Update | Games, online video help Tencent top estimates with 69pc gain in third-quarter earnings

Company’s video unit has surpassed 43 million paying subscribers, the largest user base in China’s online video streaming market

Tencent Holdings, Asia’s most valuable company by market cap, handily beat market expectations as its fast-growing online video streaming unit helped earnings in the quarter to September surge 69 per cent.

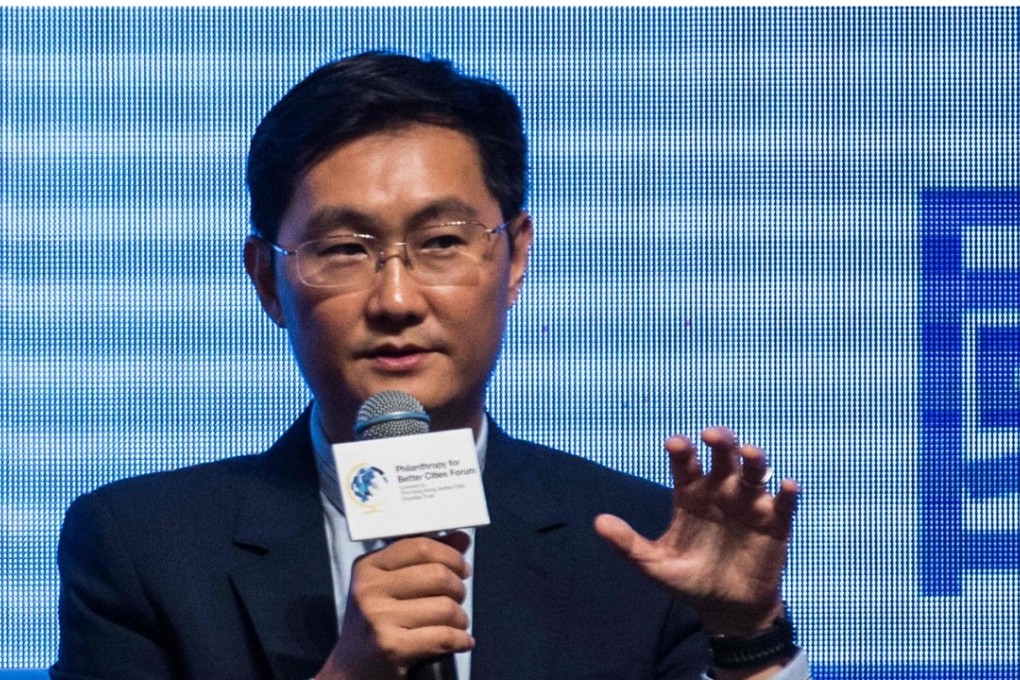

“We believe [Tencent Video] has become China’s top online video platform in terms of mobile daily active users and subscriptions,” said Tencent chairman and chief executive Pony Ma Huateng in a statement on Wednesday.

“We believe this success reflects our increasing investment in self-commissioned video content, our improved selection of licensed video content, and our scheduling and audience-management initiatives.”

The Shenzhen-based internet giant reported a 69 per cent jump in net profit to 18 billion yuan (US$2.7 billion) in the quarter ended September 30, up from 10.6 billion yuan in the same period last year.

That surpassed the market consensus of a 16.4 billion yuan net profit in the quarter, according to a Bloomberg survey of analysts’ estimates.