Chinese institutional investors are Asia's biggest spenders on overseas commercial property

Mainland money put heavily into property overseas as prospects at home weaken and the value of the yuan appreciates

Major Chinese investors were Asia's biggest spenders on overseas commercial property last year, and insurance companies are set to lead a new wave of investment by mainland Chinese institutions.

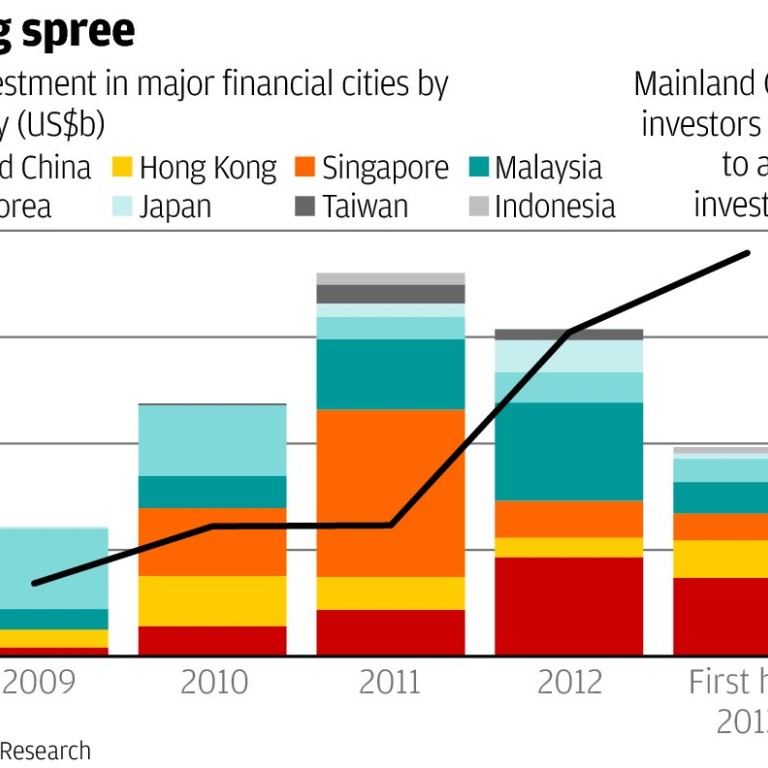

Spending on commercial property worldwide by mainland Chinese institutional investors reached US$2.34 billion last year, and accounted for 30 per cent of all Asian overseas investment in the sector, according to data from international property consultant DTZ. Malaysia and Japan ranked second and third, respectively, for outbound investment.

Big Chinese investors' share of this investment jumped from 12 per cent in 2010 and 2011. It was just 7 per cent in 2009.

The strong growth rate continued into the first half of this year, during which investment in global commercial properties by Chinese institutional and company investors amounted to US$1.9 billion, or 38 per cent of total outbound Asian investment over the period.

The data is for outbound investment in commercial properties only and does not include the residential, hospitality and industrial sectors. It also excludes investments in home markets.

Andrew Ness, head of research at property consultant DTZ, said investment has been increasing at a rapid pace because mainland Chinese capital was heading offshore because options at home were limited, liquidity was strong and the yuan's value was rising.

In a separate survey, international property consultant Jones Lang LaSalle estimated Chinese investment in commercial real estate all over the world would reach US$5 billion by the end of next year, up 25 per cent up on 2012.

Active buyers include sovereign wealth funds such as the China Investment Corp and the State Administration of Foreign Exchange's Gingko Tree Investment as well as state-owned enterprises such as China Construction Bank; companies; developers; and ultra-high-net- worth individuals.

Ness expects a new round of investment to be triggered by mainland Chinese insurance companies, who were only given permission to invest overseas 11 months ago. Ping An Insurance, the mainland's second-largest life insurer, paid £260 million (HK$3.1 billion) to buy the Lloyd's building in London in July.

Insurance firms are now actively studying investment opportunities overseas and the first pure mainland insurance company could trigger a deal probably early next year, according to Ness.

The insurance companies had abundant capital, which was earning a relatively low return in the country, he added, and "cannot keep all their eggs in one basket".

CBRE estimates Chinese insurers could invest up to US$14.4 billion in overseas real estate. The estimation is based on the total assets of China's national insurance institutions, which stood at US$1.2 trillion last year.

New regulations permit these institutions to invest up to 15 per cent of their assets in "non-self-use" real estate. By this measure, there is in excess of US$180 billion currently available for real estate investment, CBRE estimates.

Chinese institutional investors are expected to focus on premier office investment opportunities in gateway cities, which are capable of generating stable returns on investment in the short term. Targets are likely to include prime offices in cities such as London and New York, according to CBRE.