China’s state oil behemoth gets a marquee Hong Kong address after buying Li Ka-shing’s building

The largest shareholder among the buyers of The Center is a unit of state oil behemoth China National Petroleum Corp.

A company called C.H.M.T Peaceful Development Asia Property yesterday agreed to pay Hong Kong’s tycoon Li Ka-shing a record HK$40.2 billion (US$5.15 billion) for the city’s fifth-tallest tower, in what agents say is the world’s most expensive transaction for a single building.

Just who exactly is the buyer? According to several people familiar with the deal, a consortium that’s 55 per cent owned by a unit of China’s state oil behemoth is behind the purchase, and 45 per cent of it is shared by a quartet of Hong Kong businessmen.

China Energy Reserve & Chemicals Group, a Beijing-based specialist in the storage of oil and natural gas, is the controlling shareholder of the consortium, according to company officials in Beijing and Hong Kong.

China Energy bought The Center to set up a base in Hong Kong, and in “response to the Chinese government’s call to go global,” said Lui Shu-kwan, the vice general manager of its subsidiary in the city, in a phone interview with the South China Morning Post. “We just bought the building, but we haven’t really thought through the details.”

China Energy is the latest in a long queue of Chinese companies that have been increasingly taking over prime commercial space in Hong Kong’s Central district, the world’s costliest commercial area. Since Hong Kong returned to Chinese rule in 1997, one-tenth of Central’s prime office space is now occupied by Chinese companies and financial institutions, according to agents.

The Center, a 73-storey tower built in 1998 by Li’s flagship company CK Asset Holding, has 1.2 million square feet (111,483 square metres) of office space. The tallest among Li’s property portfolio, it’s one of only five complete office buildings in Hong Kong’s central business district - stretching from Central to Admiralty to Wan Chai - that’s available for sale at the moment, agents said.

“We are a state-controlled oil and gas trading, logistics and distribution and supply services provider in China,” according to its 2016 prospectus.

Chen, 54, owns 29.3 per cent of Jinhong. He could not be reached to comment. A bond prospectus by Jinhong, which sought to borrow 1 billion yuan of 270-day loan in June, contained some information.

A graduate of Baotou University in Inner Mongolia, Chen is a former civil servant in the local city council, holding jobs in the price bureau, as well as the economics and trade office, according to the prospectus.

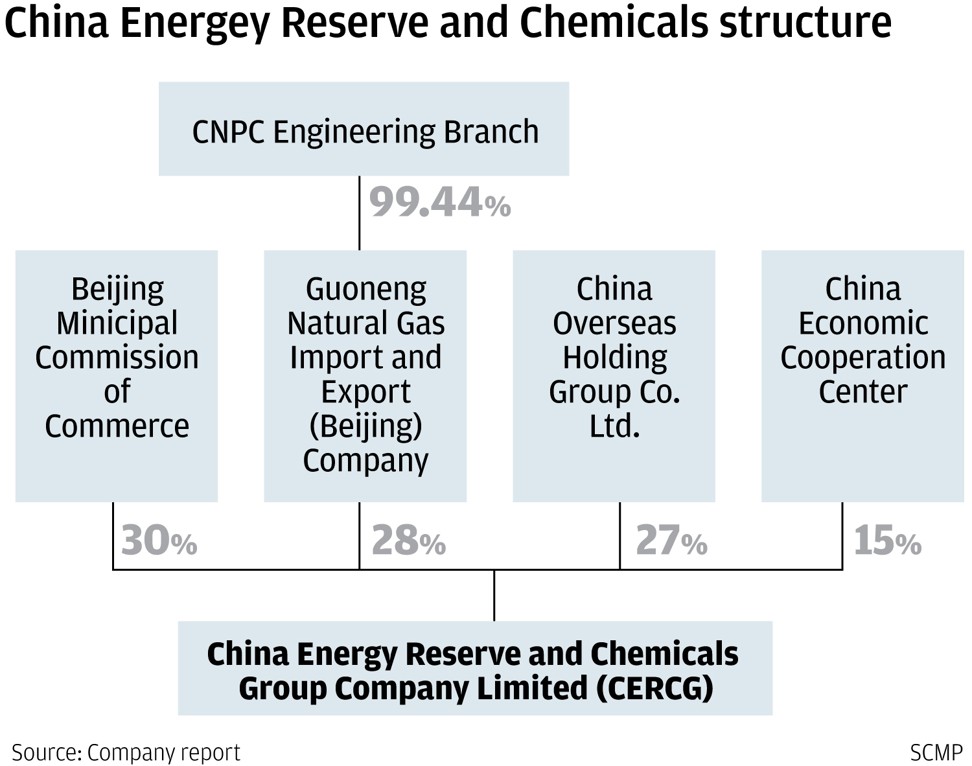

China Energy has four shareholders, according to its bond prospectus. The biggest owner, at 30 per cent, is the Beijing Municipal Commission of Commerce, responsible for trade and international economic cooperation in the capital.

Guoneng Natural Gas, a unit of CNPC’s engineering branch, owns 28 per cent, while a 27 per cent stake is held by China Overseas Holding Group, a state entity that focuses on overseas businesses.

The remaining 15 per cent is held - through an entity called Hualian International Trading Company - by the China Economic Cooperation Centre (CECC), an agency responsible for international economic cooperation under the Communist Party Central Committee’s international department.

The four Hong Kong businessmen who jointly own the remaining 45 per cent of The Center are the ACME Group’s chairman David Chan Ping-chi, Wing Li Group’s chairman Lo Man-tuen, Koon Wing Motors’ founder Ma Ah-muk and the Asia Property Agency’s owner Raymond Tsoi Chi-chung.

With additional reporting by Summer Zhen and Zheng Yangpeng