Apple’s share of global smartphone profits slumps as cheaper models, rivals cut into margins

Apple’s weakening dominance in profits is partially due to the popularity of its cheaper models, as well as the stronger performance of rivals

Apple’s share of profits in the global smartphone industry have slumped despite its latest iPhoneX selling for US$999, thanks to the popularity of the US company’s cheaper models as well as intense competition from rivals Samsung Electronics and Huawei Technologies.

The Cupertino, California-based Apple captured almost 60 per cent of the total profits generated by mobile handset sales in the July to September period, down sharply from the same three-month period in 2016 when the US company reaped 86 per cent of all profits generated in the industry, Counterpoint said in a research note released on Wednesday.

A stronger performance from Samsung and several Chinese brands helped global mobile handset profits grow 13 per cent year on year during the quarter, said Counterpoint, without providing a specific dollar amount.

“This is the first time the cumulative profits of Chinese brands crossed US$1.5 billion in a single quarter,” said Counterpoint associate director Tarun Patha. “Usually all the profits have been shared by just two brands – Samsung and Apple – however, Chinese brands have made inroads here.”

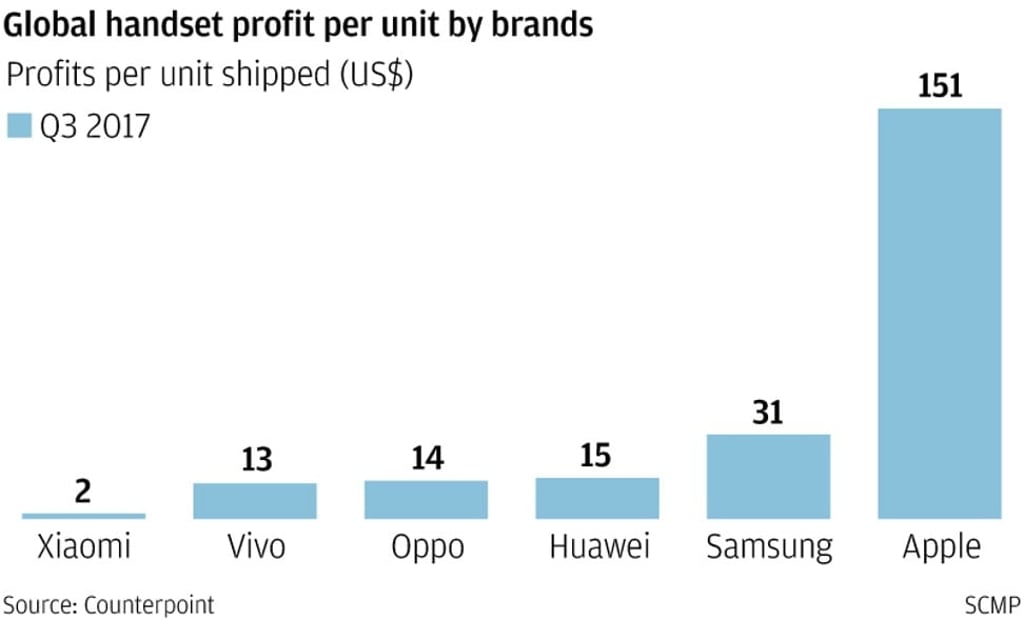

Apple’s profits far exceed that of its nearest competitors, with the company still able to reap an average of US$151 from each iPhone sale, compared with US$31 for Samsung and between US$13 and US$15 for Huawei and its Chinese rivals Oppo and Vivo.