Xiaomi investors question US$100 bn IPO valuation

It’s not entirely clear whether potential buyers are balking at the initial $100 billion number for the smartphone maker, or whether bankers and executives are seeking to temper expectations so Xiaomi can enjoy a higher first-trading-day pop.

Investors hadn’t even sifted through Xiaomi Corp.’s 597-page filing for an initial public offering last week when doubts over the smartphone maker’s lofty valuation figures began percolating.

It’s not entirely clear whether potential buyers are balking at the initial $100 billion number, or whether bankers and executives are seeking to temper expectations so Xiaomi can enjoy a higher first-trading-day pop.

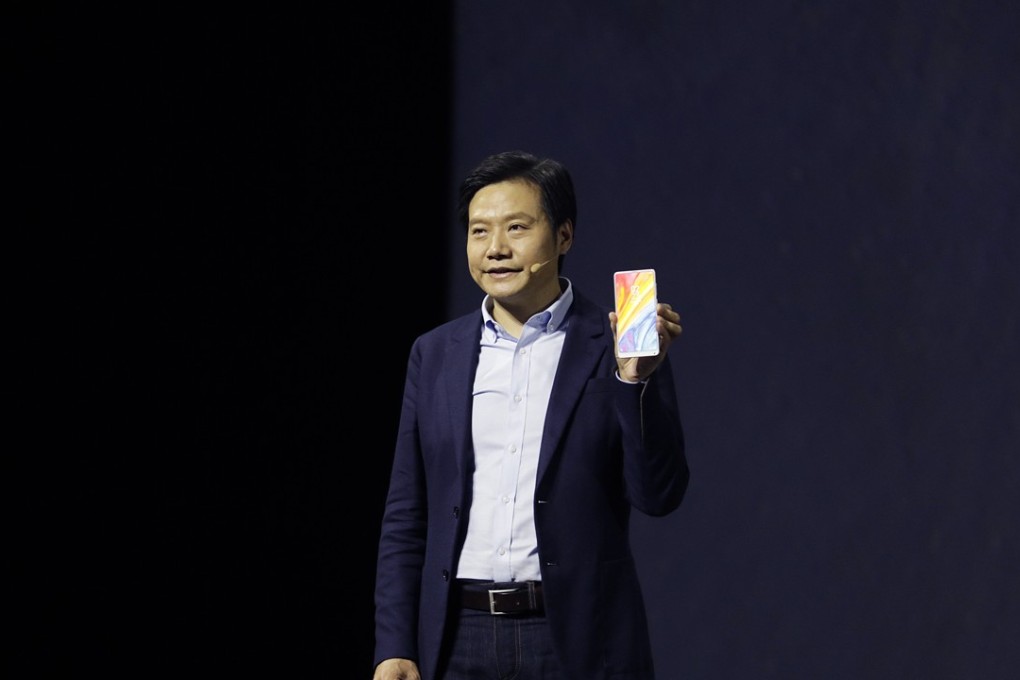

Estimates for the eight-year-old startup’s valuation have fluctuated from $30 billion to more than $100 billion in anticipation of its IPO. What’s clear is that this is partly due to mixed messages about what Xiaomi does. While 70 percent of revenue comes from selling smartphones, co-founder Lei Jun insists that Xiaomi’s real goal is to be an internet services company making money off ads and online games.

“Xiaomi is still an early stage company with multiple businesses investors don’t fully understand,” said Haifeng You, an accounting professor at Hong Kong University of Science and Technology. “With high uncertainty, there’s a greater chance of a company getting overvalued.”