China's No 2 e-commerce player JD.com sees new Hong Kong office as conduit to Asia, stepping stone to investments overseas

JD. com, China’s second-largest e-commerce services provider by sales, is gearing up to expand operations across Asia and pursue potential international investments after opening its new office in Hong Kong.

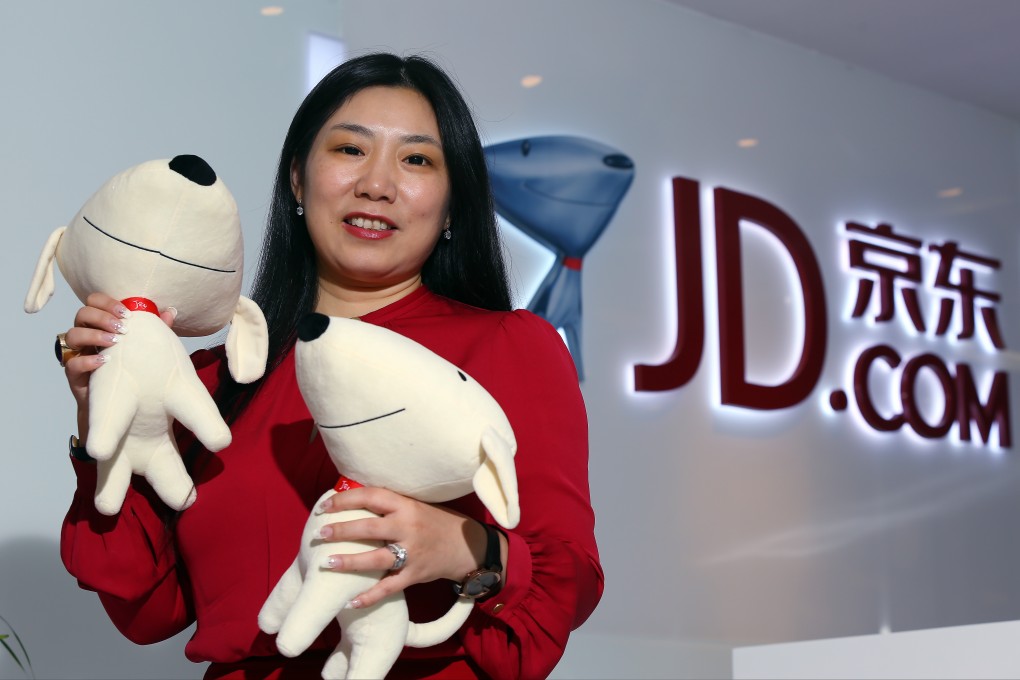

Rain Long, JD’s chief human resources officer and general counsel, told the South China Morning Post that the Hong Kong office will help the Beijing-based company better engage with various major brands and retailers around the region.

“We will also have a mergers and acquisitions team based here,” said Long on the sidelines of the office launch on Wednesday.

JD’s Hong Kong operation is located in Tower Two at Times Square in Causeway Bay, while the local offices of rival e-commerce services provider Alibaba Group are in Tower One at the same commercial complex.

Long said JD plans to grow its Hong Kong staff to about 30 in the next several months, up from just over a dozen employees at present. She pointed out that there are currently no plans for the company to build new outposts in other cities across Asia.