Is the rent too high? Yes, in most cities globally

Emerging economies currently have the least-affordable housing, while London is the least-affordable major city in western Europe

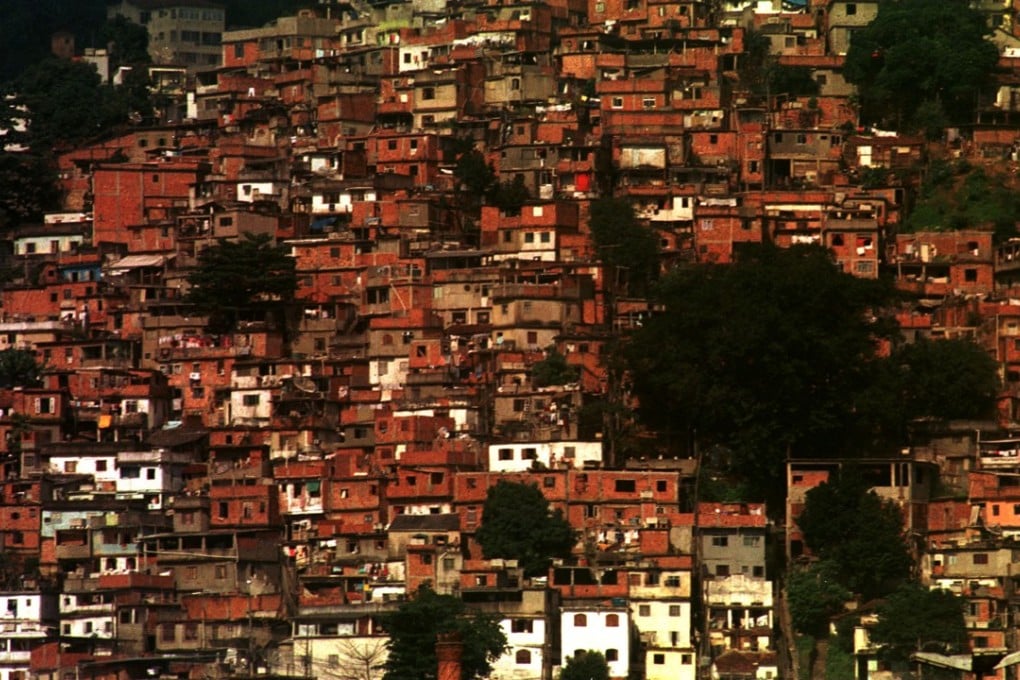

As people around the world move into cities and look for housing, one thing is clear: Most will have a hard time paying for it.

Average monthly take-home pay would not cover the cost of buying a 1,000-square-foot residence or renting a three-bedroom home in any of the 105 metropolitan areas ranked by the Bloomberg Global City Housing Affordability Index – based on a general rule of thumb among US lenders that people should spend no more than 28 per cent of net income on housing costs. Only 12 cities would be considered affordable if they spend 50 per cent.

Residents face many obstacles, including urban land-use regulations, underdeveloped rental markets and difficulty getting financing, according to Enrique Martínez-García, a senior research economist at the Federal Reserve Bank of Dallas who studies housing prices. Policy solutions to these problems were not clear, he added.

“Not having access to credit is a challenge to develop a healthy housing market,” he said. “But opening it up too fast might be a problem as well; it might actually lead to a boom-bust episode.”

The Bloomberg index calculates the affordability of renting or buying in city centres and suburbs. Rankings are based on self-reported data, including net salary and mortgage interest rates, compiled by Numbeo.com, an online database of city and country statistics.

Since 2012, 48 cities in the Bloomberg index have become less affordable, while affordability improved in 51. (Historical data were not available for all 105.)

In nine of the bottom 10, average net income fell, while income in eight of the top 10 cities rose as rental and mortgage costs declined.