Hong Kong’s hawkers and fishmongers to spearhead city’s cashless push with Alipay roll out

Ant Financial will roll out its Alipay electronics payment platform to 43 hawkers at the Po Tat market in Kwun Tong, taking a major step to popularise and lead Hong Kong’s march toward a cashless economy.

Ant Financial Services Group, which operates the payments system for the world’s largest online shopping platform, is expanding its Alipay service to the fishmongers and wet markets of Hong Kong, taking a major step to spearhead and popularise a cashless economy in the city.

Ant Financial and Uni-China (Market) Management’s Hong Kong Market unit have formed a partnership to make the AlipayHK electronic payment platform available to 43 hawkers at the MC Box Po Tat market in Kowloon’s Kwun Tong district. The service will be complete by the end of 2017, according to a press statement.

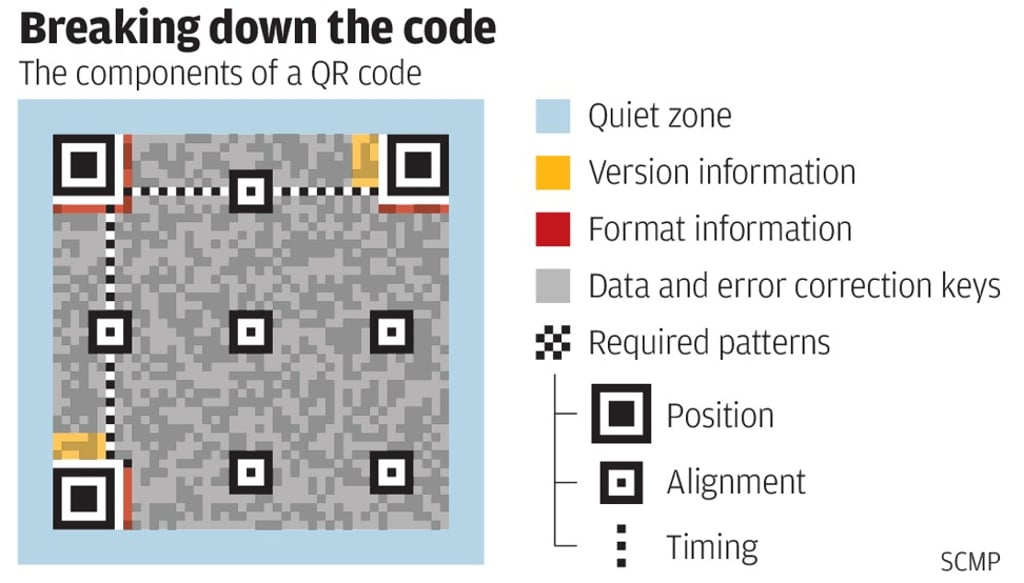

The roll out of electronics payment is a small step in improving hygiene at wet markets, preventing hawkers from handling money and food at the same time, said Hong Kong Market’s chief executive Jackie Ling. Customers can pay the exact amount of their purchases by scanning a QR code, without needing to handle any change by merchants, Ling said.

It’s also a big step to help Hong Kong catch up with mainland China’s march toward a cashless economy, two decades after the city’s Octopus card -- a reusable contactless stored value payment system -- led the world in electronic payments, an innovation that was subsequently emulated in different economies, including the Oyster card in the UK.

Hong Kong’s mobile and electronic payment transactions will expand to US$529 million this year, according to data by Statista. That’s less than half a percentage point of China’s transactions, estimated at US$138 billion, dominated by two services: Alipay and Tencent Holdings’ WeChatPay.