Topic

Shanghai Baosteel Group Corporation, usually known as Baosteel is a state-owned steel company which is one of the biggest steel producers in the world, based on output. Its 2000 initial public offering in Shanghai was the largest in China at the time even though it was restricted to domestic investors.

- The government will increase its stakes in five listed state firms while state-owned Baoshan Steel plans to buyback its shares as China moves to support weak bourses

- Last week, Central Huijin Investment, a unit of the nation’s sovereign fund, bought shares in the big four state-owned banks for the first time in eight years

The MoU between Rio Tinto and China Baowu will explore several initiatives including setting up green steel facilities in China and Western Australia.

Baosteel will invest US$437.5 million for a 50 per cent stake in the proposed joint venture with Saudi Aramco and PIF. The partners aim to make project the world’s ‘most competitive low-carbon emission thick steel plates’ plant.

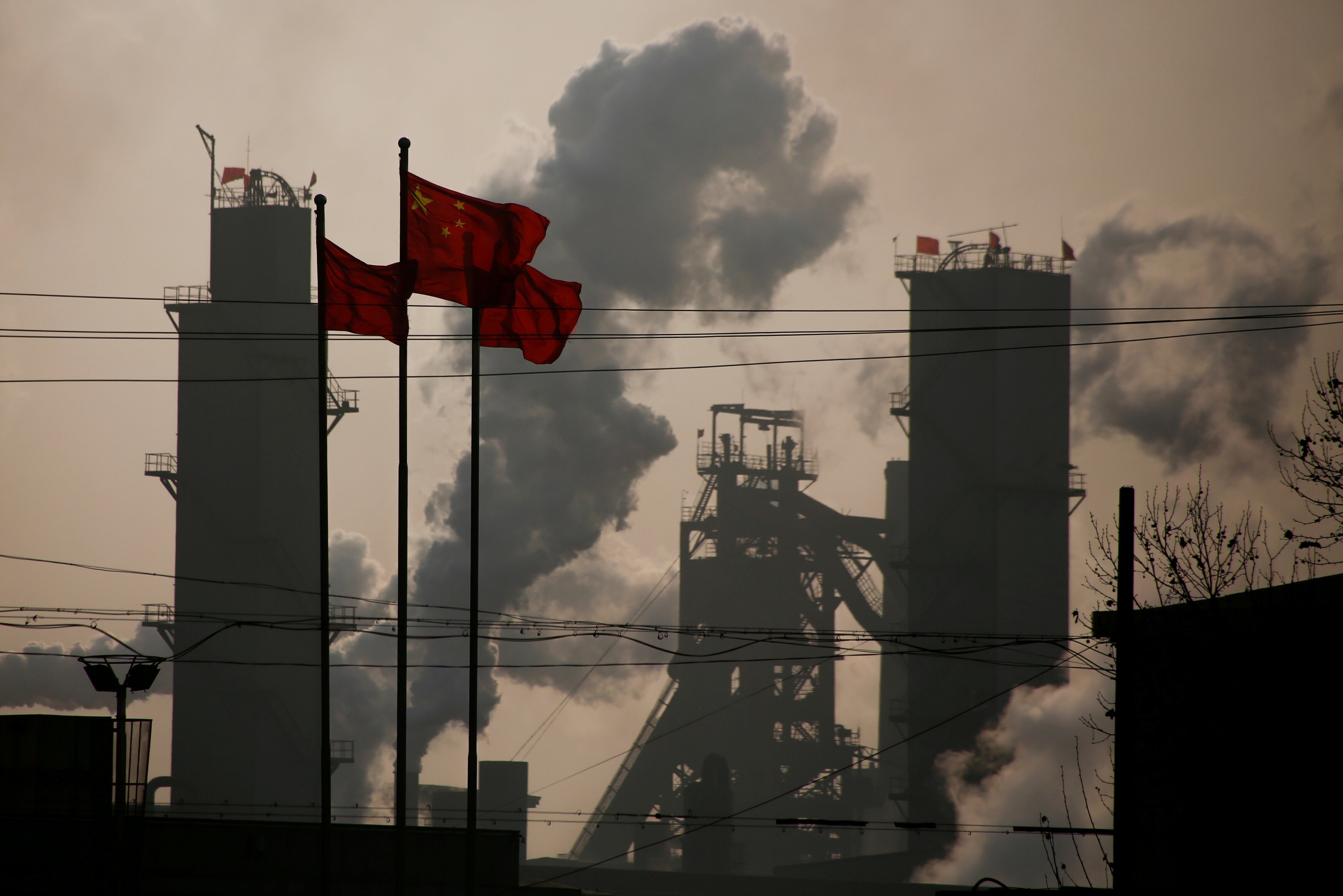

China’s steel industry will go through a multistage technology-driven decarbonisation journey, according to a senior executive at Australian mining giant BHP, which is helping the sector make this transition.

Australian governments and shareholders get rich from iron ore exports to China while traders in other industries struggle to find alternative markets for their banned goods.

Baowu Steel Group, the world’s largest steelmaker, has established an investment fund focusing on carbon-neutral projects to bolster China’s ambitions of cutting greenhouse emissions.

China has called for greater risk controls among futures traders after overnight measures to cool rapid price gains that sent contracts on iron ore to steel to record highs.

The decision by Chinese steel mills to raise prices could threaten a range of smaller downstream manufacturers, although the effect on overall inflation is not yet clear.

China’s steel accounts for about 15 per cent of the country’s carbon emissions and over 60 per cent of the global steel industry’s emissions.

Newly signed memorandum of understanding between Chinese steel mill and Australian miner will see US$15 million spent over three years on research to reduce harmful carbon emissions.

Value of mergers and acquisitions in China falls 24 per cent so far this year to US$344.3 billion, according to data provider Dealogic.

Beijing wants the country’s top 10 steel producers to have 60 per cent of the overall capacity by 2020 in a move to improve efficiency.

New study shows that Chinese steel producers are enjoying more exemptions from tariffs than those from Canada, South Korea, Spain and the United Kingdom.

Analysts gauge how raised import duties will affect China, and the US’ other major steel suppliers

Many Chinese people want to be the next Jack Ma in China nowadays and many companies want to copy the success story of Alibaba too including the latest and unusual effort by something that doesn’t have too much to do with technology – China’s No.1 steelmaker.

Aquila Resources and new strategic stakeholder Mineral Resources said yesterday that they plan to announce a deal that could thwart Chinese steel giant Baosteel Resources' US$1 billion bid for Aquila.

Overcapacity on the mainland, which produces nearly half the world's steel, has reduced the profit margins of domestic steelmakers. Baosteel reported a 61 per cent drop in first-half earnings on Friday.

Some mainland steelmakers are tentatively curbing output by starting plant maintenance as weak prices squeeze margins. However, the cuts look too little and too late to support steel prices, which are at their lowest level in more than nine months.

Chief executive Neville Power said in a media briefing at the Boao Forum yesterday that the group was studying the feasibility of an initial public offering of FMG Iron Bridge, an iron ore project it jointly develops with Baosteel in Western Australia.

Unaudited net profit at Baoshan Iron & Steel, the country's largest listed steelmaker, rose about 40 per cent last year to 10.3 billion yuan (HK$12.8 billion), helped by the sale of some assets, the firm said. But operating profit before one-off items fell 33 per cent to 6.2 billion yuan.