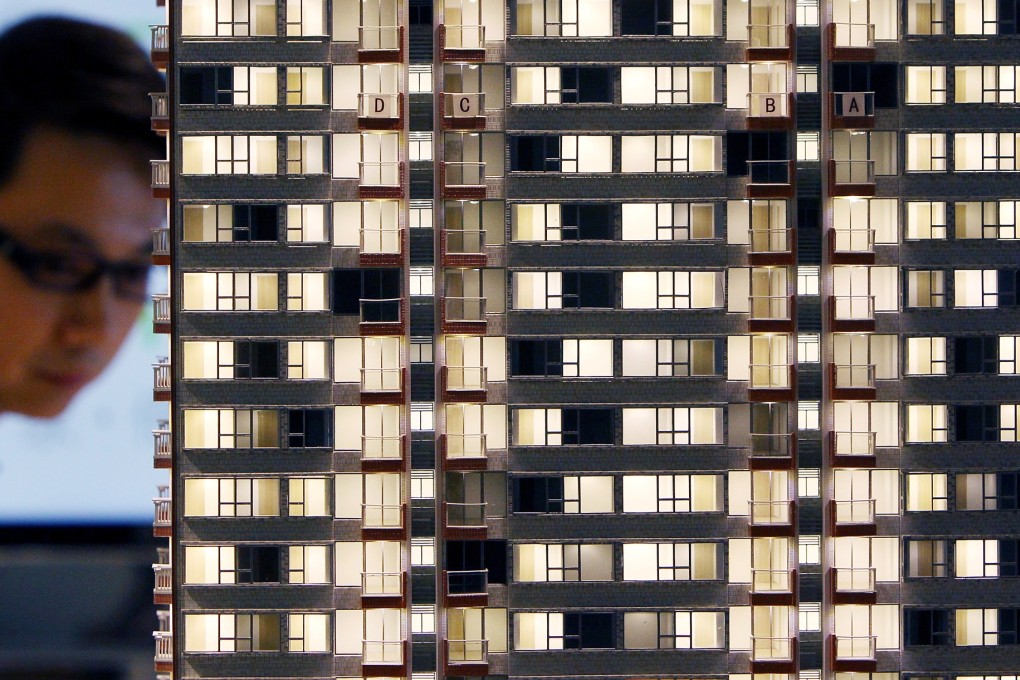

Hong Kong home prices stay firm on high building costs, strong demand

New private housing supply seen reaching 8-year high of 73,000, near government target

High construction costs and strong demand are seen keeping property prices high although new private housing supply over the next three to four years is set to push inventory to an eight-year high, analysts say.

Figures from the quarterly report of the Housing Authority show that there is expected to be 73,000 flats available for sale by 2018. The housing supply included unsold units in completed projects, units under construction, and those ready to start construction. It means new housing supply could reach 18,250 flats every year, close to the government's target of 20,000 annually.

"Housing supply is only one of the factors affecting property price movements. Since the construction cost continues to increase, developers would be reluctant to cut their asking prices significantly. Also, the housing demand is strong," said surveyor Albert So Chun-hin. "But the increasing new housing supply could stop strong growth in property prices."

Property prices would only ease slightly, unless interest rates rose sharply or if an economic crisis flared again.

Centaline's Centa-City Leading Index of mass residential property, which tracks prices at 85 housing estates across the city, fell 0.14 per cent to 121.95 last week, near its 2013 market peak.

Over the last few years, the government has been trying to cool the overheated property market by increasing land supply.