Tech deals down in China, despite record Didi funding in April

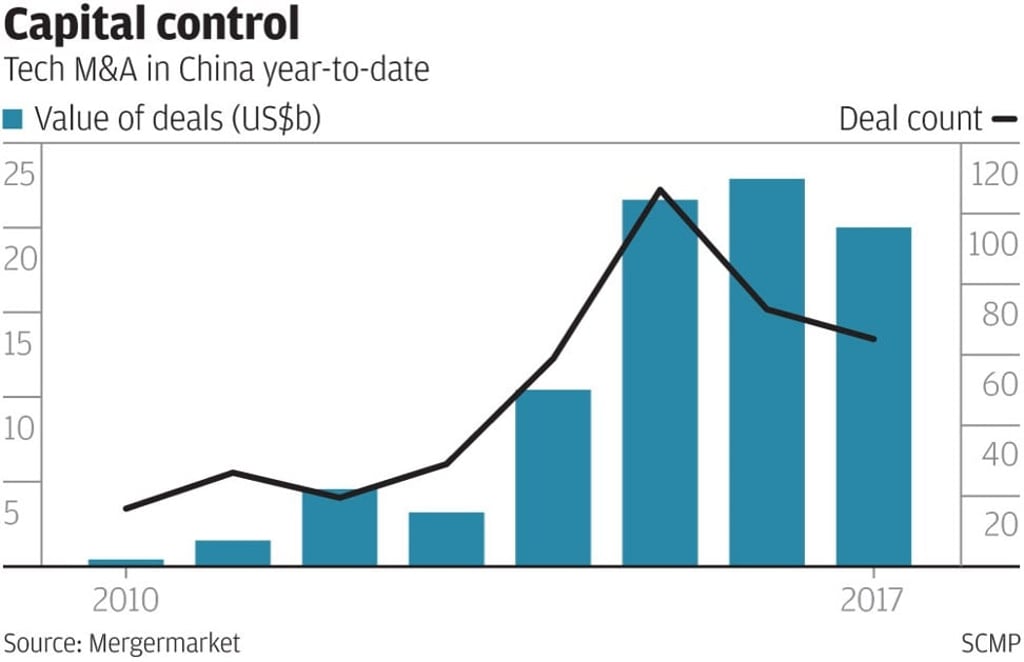

Mergers and acquisitions in mainland China’s technology sector saw a year-on-year decline of 12.9 per cent in the past four months, despite the massive US$5.5 billion funding round scored by ride-hailing giant Didi Chuxing about two weeks ago, according to Mergermarket.

“The value of technology deals [on the mainland] reached US$19.9 billion across 65 transactions from January to April, down from US$22.8 billion in 73 deals recorded in the same period last year,” Mergermarket financial researcher Sophie Jin said on Tuesday.

The decrease in the size and number of deals in the first four months of the year was chiefly attributed to Beijing’s tough capital controls.

“The environment for tech M&A in China has changed after the banner period in 2015, which saw a frenzy of large mergers among [the country’s start-up] unicorns,” Jin said.

In February of that year, rival ride-hailing app operators Didi Dache and Kuaidi Dache announced their blockbuster merger valued at about US$6 billion.