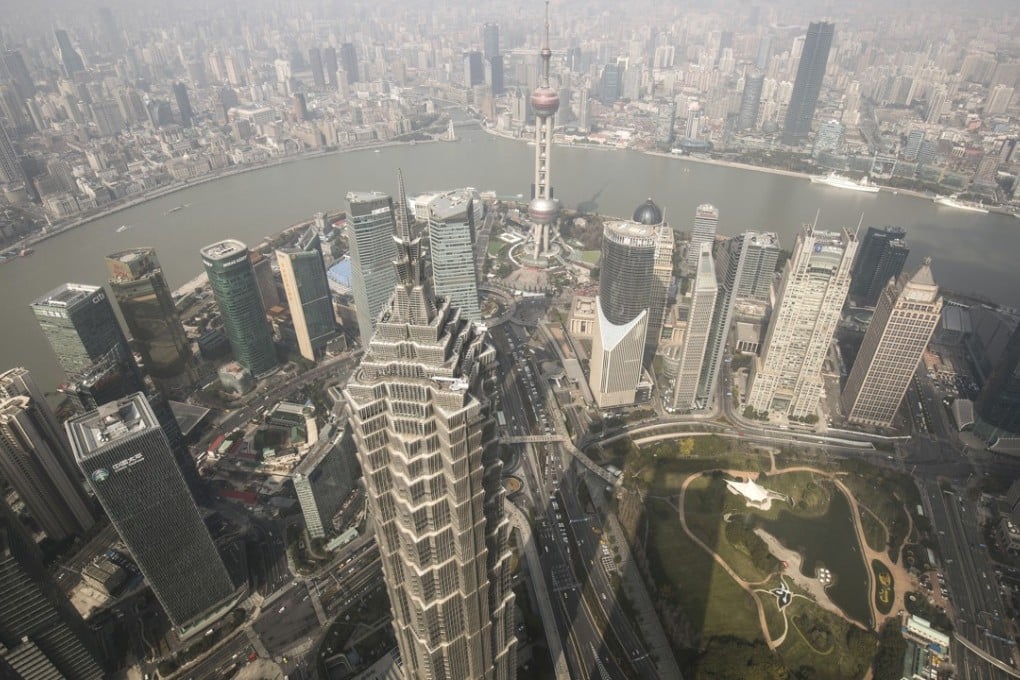

The Shanghai district aiming to rival the financial hubs in New York and London

More than half of the 1.65m sq m of Pudong’s new office supply in the next five years will come from Qiantan, Shanghai’s second financial district south of the core Lujiazui area

Twelve kilometres south of Shanghai’s financial hub of Lujiazui, workers are putting the finishing touches to a glitzy-looking office tower designed to resemble a crystal which dominates the skyline.

The futuristic-looking edifice designed by American developer Tishman Speyer is part of a grand plan known as “the second Lujiazui”, reflecting its planners’ ambitions to rival Manhattan and London

Called Qiantan, gleaming new area is aimed at appealing to multinational and financial firms, especially, looking for an alternative far costlier and crowded Lujiazui.

Of the 1.65 million square metres of new office space planned in Pudong, across the Huangpu River from the city’s historic Bund, over the next five years, more than half is earmarked for Qiantan, according to Colliers International.

In contrast, the core Lujiazui area will supply just 310,000 square metres.

Shanghai’s newer districts prove to be a top draw for MNCs

In the heart of Qiantan, four overseas developers – Tishman Speyer, Swire Properties, Hongkong Land and Shun Tak Holdings – have already formed partnerships with the biggest landlord, the Shanghai government-owned Lujiazui Group to create mixed-used complexes.