Topic

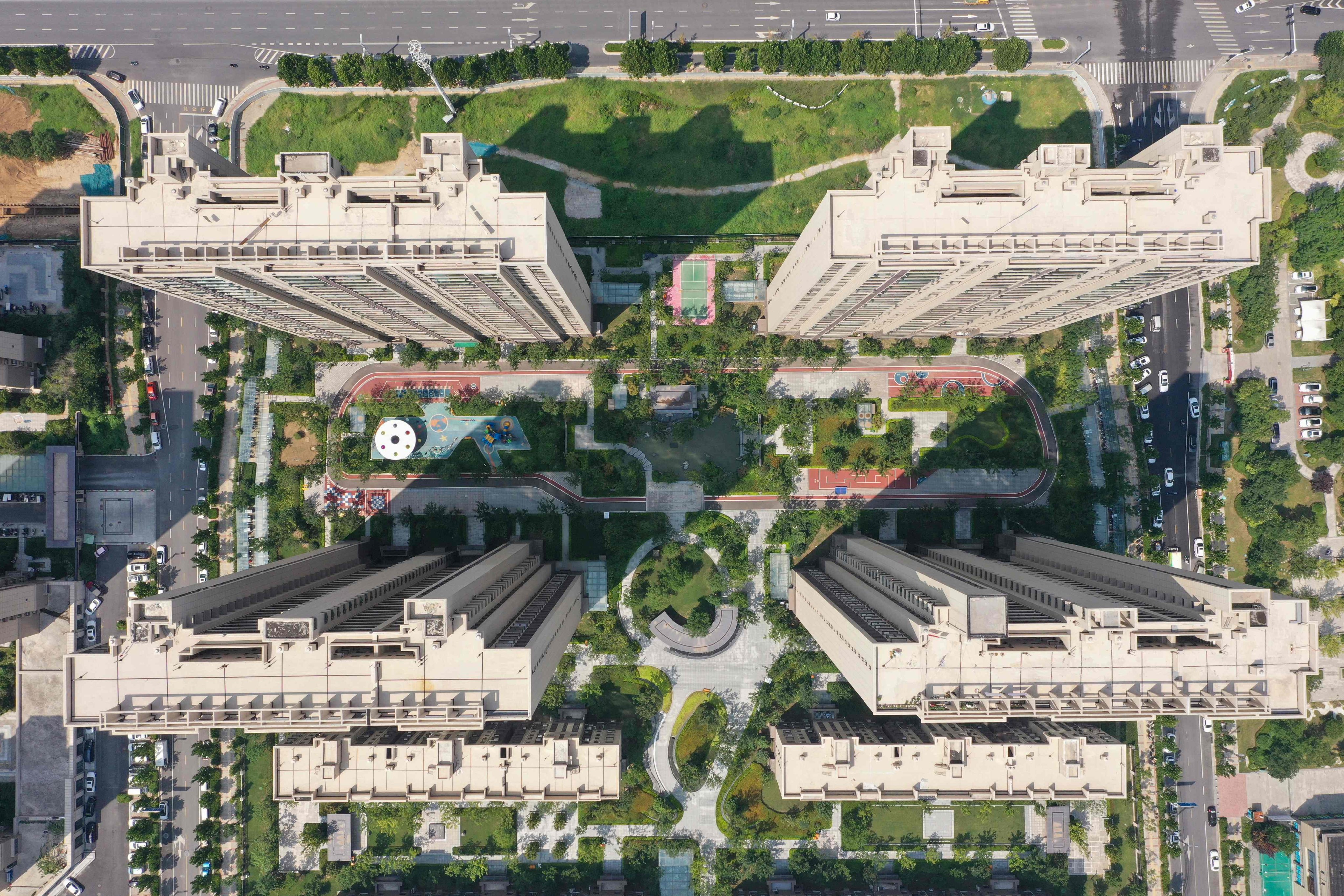

China’s property market has surged in recent years. After prices jumped 25 per cent in 2009 alone, the central government imposed austerity measures, including lending curbs, higher mortgage rates and restrictions on the number of homes each family can buy.

Services sector and overseas demand for exports may have buoyed first-quarter GDP, but daunting challenges remain for country on path to recovery.

- Asia official with Washington-based agency points to PBOC’s policy moves, as well as China’s infrastructure spending, as economic bellwethers

- But years-long property crisis, local-level government debt and overcapacity remain high hurdles to overcome

Vanke has held discussions with parties including state-owned investment company Guangdong Holdings and a Tianjin-based state-owned firm to exit its investment, said people familiar with the matter.

Hong Kong developers are pricing new flats at a deeper discount as the property market attempts to rebound from a multi-year slump. Great Eagle is joining the fray with discounts at its project in Ho Man Tin.

More than 40 of the 50 jobs the Wall Street firm plans to cut will be from Hong Kong and mainland China. Morgan Stanley joins a host of banks that have laid off bankers this year.

Country Garden is pushing back some onshore bond payments to later dates despite a round of extensions last year, underscoring the financial stress at the Chinese property developer.

While first-quarter GDP data shows China is on course to meet its full-year economic growth target, policymakers are still being called on to bolster demand and introduce stronger policy support.

After the release of China’s first-quarter GDP growth, International Monetary Fund says the lack of a ‘comprehensive response’ could lead to less economic growth than Beijing is hoping for this year.

Accounting firm vows investigation, possible legal action against creators of ‘fabricated’ letter circulating on social media, which names partners it claims were involved in ‘auditing failure’ tied to the indebted developer.

Debt-laden property developer Times China Holdings is faced with a winding-up petition as it becomes the latest property company creditors are seeking to liquidate.

Prices weakened in March, extending sequential erosion since May 2023. China’s efforts to stem declines in home prices have not produced the desired results, prompting Goldman Sachs to predict a more aggressive policy response.

Ahead of China’s quarterly GDP release, survey figures reflect how difficult times have been for half a billion Chinese people, and where their priorities now lie.

China needs more than 15 trillion yuan (US$2.1 trillion) to overturn a three-year housing crisis, Goldman says. Rescue efforts have not been good enough and the market downturn could still get worse.

More divestments to come, analyst says, as conglomerate aims to cut debts by US$1.38 billion annually in the next two to three years.

Vice-Premier He Lifeng completed a two-day inspection tour of Zhengzhou, Henan province, over the weekend with a focus on China’s troubled real estate market.

Embattled China Vanke said it was well-prepared to resolve its liquidity problems and operational difficulties, while denying that travel restrictions were imposed on its key managerial staff.

China’s banks are removing some of their long-term fixed-income products and cutting rates offered to depositors in an effort to shore up profitability, as challenges including a slumping property sector, mounting local government debt, and slow consumption recovery weigh on bank earnings.

China is encouraging more property owners to swap their old homes for new ones as a way to rejuvenate the market. Zhengzhou, home to the largest iPhone factory, is among at least 30 other mainland cities to introduce the trade-in scheme.

Shanghai-based developer, facing 61.86 billion yuan (US$8.5 billion) in debts, says it needs more time to consider restructuring plan amid slumping sales and slow asset disposal as the property market crisis grinds on.

Lianjia has teamed up with coffee chain operator Manner to open a cafe in one of its outlets in Shanghai, launching a crossover marketing campaign to drive transactions amid lack of homebuying interest.

The city’s commercial real estate market recovered partially in the first quarter of 2024 and is gearing up for further stabilisation this year as a rebound in consumption and policy support drive demand for leasing and investment, analysts say.

The 99-room The Opposite House, the group’s first hotel, will close after 16 years to make way for an ‘innovative retail landmark’ in the Taikoo Li Sanlitun area.

Troubled property developer Shimao Group Holdings is facing a liquidation suit brought by China Construction Bank, the country’s second-largest lender, for a financial obligation amounting to around HK$1.58 billion (US$201.8 million).

Sales of pre-owned homes in 25 major cities jumped by nearly 25 per cent in January and February, compared with the same period in 2022, as activity is on the rise in top-tier cities, analysts say.

‘Foreign investor appetite could not be stronger for Japan at the moment,’ JLL analyst says.

Wuhan University professor Feng Chuan says local government debt problems in China have torn apart the fundamental trust system that upholds social governance order.

Transactions involving lived-in homes in Shanghai shot up in March as owners offered discounts to bargain hunters, but the outlook for the city’s housing market remains cloudy due to concerns about a bleak economy.