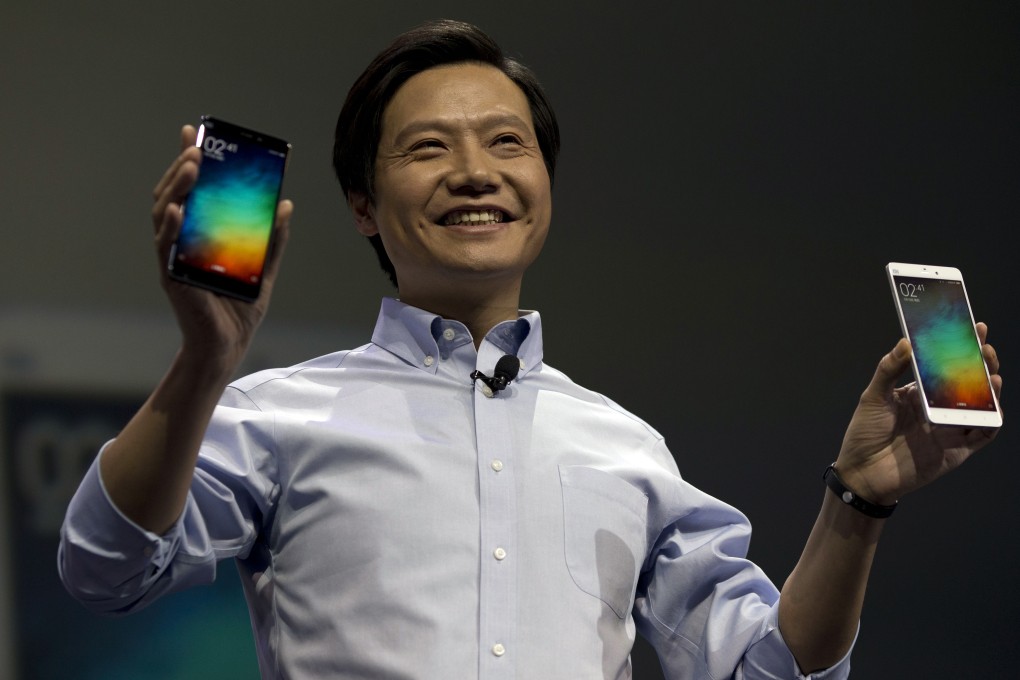

Smartphone brands Xiaomi, Huawei lead China market as cheap domestic models overtake Samsung, Apple

Chinese smartphone makers Xiaomi and Huawei led the Chinese market in the second quarter despite adopting divergent strategies as consumers flocked to domestic brands offering quality on par with foreign brands at a cheaper cost.

The two brands accounted for nearly one-third of all smartphones shipped in the three-month period, while Apple dropped to third place, followed by South Korea’s Samsung and China’s Vivo.

Xiaomi, dubbed "China's Apple" for the clone-like nature of some of its products, regained its crown as the China’s top smartphone vendor with 15.9 per cent market share, according to research firm Canalys estimates. Huawei was close behind at 15.7 per cent.

Canalys did not release estimates for the market share held by Apple or Samsung. It is due to release a full report on China’s smartphone market later this week.

“The China smartphone market continues to mature, remaining stagnant quarter-on-quarter. Competition among major brands has never been so intense,” said Jingwen Wang, an analyst at Canalys.