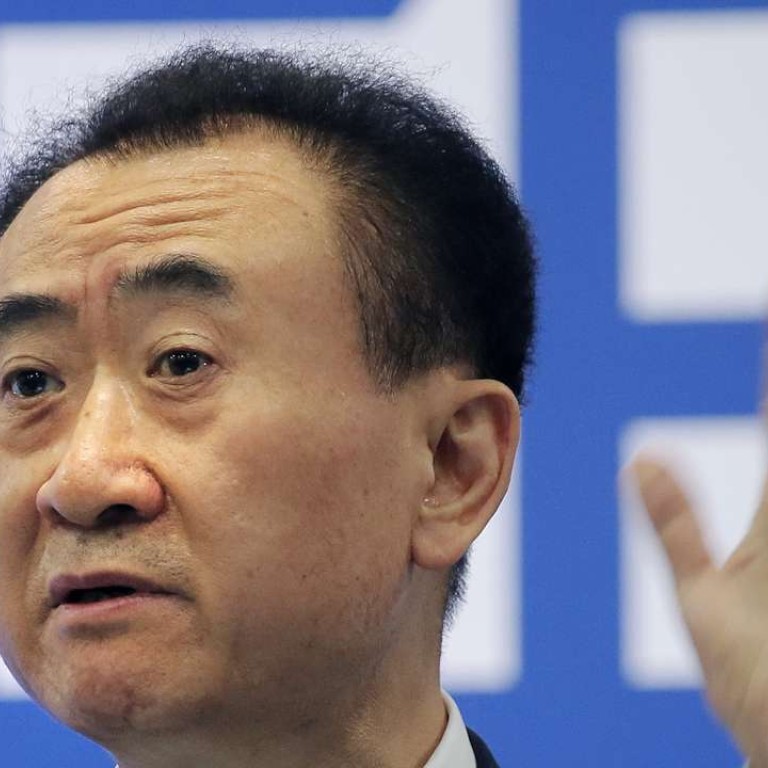

Wang Jianlin offers HK$52.8 a share to delist Dalian Wanda Commercial Properties from Hong Kong

The delist-relist attempt requires approval from shareholders and regulators to proceed, analysts say

Dalian Wanda Group, chaired by billionaire Wang Jianlin, is offering HK$52.80 per share to buy out owners and privatise its Hong Kong-listed property unit, Dalian Wanda Commercial Properties, the latter said in a filing to the Hong Kong stock exchange on Monday morning.

The offered price puts the total capital needed at about HK$34.45 billion. The price is 10 per cent higher than its December 2014 initial public offering price of HK$48 a share and compares with an earlier indicative offer of at least HK$48.

Trading resumed at 1pm Monday, after the filing, and declined by 1.4 per cent to HK$49.3 by close. Wanda Commercial’s Hong Kong shares had been suspended since April 25.

In an interview with Chinese state-run CCTV on May 22, Wang said Dalian Wanda Commercial Properties “must be taken private” as its undervaluation on the Hong Kong market made Wang “feel sorry” for shareholders and investors.

Analysts said the 10 per cent premium is acceptable as that is what the group promised to investors for the privatisation funding. But, they added, it would be challenging to get shareholders’ approval as a general buyout offer usually entails a 20 per cent markup in Hong Kong.

Hong Kong’s takeover rules are more friendly to minority shareholders than those in the US.

Wanda would need 90 per cent of shareholders to accept the tender offer and more than 75 per cent of the total independent shareholders attending the vote to accept it. Opposition to the deal must be less than 10 per cent of the voter head count.

Liu Feifan, a property analyst with Guotai Junan International, said there was still room for Wanda to raise the buyout offer as long as Wang and other group leaders were determined to relist Wanda on the domestic market.

“It is reasonable that mainland investors will pay Wanda a valuation higher than peers [so] that would give them plenty room to raise the buyout price.”

Currently, large property developers on the A-share market are trading at around 15 times their earnings on average, while smaller ones are trading with a higher valuation at around 20 to 25 times earnings, due to their flexible business structure.

Some bullish analysts expect domestic investors will pay 20 times earnings for Wanda’s relisted commercial property entity, making the market capitalisation of Wanda Commercial Properties 500 billion yuan (HK$590.28 billion), compared with the current valuation of roughly HK$200 billion on the Hong Kong market, with a 5.8 times price to earnings ratio.

Besides challenges from shareholders, Wanda also needs to overcome regulatory hurdles at a time when initial public offerings (IPOs) are becoming harder on the mainland.

Mainland investors will pay Wanda a valuation higher than peers [so] that would give them plenty room to raise the buyout price

China’s securities market watchdog, the China Securities Regulatory Commission (CSRC), postponed a reform plan designed to simplify the IPO approval process, following the devastating stock rout last summer. The sell-off saw China’s stock benchmark plunge by more than 40 per cent in less than three months from a seven-year peak in mid June.

Separately, as impatient IPO candidates turned to back-door listings as a means to go public, the CSRC has also tightened scrutiny in this field to curb cross-border arbitrage and speculation in shell companies.

Shell companies refer to poorly-run listed companies that are willing to transfer control to other investors and cash out from their business.

If Wanda Commercial has not gone public on a mainland exchange by either August 31, 2018, or within two years of the Hong Kong delisting, Wanda Group will buy back the shares with a 12 per cent annual return for domestic investors and 10 per cent for those overseas, according to an earlier document sent to prospective backers.

Song Qinghui, an independent economist based in Beijing, said Wanda chairman Wang Jianlin would be able to relist Wanda on the A-share market based on his “profound network”, but things would not be as easy for other companies.

Wanda is the latest case of an offshore listed company trying to delist from the market, on the heels of a wave of US listed companies filing for privatisation and looking for higher valuations on the domestic mainland market.

Since 2015, company founders have launched almost 40 buyout deals for US-listed Chinese companies worth a total of US$36 billion, with the backing of investors ranging from Sequoia Capital China to Alibaba Group Holding, according to Dealogic. Alibaba is owner of the South China Morning Post.

“Delisting cases remain a contingency on the Hong Kong market,” said Eddie Wong, a partner for capital markets services at PwC Hong Kong. “On average there are more than 100 companies going public in Hong Kong each year, but only very few of them would choose to delist, even though the Hong Kong stock market has its own upward and downward cycles,” he said.

Companies have different priorities in terms of their IPO destination. Hong Kong is still the most accessible international market, which caters to the financing demand of mainland based companies, he added.