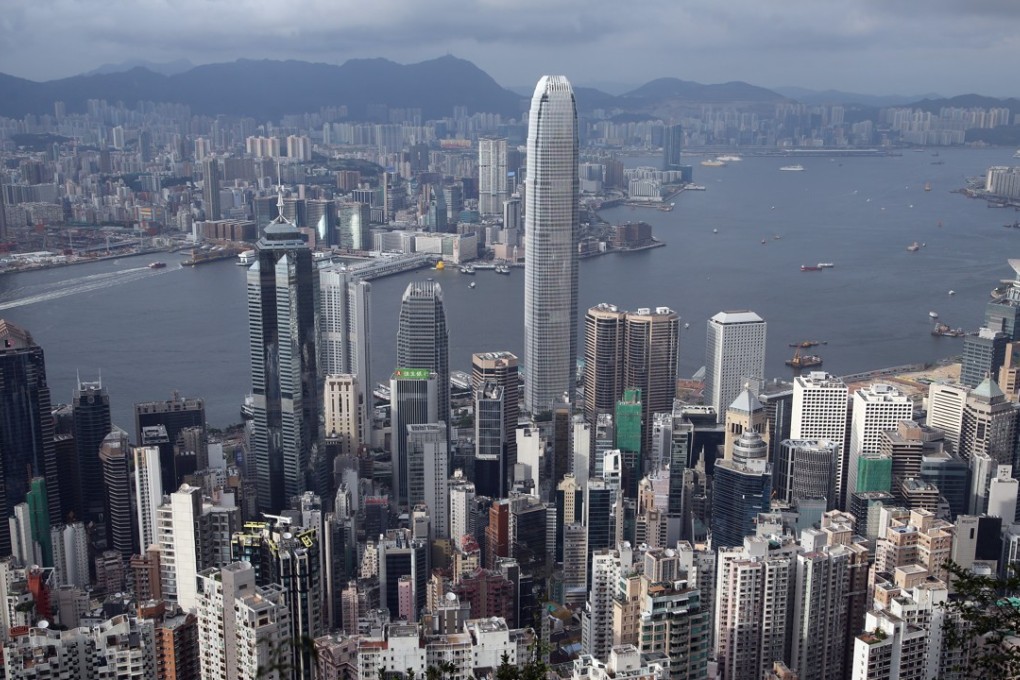

World’s highest rents aren’t too high for Chinese firms

Analysts say the high rents will not hurt Hong Kong’s competitiveness, even though non-Chinese firms have been forced to decentralise from the CBD.

For 30 years that it has been in Hong Kong, Ince & Co. – one of the UK’s top maritime law firms with a history that stretches back to 1870 – has always had its place in the city’s central business district.

Ince, which opened its first Asia office in 1979, has also witnessed Hong Kong’s maritime rise as the world’s largest container port, and only to loose the glory to Shenzhen and Shanghai.

But the changing tide hit home harder last November when the firm fell prey to Central’s surging rents and was forced to move out of Citibank Plaza to One Island East in Quarry Bay.

Ince’s landlord had demanded a 50 per cent increase in rent, which would make the firm’s 12,000 square feet office cost HK$1.5 million to lease every month.

“When we renewed our lease last year, the landlord asked for HK$125 per sq foot, that is 50 per cent rise from what we signed three years ago, so we decided to leave,” said the firm’s regional business and finance director Lionel Noronha. “It’s just too expensive in Central, and we have to make sure our business maintains a profit margin.”

The firm ended up relocating seven subway stops eastwards to Quarry Bay, to Swire Properties’ relatively new building, where they can afford 12,000 sq ft of space within their 2016 budget.