Topic

The billionaire investor misunderstands the political dynamics of the country, writes Wang Xiangwei.

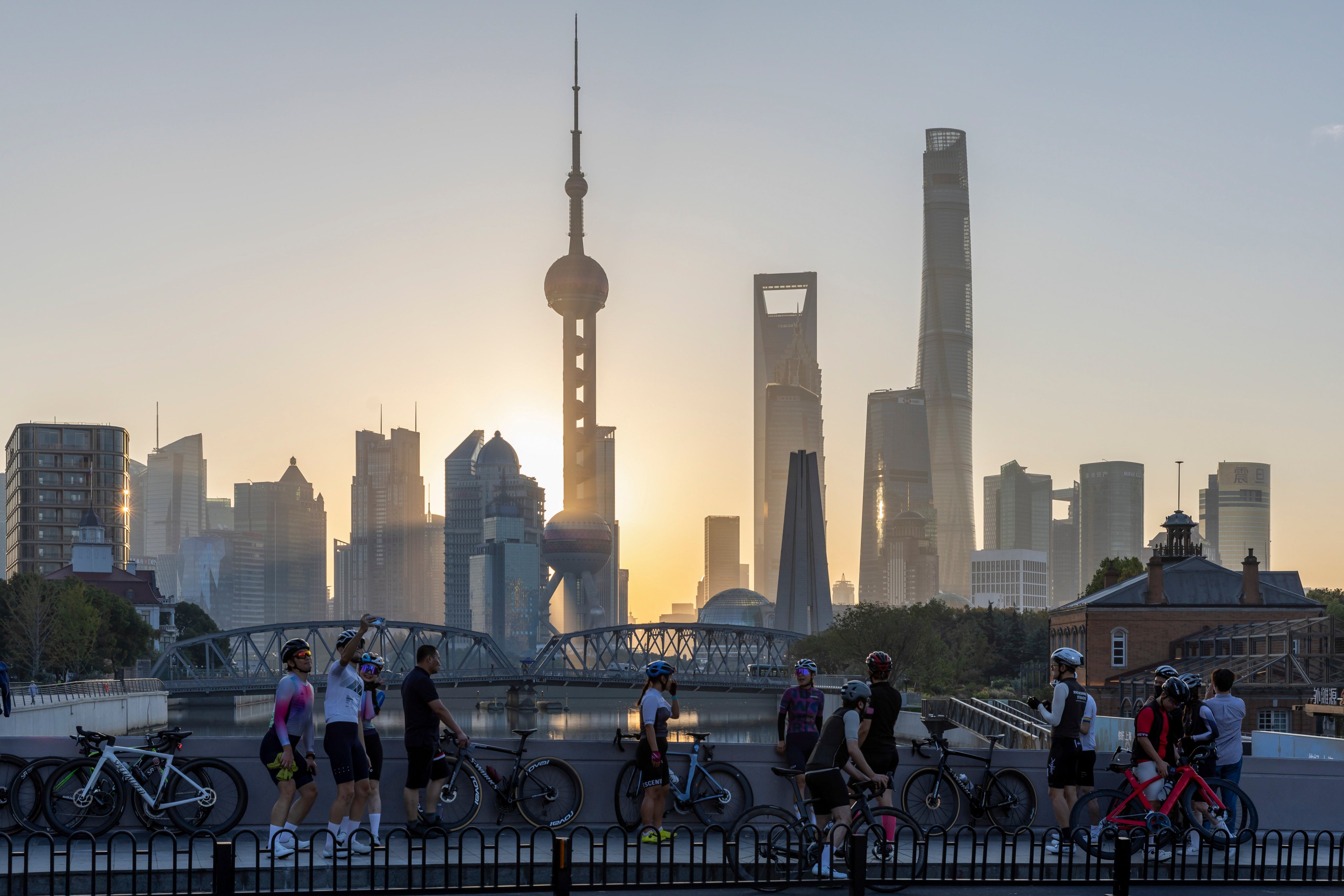

- The New York-based asset manager is marketing the property in northwestern Shanghai at a reduced rate to speed up the sale

- Prime offices in Beijing and Shanghai traded at capitalisation rates of about 5 per cent last quarter, the highest in more than a decade, Colliers data shows

The oversubscribed fund will focus on bolstering Asia’s digital infrastructure and energy transition with investments in companies including a green data centre operator and an offshore wind farm vessel operator.

The world’s largest asset manager believes AI will be transformational, and is investing in finance-specific machine learning to augment the investment-analysis process.

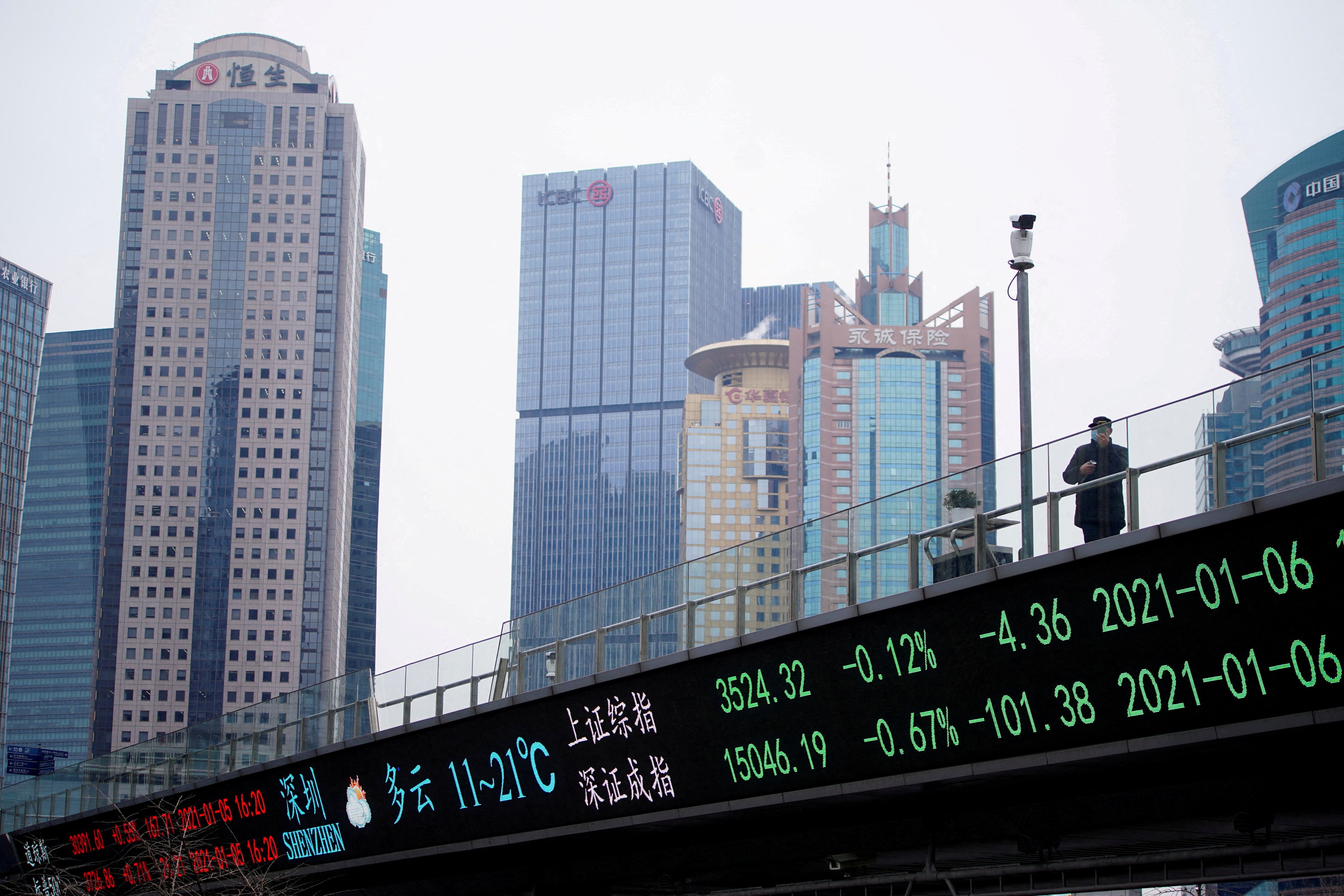

Stocks slipped after BlackRock strategists added to the downbeat view on Chinese equities. Risk appetite was weak before key rate decisions from the Federal Reserve and Hong Kong’s monetary authority.

BlackRock, the world’s biggest money manager, downgraded Chinese stocks and their emerging-market peers. That reversed its bullish call in February as China’s post-Covid reflationary measures fell short of expectations.

The transition to net zero is ‘the single biggest investment opportunity out there’, says BlackRock executive, as government official calls on companies to step up investment in green finance, hydrogen, biofuels and low-carbon technology.

The firms helped American capital flow to companies the US blacklisted for human-rights abuses or fuelling China’s military advancement, according to the House of Representatives’ Select Committee on the Chinese Communist Party.

Citadel Securities has hired Tang Xiaodong, former head of China at BlackRock and an ex-regulator, to spearhead its expansion plan in the US$10.3 trillion market.

Investment management behemoths BlackRock and Invesco have reiterated their positive views on regional laggards Chinese stocks and are betting that policy support will underpin strong second-half performance for the regional laggards, even as major investment banks slash their targets for key equity benchmarks.

The bullish start in 2023 has obscured the fact that the first quarter tends to be painful for investors in Chinese stocks in recent memory. BlackRock says the market view is too rosy for now.

The executives from HSBC, Standard Chartered, Citigroup, UBS and others, are expected to endorse Hong Kong as an international financial centre.

Wider use of the TCFD (Task Force on Climate-related Financial Disclosures) approach is welcome, but companies must move beyond mere compliance, said panellists at SCMP’s Climate Change Hong Kong Summit.

Local stocks suffered the first back-to-back losses in two weeks amid weaker corporate earnings from Tencent, JD.com and tech peers as strategists cut China growth outlook.

BlackRock jettisoned its bullish stance on China as Covid lockdowns jeopardise the nation’s economic growth, triggering a steep drop in local stock prices.

BlackRock and CCB’s joint venture launches its first pension product as China expands its private pension scheme to tap the country’s vast savings.

With inflationary pressure in the US, the Fed envisages seven rate increases this year, with another four next year, taking the Fed funds rate to 1.9 per cent by the end of 2022 and 2.8 per cent by the end of 2023

The light at the end of the tunnel remained an illusion as major tech-focused funds took one of their heaviest beatings in years last quarter. A case of mistimed optimism?

The world’s biggest money manager is turning modestly positive on tactical basis, saying the slowdown has reached levels policymakers can no longer ignore.

BlackRock became the first global asset manager to win a licence for a wholly-owned onshore mutual fund business in China in June.

Billionaire investors George Soros, an early investor in Hainan Airlines, said in an opinion piece that BlackRock expansion could harm investors, US security interests.

BlackRock, the world’s biggest money manager, has voted against the election of 1,448 independent directors in 819 listed companies in Asia-Pacific in the 12 months to June 30, according to its latest proxy voting report.

A technology sell-off, Evergrande’s five-month plunge and the education technology stock wreckage are forcing investors to raise their defences against China’s unrelenting regulatory clampdown.

Here’s what you need to know about sustainable and responsible investing under the ESG label, and how funds can outperform markets or rivals with such an approach.

China’s stock market, muddled by slowing growth and policy tightening risks, has turned the nation’s top dividend-paying companies into a safe harbour and runaway winners for funds managed by BlackRock and Vanguard.

China’s clampdown on commodity prices is eroding the appeal of the nation’s best-performing industry group, denting stocks cherished by funds including BlackRock and Vanguard.

More than half of Hang Seng Index companies have yet to commit to carbon emissions reduction targets. Investors including BlackRock want board directors to step up.

BlackRock is the latest foreign firm to seek to expand its wealth-management operations in China as a swathe of financial service providers bet on rising incomes across the mainland.

Regulatory tightening in China’s technology sector is probably not over yet, said Lucy Liu, who has been trimming her bets on Alibaba, Tencent and Meituan over the past three quarters in her US$1.64 billion BlackRock China Fund.

Rachel Lord, the incoming Asia-Pacific chair of BlackRock, joined the world’s biggest asset manager in 2013 after stints in Asia with Citigroup and Morgan Stanley.