Hong Kong property prices heat up anew after record land sale price and surge in stock market

CK Asset Holdings revises target price for nine villas in Hung Hom up by HK$300 million, while Wheelock ups prices at a Kai Tak project by about 12 per cent

The sale this week of a residential site in Kowloon for a record price and a surge in the city’s stock market are fanning the flames of Hong Kong’s red-hot housing market, with developers as well as individual owners rushing to take advantage of positive sentiment in the sector.

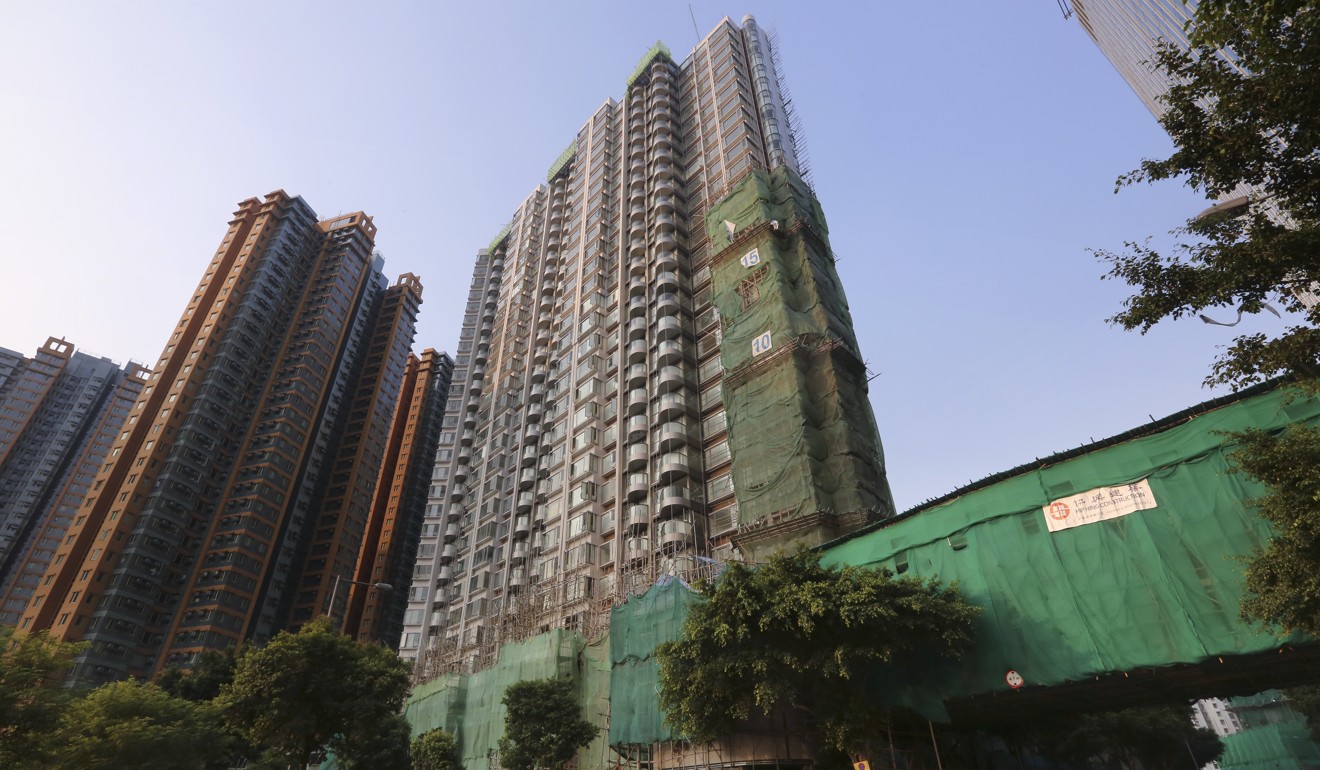

Wheelock Properties released the price list on Thursday for 84 flats at Grand Oasis Kai Tak, the second phase of its Oasis Kai Tak project on the site of Hong Kong’s former airport, with prices at an average of HK$22,665 per square foot after factoring in a discount of as much as 16.5 per cent.

That is about 12 per cent higher than the HK$20,225 per square foot at the previous launch in September last year. The cheapest flat at the Grand Oasis Kai Tak development, which is scheduled to be completed in June 2019, is a 360 sq ft unit costing HK$7.6 million (US$972,055).

Almost at the same time, Sun Hung Kai Properties launched the Babington Hill development in Mid-Levels West at an average of HK$32,200 per square foot, after factoring a 12.5 per cent discount, setting

a record in the area where apartments, which are mostly more than 40 years old, are currently going for HK$16,000 to HK$18,000 per square foot.

CK Asset Holdings meanwhile has revised upwards its target price for the tender of nine villas at Stars By The Harbour in Hung Hom by HK$300 million, or 20 per cent, to HK$2.16 billion.

William Kwok, a director at Cheung Kong Real Estate, a wholly owned subsidiary of CK Asset, said the company was likely to sell the villas to a single buyer.

“It shows developers’ optimism about the market outlook after the Kowloon land price set a record. Also buoyed by the wealth effect of a bull run in the stock market, developers is likely to speed up their marketing for new projects,” said Sammy Po, chief executive of Midland Realty’s residential department.

Also driving the positive outlook was the sale on Tuesday of a residential site in Kowloon Tong for HK$28,531 per square foot on Tuesday, making it the priciest plot of land in Kowloon. The Lands Department awarded the plot to Wharf Holdings for HK$12.45 billion.

“Some of them mark up prices every day. The land sale has added fuel to the fire,” he said.

“The land price is even more expensive than flats currently going for an average price of around HK$20,000 per square foot in Kowloon Tong,” said Lam. “In response to the good news, owners have raised their asking prices by 10 per cent to 20 per cent.”

It shows developers’ optimism about the market outlook after the Kowloon land price set a record

Terence Lau, a senior sales director at Midland Realty’s Beacon Hill branch, said flats were being offered for between HK$10 million and HK$70 million in Kowloon Tong, which is a luxury residential area.

“A 10 per cent increase equates to at least HK$1 million up for a flat that costs HK$10 million,” said Lau. He said sales in the secondary market could drop in the coming week.

The impact has spilled over to other major housing estates in Hong Kong.

“Prices at Taikoo Shing have set new records every month. We have seen more buyers, cashed up from the stock market, shifting to buy property and further lifting prices,” said Rick Wan, a director at Hong Kong Property’s Taikoo Shing branch.

Morgan Stanley said average selling prices and strong sell-through rates for projects have been driving positive sentiment in the second half of 2017, and it expected home prices to increase 5 per cent in the first half of this year.

“But in the second half of 2018, we will see several headwinds developing, resulting in property prices declining by 5 per cent and full-year primary volumes declining by 10 per cent on shrinking pre-sale pipelines and lower investment demand,” according to its research note.