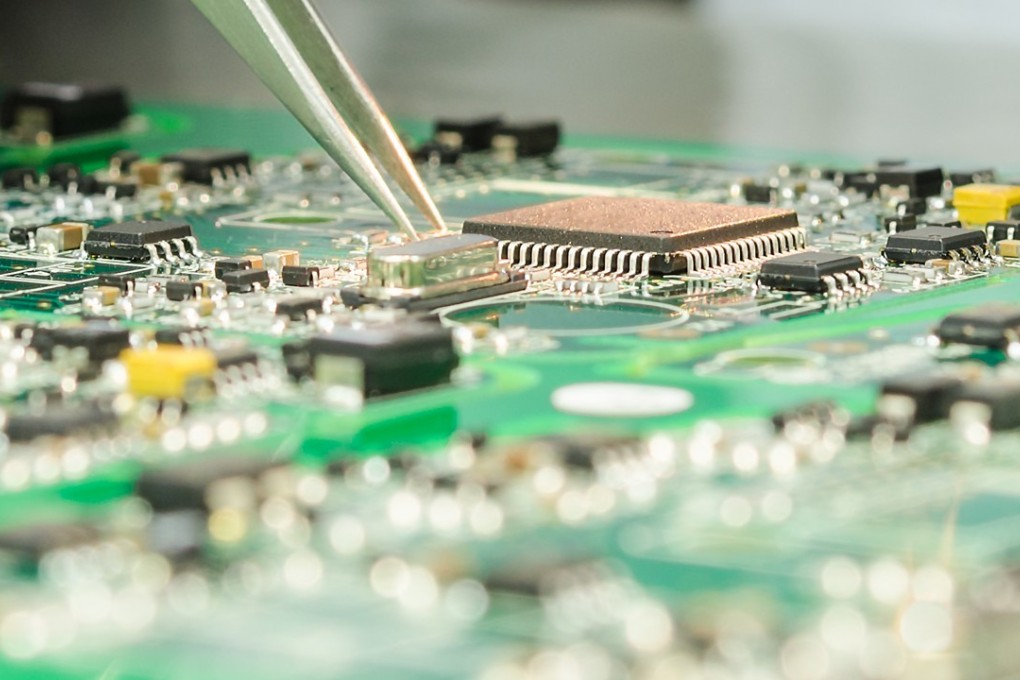

Bullish on chips: Everbright’s fund earmarks US$500 million to invest in semiconductors

The joint initiative with venture capital firm Walden International promises to heat up China’s pursuit of semiconductor assets worldwide

Hong Kong-listed investment company China Everbright has teamed up with venture capital firm Walden International Group to launch a private equity fund that will invest in semiconductor and industrial information technology companies.

The Walden CEL Global Fund I, which has a target size of US$500 million, is expected to make investments and initiate acquisitions in semiconductor companies in the growth and mature stages.

Interest by Chinese companies in semiconductor-related investments, mergers and acquisitions at home and abroad has intensified the past two years, following the government’s introduction in June 2014 of a policy to build an advanced chip manufacturing supply chain.

The target is for the nation’s semiconductor industry to record a 20 per cent compound annual growth rate by 2020 while reducing dependency on imported chips.

He said the company predicted a bright future for the semiconductor industry, as represented by the nearly US$100 billion in investments it made in the sector last year.