China’s Huawei says rivals using politics to keep it out of US for fear of competition

Huawei Technologies, the world’s largest telecommunications equipment supplier, plans to introduce its first 5G smartphone later this year

Huawei Technologies plans to launch one of the world’s first 5G handsets as it looks to move beyond its setback in the United States market, which the company described as an attempt by rivals to keep out a strong competitor.

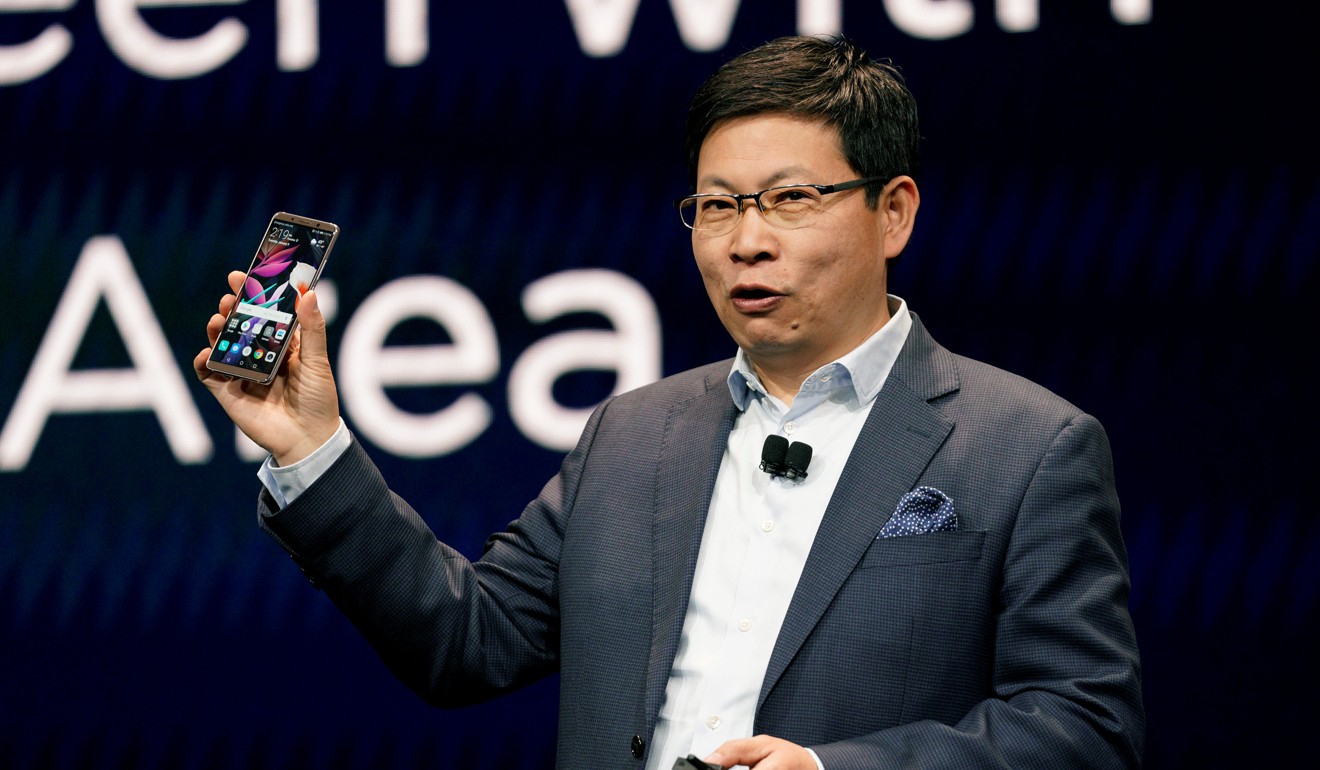

Richard Yu Chengdong, the chief executive of Huawei’s consumer business group, said on Sunday that certain governments worry that the company has “become too strong” at a media round-table in Barcelona, Spain.

“Huawei has no issue on cybersecurity and privacy. In fact, we are doing better than others. Huawei is a transparent company, and we follow local laws”, said Yu.

“All US carriers want to do business with Huawei. The US government and some competitors do not compete with Huawei on technology, but they are using politics to keep us out. That’s unfair. They worry we are too strong.”

He did not elaborate on who those competitors are.

Shenzhen-based Huawei, the world’s largest telecommunications equipment supplier and third biggest smartphone brand, has seen its network equipment and handset sales flourish over the past few decades across the world, where it “has formed strategic relationships with all major telecoms operators”, said a company spokesman on Friday.

Those alliances have allowed Huawei to aggressively push new hardware and software systems to support preparations of these operators to deploy advanced 5G mobile services from 2020.

Security concerns were widely reported to have prompted US carrier AT&T to walk away from a smartphone distribution deal with Huawei ahead of the Chinese firm’s launch of its flagship Mate 10 Pro handset at the CES trade show in Las Vegas last month. Later it was reported that Verizon Communications also abandoned plans to distribute Huawei’s smartphones in the US.

With no US carrier deal in place, Huawei offered its Mate 10 Pro at a steep discount through major electronics retailers, including Amazon and BestBuy. That promotion, however, could hardly make up for Huawei’s failure to secure a distribution deal with US carriers, which corner more than 90 per cent of smartphone sales stateside.

Republican lawmakers last month introduced legislation to prevent the US government from buying or leasing network equipment from Huawei and ZTE.

On Sunday, Yu sai Huawei’s 5G smartphone is likely to be introduced in the second half of this year as part of the company’s updated Mate series, the company’s flagship Android smartphone line.

That plan capped a series of announcements made at Huawei’s 5G product launch a day before the opening of the annual Mobile World Congress (MWC), the world’s biggest trade show for the mobile industry, in Barcelona.

The company also unveiled 5G networking routers for telecommunications carriers, which it claimed as the first such products to be introduced in the market.

“At Huawei, we’re guided by a vision of an all-connected world,” said Yu. “5G technology will underpin the next leap forward for our intelligent world, where people, vehicles, homes and devices are fully connected, delivering new experiences, insights and capabilities.”

He said Huawei will have a slate of commercial 5G products, from carrier networking gear and chips to smartphones, to support the initial roll-out of 5G networks in China this year.

Huawei’s new 5G network router, which will be powered by the company’s own Balong 5G01 chip set, is expected to be released by 2019, according to a company spokesman.

But Bryan Ma, a vice-president at technology research firm IDC, indicated that recent developments in modem and antenna technologies seemed to point to 5G smartphones shipping in commercial volume from late 2019.

“I think we need to see more details on [Huawei’s announcement] first,” said Ma. “Huawei is naturally trying to be as aggressive as it can on 5G. Huawei wants to claim a lot of firsts and show its technological prowess at the Mobile World Congress, which has the right audience for the company.”

The international authorities overseeing the creation of a universal 5G standard are expected to release the next-generation mobile system’s initial specification this year and the final phase in 2019, paving the way for wide commercial deployment of 5G mobile services around the world from 2020.

Apart from providing faster data speeds and wider coverage than existing 4G networks, 5G is expected to serve as the wireless platform to support various advanced services that include autonomous driving, smart transport systems, cloud computing and artificial intelligence systems.

“With its debacle in the US, we expect Huawei to sharpen its focus on Europe, which is the company’s biggest market after China,” said Counterpoint research director Neil Shah. “Europe currently makes up about 20 per cent of Huawei’s total annual smartphone shipments.”

Huawei posted total revenue of 521.6 billion yuan (US$82.3 billion) in 2016, up 32 per cent over 2015. Its carrier business in 2016 was worth about US$42 billion, which surpassed Swedish rival Ericsson’s revenue of about US$25 billion that same year.

Yu pointed out that Huawei may become a top-two global smartphone brand “within one or two years, and even become number one some day”.

“We saw strong smartphone growth globally, except in the US,” he said. “Our products are sold in 170 countries.”

Huawei shipped 153.1 million smartphones last year, up 9.9 per cent from 2016, to seize a 10.4 per cent global market share behind industry leaders Samsung Electronics and Apple, according to IDC.

Yu, however, predicted further consolidation in the smartphone industry, especially in China – the world’s biggest smartphone market.

“Many smaller brands are dying because competing in the smartphone industry requires huge investments in research and development, marketing and distribution,” he said.

Such scale would be needed to compete when advanced 5G mobile networks and services are rolled out. Mainland competitor ZTE last month said it would launch its own 5G smartphone next year.

The International Telecommunications Union (ITU), the UN agency shepherding the development of the IMT 2020 standard for 5G mobile technologies, has said the upcoming universal specification will support: a million connected devices per square kilometre; 1 millisecond latency, or the amount of time a packet of data takes to get from one point to another; higher energy and spectrum efficiency; and a peak data download speeds of up to 20 gigabits per second.

The ITU is working on a universal standard and global mobile spectrum allocation in tandem with the 3rd Generation Partnership Project (3GPP), an international collaboration of seven telecoms standard development organisations.

Ryan Ding Yun, the president of Huawei’s carrier business group, said earlier this month that the company plans to invest 5 billion yuan (US$787 million) in further 5G research and development, and launch a range of commercial 5G equipment, including wireless access networks and devices.

Huawei and ZTE are leading the research, development and commercialisation of 5G-related technologies in China, which is expected to be the world’s biggest market for that next-generation mobile system.

“Since 2009, Huawei has invested US$600 million in research and development into 5G technologies, where we have led the way with innovations around network architecture, spectrum usage and field verification,” said Yu. “From connected vehicles and smart homes to augmented and virtual reality (VR) and hologram videos, we are committed to developing a mature 5G ecosystem so that consumers can benefit from a truly connected world that transforms the way we communicate and share.”

Huawei introduced on Sunday a pair of 5G networking devices, geared for both outdoor and indoor deployment, based on the 3GPP standard. The routers can support 5G mobile services across all mobile spectrum bands, including those under 6 gigahertz and those above 24GHz – loosely known as millimetre wave.

Yu said the Balong 5G01 chip set, which powers those products, was the first commercial chip set based on the 3GPP’s 5G specification. It has made Huawei a direct competitor to Qualcomm Technologies, the world’s biggest supplier of mobile chips.

Huawei has its own subsidiary, HiSilicon Semiconductor, that is reportedly the largest chip design company in China.

Huawei had also introduced a new notebook with touch display, the MateBook X Pro, and a tablet, the MediaPad M5, on Sunday.

The company’s initial 5G network routers have measured downlink speeds of up to 2Gbps, which will enable VR video and gaming, and downloading of a television show within a second, according to Huawei.

It said more than 30 global telecommunication carriers, including Vodafone, SoftBank Corp, T-Mobile, BT, Telefonica, China Mobile, China Unicom and China Telecom, have started testing its early 5G-ready equipment.

Huawei rivals Ericsson, Nokia and ZTE have also been actively testing their own 5G-ready networking gear with various telecoms carriers around the world.

Thomas Husson, a vice-president at US research firm Forrester, said Huawei’s lack of a new flagship smartphone announcement at the MWC this week, compared with previous years, could give Samsung Electronics “a window of opportunity to claim leadership in the high-end smartphone market, competing with Apple’s iPhone X”.

All US carriers want to do business with Huawei. The US government and some competitors do not compete with Huawei on technology, but they are using politics to keep us out. That’s unfair. They worry we are too strong.

Huawei will launch its premium P20 Android smartphone in Paris next month, according to Yu.

Husson said Huawei started its mobile phone business in Europe by selling white-label handsets which carriers rebranded as their own.

“[European carriers] welcome a third [major smartphone] player to be less dependent on Samsung or Apple, and certainly appreciate the greater flexibility Huawei may offer,” said Husson.

The more diverse and fragmented smartphone sector in Europe provides more opportunities for Huawei because the market is “less concentrated among carriers and consideration for the Huawei brand is strong”, he said.

Data from IDC showed that Huawei shipped 28.5 million smartphones in Europe last year, which was third behind Samsung’s 70.2 million units and Apple’s 44.7 million.

Total smartphone shipments in Europe last year reached 206.4 million units, compared with the global volume of about 1.5 billion in the same year.

IDC’s Ma said the MWC, with its heavy European emphasis, represented “a good platform for Huawei to reinforce and strengthen its smartphone brand, which is crucially needed right now when countries like the US are pushing back”.

Huawei established its European operations in 2000 with the opening of a research and development centre in Stockholm, Sweden. The company, which has offices in 33 countries across Europe, has more than 10,000 staff in the continent, with more than 1,500 involved in research and development activities across 18 centres.

Counterpoint’s Shah said marketing investments, strong carrier business and key partnerships, including with German lifestyle brand Porsche Design and high-end camera maker Leica, “have helped Huawei establish a mix of carrier and open market distribution in Europe”.

He expected those and potential new alliances would also help Huawei when the time comes for a wide release of its 5G smartphones.