A peek into the future of retailing as technology reinvents how the world shops

The history of how Alibaba and Amazon have come to dominate retail through e-commerce has been told countless times. What about the future?

Needless to say, Alibaba and Amazon have not been complacent sitting on their laurels. Together with other innovative companies in China and America, Alibaba and Amazon are aiming to reinvent the retail experience again for consumers over the next decade.

Here are 5 current trends that provide glimpses into how technology will shape our buying habits in the future.

Online and offline retail will be more integrated and seamless. When Amazon acquired Whole Foods in June 2017, the e-commerce giant gained more than a stronghold in groceries and fresh foods. Combining the strengths of online with offline retailing, Amazon is now in position to potentially offer O2O services such as buying online and picking up in store, or buying in store with delivery to home.

The Whole Foods acquisition parallels Alibaba’s move in January to privatise InTime, a Chinese operator of shopping malls and department stores, for US$2.6 billion. Both Alibaba and Amazon recognise that an offline retail network can be highly synergistic with their already massive online marketplaces.

“The proliferation of partnerships and acquisitions by online players of offline players (and vice versa) signals an evolving mindset from product centricity to consumer centricity,” said Robert Hah, Managing Director of Accenture Strategy Greater China. “Along the consumer’s journey, there are a myriad of touch points where offline and online channels come together to enhance the overall experience. While Gen Z’s are certainly the most digitally savvy of all consumer groups, they still have a strong preference to visit physical stores. To them, the store is an extension of a brand and they expect the store to supplement their digital experiences.”

Since early 2016, Alibaba has incorporated live streaming features into both its Taobao and Tmall platforms, to empower influencers to tell stories about lifestyles, brands and products to potential shoppers via live video. In the US, more and more businesses are using Facebook Live, Instagram and YouTube Live to drum up e-commerce demand as well.

“By integrating e-commerce with the addition of a ‘shop’ button in the broadcast room, live streaming platforms have enabled anybody with an audience to become a salesperson and to earn referral income whenever his or her fans complete a purchase,” says Kenneth King, co-founder of Tian Tian, a video-based social mobile app acquired by Yixia Technology, operator of Yizhibo, one of China’s largest live streaming platforms.

“While this can theoretically be applied to all e-commerce verticals, we have seen promising data from cosmetics, fashion and home appliances - items that the influencer can demonstrate how to use in front of the viewers. Live demonstration and live interaction, along with trust and loyalty towards the influencers, are the reasons why this works.”

Around last year’s Singles Day – Alibaba’s annual shopping bonanza in November – Alibaba showed how virtual reality can be used in shopping, allowing customers to place their smartphones into VR cardboard headsets for immersion in a virtual Macy’s store, where they could interact with products and make instant purchases. Alibaba calls this “Buy+”, and more than 8 million Chinese users have gotten a taste of this VR e-commerce experience since the debut of Buy+. Alibaba owns the South China Morning Post.

Amazon is also working actively on VR, recruiting talent to join its team. Having amassed businesses from e-commerce to content, one could imagine Amazon potentially using VR to power a range of future applications: shopping, consuming movies and TV shows as if a user is on set, or simulating a front row experience for concerts. With its ownership of Twitch and a recent deal to stream Thursday night NFL games, both sports and gaming could be in play too.

As consumers catch on to new technology platforms that brands and retailers must adapt, it’s immensely important to choose the right retail channel that matches a brand’s target customers, goals and growth stage.

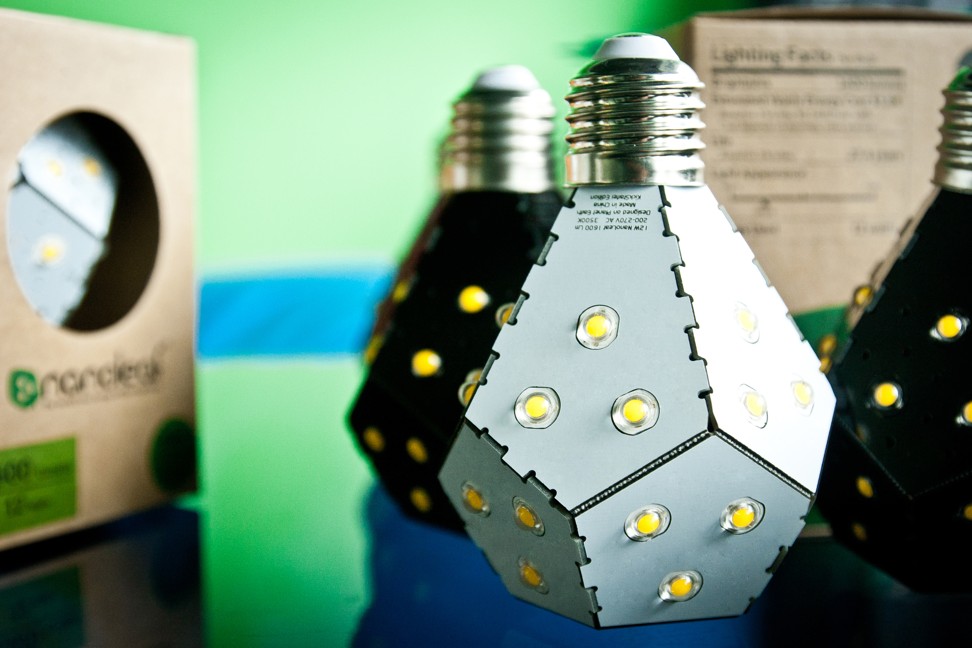

A good example of doing this right is Nanoleaf, a smart lighting company that scaled up with different retail channels as the company grew. In 2013, the company began by launching on the American “pretail” platform Kickstarter, where start-ups can crowd fund from early adopters and pre-sell products, even before they are designed or manufactured.

Nanoleaf found more than 5,000 Kickstarter backers and went on to receive investments from Li Ka-shing’s Horizons Ventures and Kleiner Perkins, among others. Its lighting panels are now on sale at Apple stores, essentially the Major League of retailing.

“It’s not just start-ups that can leverage small-scale pretail as a stepping stone towards large-scale retail,” said Christian Yan, Nanoleaf’s co-founder and chief operating officer. “Big brands can go from retail back to pretail too. They can use Kickstarter and Indiegogo to launch new products to early adopters, generate buzz and get product feedback from customers.”

If the e-commerce potentials of omnichannel, live streaming, VR and “pretail” don’t surprise you, consider the recent tie-up between e-commerce and China’s latest phenomenon – the sharing of mobile phone chargers.

Since April 2017, three of the Chinese market leaders in charger sharing – Laidian, Jiedian, and Xiaodian – have received a total of US$128 million in investments, according to Crunchbase. Jumei, a New York-listed Chinese cosmetics e-commerce company, bought a controlling stake in Jiedian for US$43.5 million. While the acquisition was mostly seen as Jumei seeking new growth areas, potential synergies to its e-commerce business should not be overlooked. China’s online customer acquisition costs have increased dramatically over the last few years, and businesses are looking for cheaper, more creative ways to acquire customers.

Imagine e-commerce players providing complimentary smartphone charging services, distributed throughout cities, to customers whenever they shop via smartphones. Already, Alibaba’s affiliate Ant Financial is collaborating with Laidian to let some Alipay users rent Laidian chargers without paying a deposit.

Things will only get more creative in e-commerce. So, buckle your seat belt and enjoy the ride, as technology charges ahead to shape the future of how we buy.

Andrew Kwan is founder and chief executive of Outwhiz and strategic adviser of CoCoon.