Hong Kong property market continues to follow a path of growth in 20 years since handover

Twenty years after the Handover, Hong Kong’s real estate market continues to follow a path of growth, driven primarily by policies which have fostered closer economic ties between Hong Kong and mainland China.

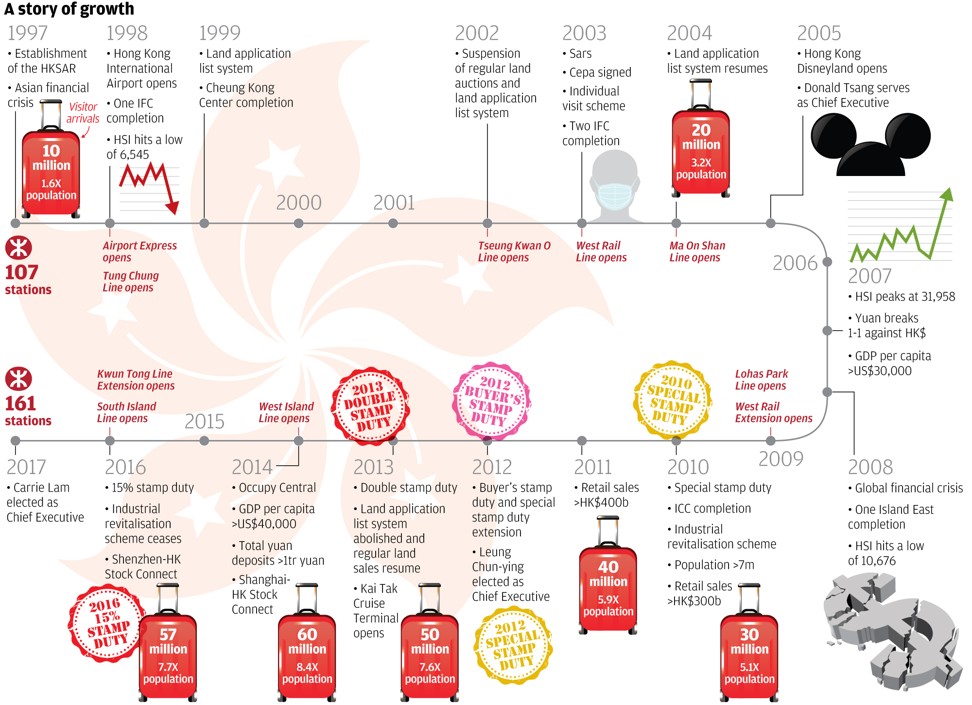

Hong Kong’s economic platform and infrastructure has significantly strengthened since 1997. Cross-border economic activities have been encouraged by policies including the closer economic partnership arrangement and the Stock Connect platform, which joins the bourses of Hong Kong with those in Shanghai and Shenzhen. Hong Kong is also the first and largest offshore renminbi investment hub, offering a wide range of renminbi financial products ranging from loans, bonds, real estate investment trusts to currency futures.

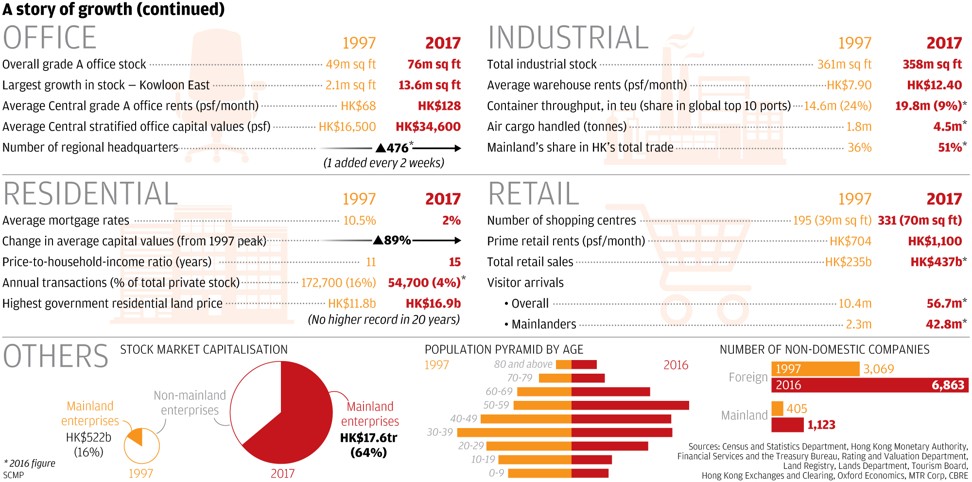

These newly-listed firms and their mainland-based sponsors need office space in Hong Kong, which has increased demand for Grade A offices in prime locations, diminishing supply further.

Since 1997, the number of Chinese firms in Hong Kong has almost tripled while an additional 3,700 foreign firms have registered and operate in the city.

Clearly, Hong Kong has retained its status as a major business hub. It has also become an increasingly popular headquarters location. Over the past 20 years, more than 476 companies have established their regional headquarters in Hong Kong, translating into one new headquarter every two weeks.

As such, rents in Central have now doubled to HK$128 per sq ft per month. Meanwhile, stratified office capital values in Central increased to an average of HK$34,600 per sq ft, nearly double that of 1997, as more mainland corporates opt to invest in office buildings for their own use. This has pushed out many multinational corporations, which have been exploring options in decentralised areas such as Quarry Bay and Kowloon East.

Although the Hong Kong government introduced the Special Stamp Duty to tame surging home prices in 2010, followed by several rounds of austerity measures, it has failed to rein in the rampant home prices. It takes an average family 15 years of their annual income to buy a home.

In fact, the cooling measures may be fueling price rises by restricting transactions in the secondary market. Annual residential property transactions in 2016 were less than one-third of that in 1997.

Total retail sales (HK$437 billion) have risen by 86 per cent since the Handover. However, they have also been plummeting for 24 consecutive months since 2014, dragging down prime street shop rents by nearly 30 per cent. Although rents are decreasing, it still costs a retailer an average of HK$1,100 per sq ft per month to secure a prime high street shop, compared with HK$704 in 1997.

Overall, Hong Kong’s economy has become more diversified and international after the Handover. Looking forward, the soon to be completed Hong Kong-Zhuhai-Macau Bridge and Express Rail Link will shorten the travel time between Hong Kong and major Pearl River Delta cities. This Greater Bay Area concept being actively promoted by the mainland China and Hong Kong governments is set to open up more opportunities for both the Hong Kong and southern China economies.

Marcos Chan is head of research for Hong Kong, southern China and Taiwan at CBRE