Spanish 'bad bank' gets serious about selling off land

Spanish agency to put about 80 plots taken over from bailed-out lenders up for auction

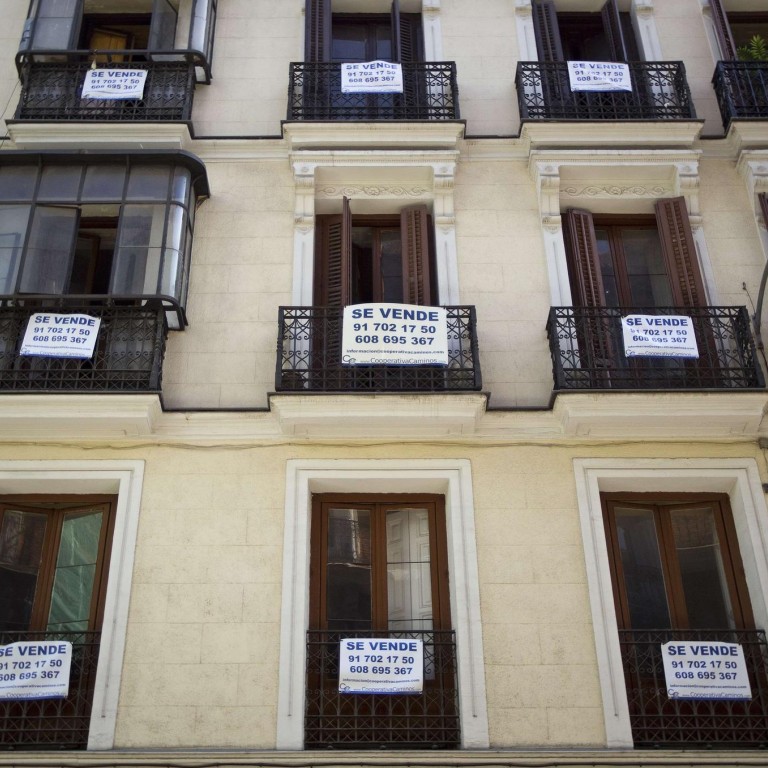

Spain's "bad bank" is about to start its biggest sale so far of land taken over from bailed-out lenders, as property prices in some of the countries worst hit by the euro zone crisis show signs of recovery.

The Sareb agency, set up to cleanse troubled Spanish banks of real estate holdings that went sour in the crisis, is taking advantage of growing interest from professional investors to catch up from a slow first six months of operations.

The government-backed vehicle, known by its Spanish acronym, aims to put a package of about 80 plots of developed land up for auction.

Sareb values the portfolio at €350 million (HK$3.65 billion), which will be the starting point for price talks.

Sareb declined to comment. But one private equity investor said: "It's got the market excited in that they are going to set the floor on a lot of asset classes."

Investors said Sareb, created as a condition of a €41 billion rescue for Spanish banks with European money, was selling off its best assets first and may struggle to get rid of its poorer quality properties, especially undeveloped land.

Nevertheless, the private equity investor praised its "Herculean effort" following Spain's banking crisis, brought on by a 40 per cent dive in property prices from a 2007 peak.

The planned sale includes land ready for construction in the Madrid area, as well as in the northeastern region of Catalonia, Galicia in the northwest, and in coastal areas.

In recent weeks Sareb put at least seven portfolios on the market. These contain stakes in tourist resorts and a shopping centre, seven prime office buildings, more than 2,000 homes and chunks of syndicated loans to property developers.

Investors' interest in property is rising again across Europe as many countries emerge from recession. Ireland's bad bank is speeding up sales of real estate loans, and in August house prices there rose at the fastest pace in six years.

Real estate companies have flocked back to the markets this year, with LEG Immobilien's German stock exchange listing in January the biggest float in Europe so far this year. British property agents Foxtons and housebuilder Crest Nicholson have also listed.

Sareb started this year with €51 billion worth of assets transferred from state-rescued lenders such as Bankia. It is 51 per cent owned by private investors, aiming to reduce the burden on stretched state finances.

The private equity investor said sales had been small. "They've sold a lot more in a shorter time span than any other bad bank I've seen," he said. "Still, there are a lot of assets there that they will never sell ... and will still be there in 15 years."

Sareb is aiming for a 13 to 14 per cent annual return over its 15-year life.