China’s 5G expansion plans threatened as ZTE is pinched by US export ban, trade tensions

ZTE, the world’s fourth largest telecommunications equipment supplier, sets up crisis team as company faces challenge to meet orders

Amid the incessant headlines about the rise of China into a technology powerhouse, the ban on the sale of American-made parts to ZTE exposed the soft underbelly of the country’s tech industry: a lingering dependence on US semiconductors and software.

If no settlement is reached, the seven-year export ban would not only hurt ZTE, China’s largest listed telecommunications equipment manufacturer, but deal a blow to the country’s goal of recasting itself as a leading innovator. It would also handicap the mainland’s ability to build the world’s largest 5G network by the end of this decade.

“The US trade sanction is a major roadblock on China’s path to become a global hi-tech leader,” said Paul Haswell, a partner who advises technology companies at the international law firm Pinsent Masons.

Without the US-made chips and other components that it needs, ZTE would be hard-pressed to meet its network equipment as well as smartphone orders around the world, and push forward its 5G-related research and development.

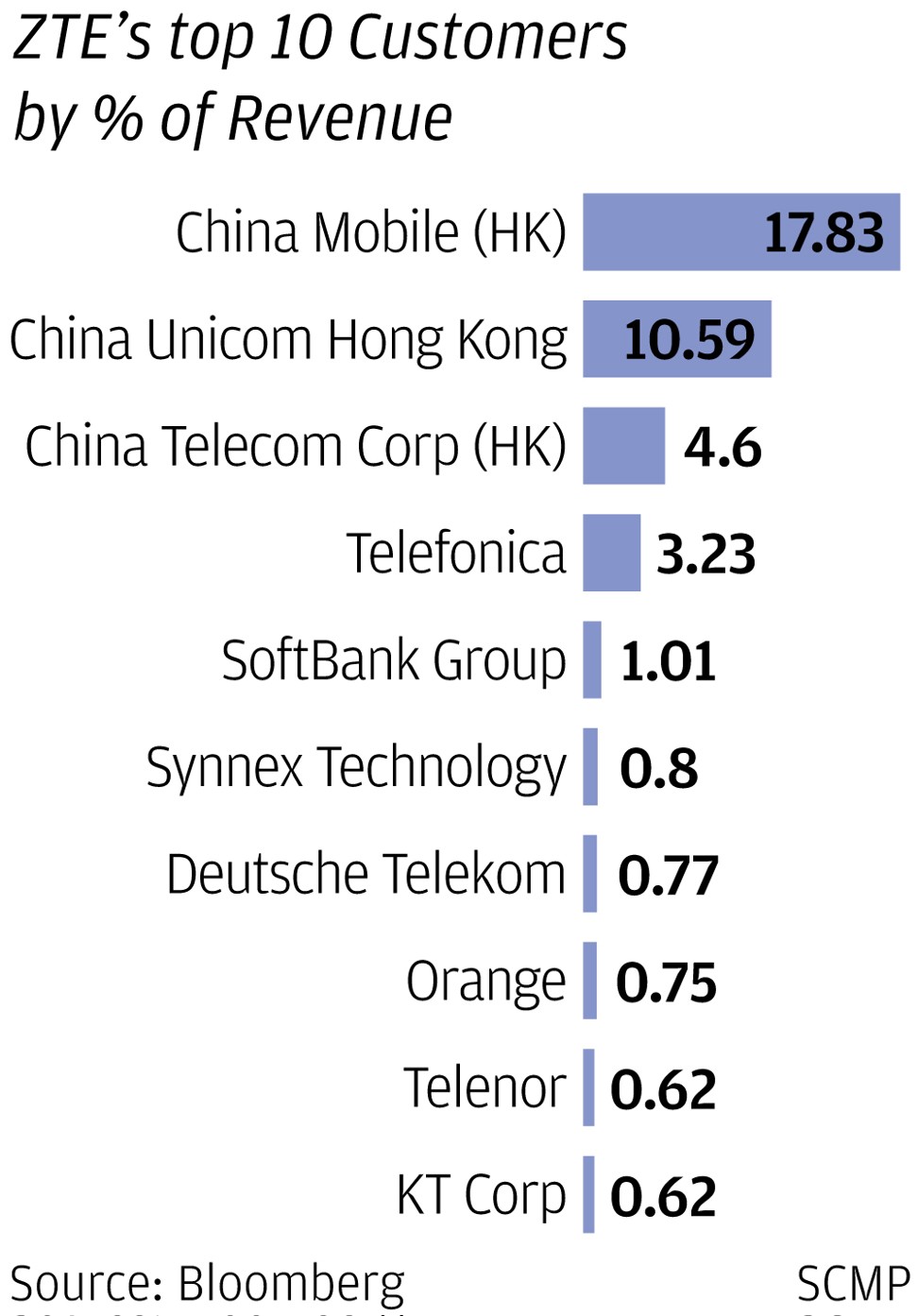

Hong Kong-listed ZTE and Shenzhen-based rival Huawei Technologies have been spearheading the development and commercialisation of 5G-related technologies on the mainland. Both companies are also the primary network equipment suppliers to nationwide carriers China Mobile, China Unicom and China Telecom, helping them on 5G infrastructure deployment initiatives.

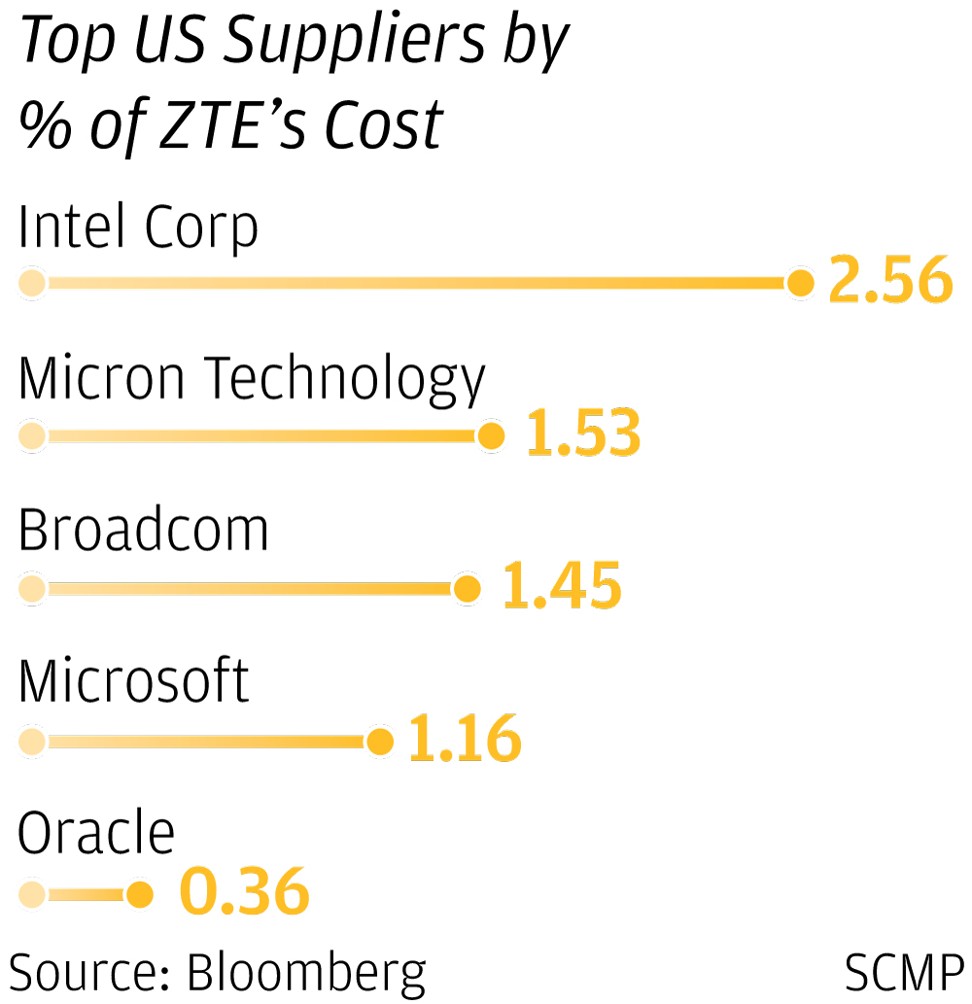

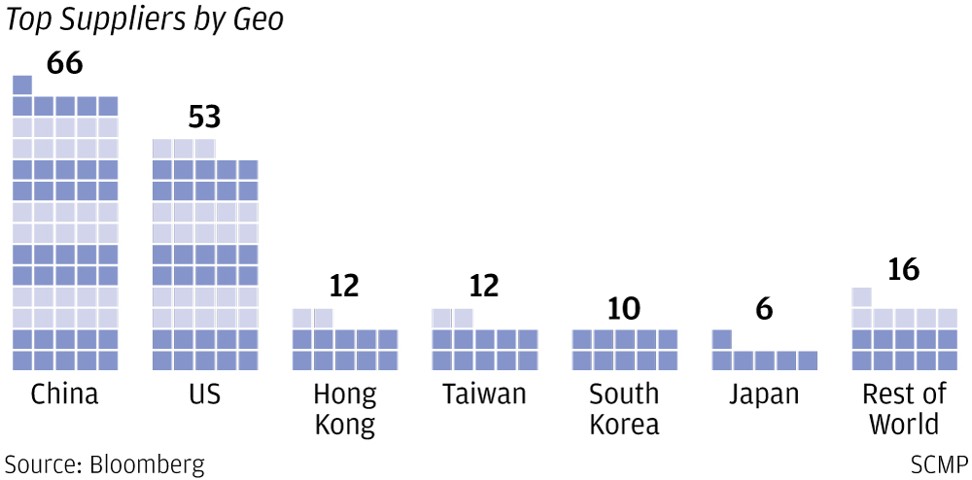

As of last year, US-made components accounted for up to 15 per cent of ZTE’s total bill of materials, Nomura analyst Joel Ying said in a report on Tuesday.

Why China is set to spend US$411 billion on 5G mobile networks

5G, the latest advancement in mobile communications technology, has become the biggest opportunity for China to emerge as a leader in telecommunications development. While China has the world’s largest mobile subscriber base at about 1.4 billion and the biggest 4G network on the planet, the US and other Western countries have dominated mobile systems innovation over the past few decades.

Everything you need to know about 5G

ZTE, Huawei and Chinese telecoms industry officials have been working to enable China to gain a greater share of the intellectual property behind the universal 5G standard during its development.

Their success would not only increase China’s global influence, but improve its bargaining power with foreign patent holders and help lower costs for mainland telecoms equipment makers, chip companies and other enterprises in the supply chain, according to Jefferies equity analyst Edison Lee.

The commercial roll-out of 5G networks around the world is expected to start in 2020.

Beijing has forecast the country’s total investments on 5G mobile networks to reach 2.8 trillion yuan (US$446 billion) from 2020 to 2030, which would mark the most expensive buildout of telecommunications infrastructure on the mainland.

All those plans, however, could get derailed by ZTE’s latest run-in with the US government.

The US ban followed Shenzhen-based ZTE’s failure to comply with some of the terms of its settlement with the US government in March last year. ZTE had agreed to pay US$1.2 billion in penalties to the US government to settle its violation of long-standing trade sanctions on Iran and North Korea.

ZTE agreed to a seven-year suspended denial of export privileges and suspension of US$300 million in penalties during that probationary period.

The company had also promised to dismiss four senior employees and discipline 35 others involved in the trade violation by either reducing their bonuses or reprimanding them, according to a Reuters report that cited senior officials from the US Department of Commerce. But ZTE admitted in March that it had not disciplined or reduced bonuses to the 35 other executives.

“This may seem like a minor mistake, but it happened at the worst time,” said Lee, the equities analyst, referring to the brewing trade war between China and the US.

US President Donald Trump’s administration has threatened tariffs on US$150 billion worth of Chinese imports amid complaints about the alleged theft of US intellectual property by China.

“The damage to ZTE’s 5G business could be fatal if the ban lasts for more than six months,” said Charlie Dai, a principal analyst at Forrester Research.

ZTE’s baseband and radio frequency chips, storage system and most of its optical components are from the US, so the ban will have a significant short-term impact, according to a Citic Securities report. It said the delivery of existing orders would be severely affected, along with payment collection.

Under the export ban, ZTE would not be able to receive goods from US chip suppliers Qualcomm, Intel and Micron Technology, optical components suppliers Maynard, Acacia, Oclaro and Lumentum, as well as software suppliers Microsoft and Oracle.

It remains unclear how the ban will impact Google’s pre-installed apps on ZTE’s smartphones. The Android operating system is under an open-source licence, so ZTE can keep using that software. Mobile apps like Google Search, however, are directly licensed from Google.

Adding to ZTE’s woes is the warning sent by Britain’s National Cyber Security Centre to the country’s telecoms providers that the use of the company’s equipment and services could pose a national security risk, the BBC reported.

China’s Ministry of Commerce said it would take the necessary measures to protect the interests of Chinese businesses. It said ZTE has cooperated with hundreds of US companies and contributed to the country’s job creation.

At ZTE, the ban has shaken the company, with chairman Yin Yimin appealing for calm.

“The company takes the US ban seriously and has immediately set up a crisis team, with every division analysing and coming up with measures to deal with the crisis,” Yin said in an internal memo to the company’s employees seen by the South China Morning Post.

“We need the combined strength of ZTE’s 80,000-strong staff in this tough time. I’d like to appeal to all employees to maintain a state of calm, to man one’s post and do one’s job well,” the memo said. “The company is actively communicating and giving its all to resolve this crisis.”

ZTE has been banking on 5G mobile network equipment sales to become its new engine for growth, as 4G mobile operators start to upgrade their networks.

While some analysts expect ZTE to be granted a reprieve from the export ban as it pursues another settlement with the US government, Pinsent Masons’ Haswell said trade relations between the US and China were quite different from what they were last year.

“It is possible that a settlement could be reached, but I don’t think the climate is right for it at the moment,” Haswell said.

ZTE’s Yin alluded to the trade tensions in his memo. “The company’s internationalisation will also have its ups and downs,” he said. “On the road forward, we must be steadfast in belief, have even more faith in the company and believe that we will be stronger after weathering the storm.”

Trump’s rush to build a national 5G network may backfire, give China the technological edge

Things seemed to be going well for ZTE after its settlement with the US government last year, with 5G spending expected to be a tremendous boon, a Bloomberg report said. Its market value doubled over the past year, and consumer division chief Cheng Lixin spoke openly about breaking into Apple’s home turf.

Those developments show that much is riding on ZTE getting the US export ban overturned.

With additional reporting by Celia Chen and Meng Jing