Topic

The Hong Kong Monetary Authority (HKMA) was established in April 1993 by merging the Office of the Exchange Fund with the Office of the Commissioner of Banking. The HKMA is responsible for maintaining monetary and banking stability, including maintaining currency stability within the framework of the Linked Exchange Rate system under which the Hong Kong dollar is pegged to the US dollar.

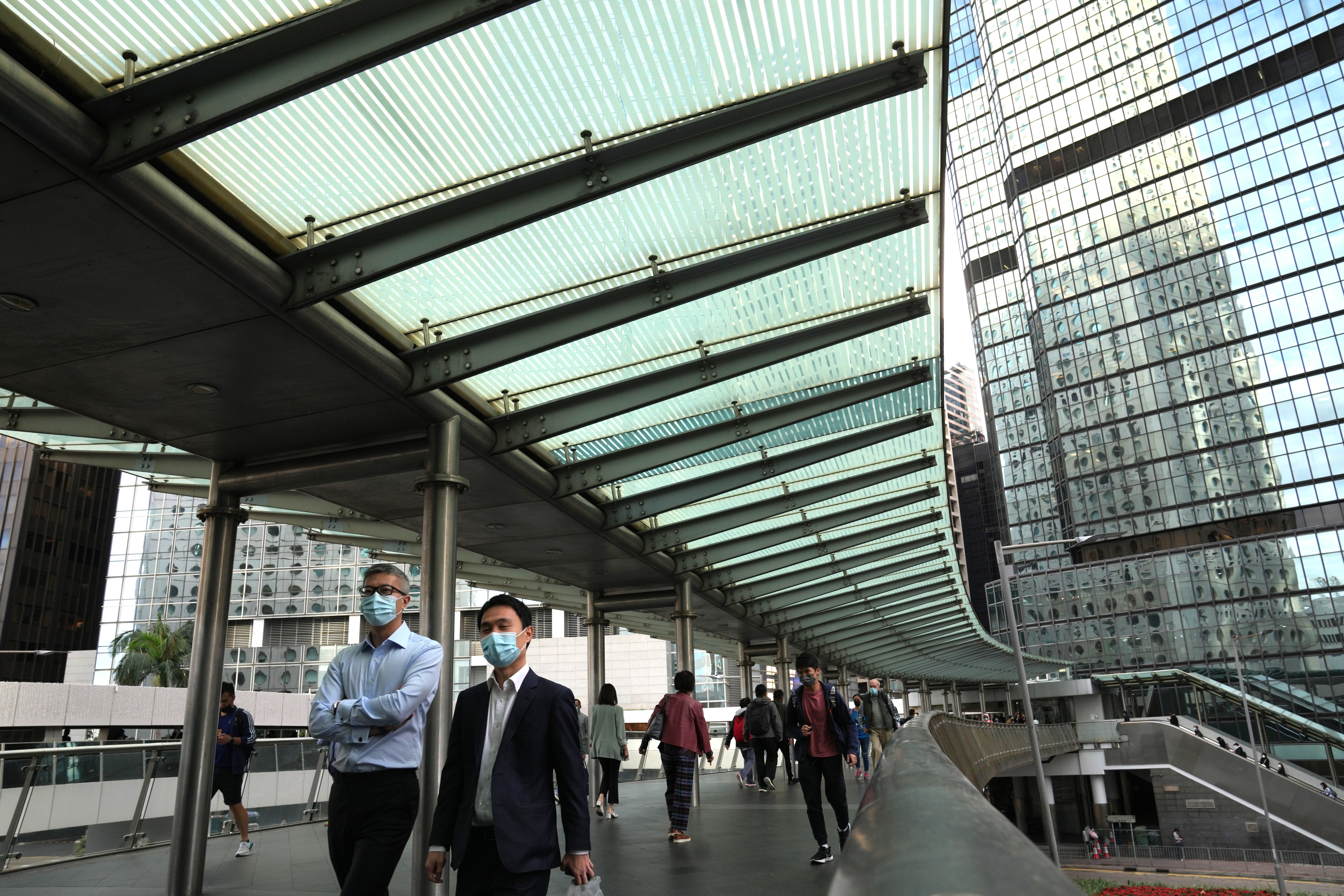

De facto central bank aims for first-mover advantage through blockchain technology, providing welcome lift to Hong Kong’s image as global financial centre

Large supply of homes due to come online soon in Hong Kong will, hopefully, help thwart the rise of a new generation of speculators.

With the Fed expected to start cutting rates before the end of the year, margins for lenders will narrow, potentially exposing threats in other areas. Hong Kong’s banks have made provisions and shored up balance sheets to ward off China property risk

From wealth management to bonds and banking services, mainland China has shown further support for city as a financial hub

Meeting of leading central bankers an answer to those who doubt city’s reputation as global financial centre.

Strong bond market drives rebound by war chest that helps defend Hong Kong dollar and hopes are high it will continue.

Hong Kong’s financial system is robust, but prudence is called for as even steady interest rates are likely to remain high for a while next year.

- Hong Kong offers wealth management and stock market opportunities despite headwinds and uncertain economic outlook in China, top business leaders say

- Some 200 business leaders from across the region are in Hong Kong for a four-day summit of the Apec Business Advisory Council

Hong Kong’s SMEs are more optimistic than their peers in mainland China, Singapore and Australia when it comes to growing their businesses this year, thanks to government support and an increase in online sales, a survey shows.

The Hong Kong Monetary Authority’s SME information platform is part of its ongoing efforts to help SMEs affected by the shift in consumer and tourist spending patterns.

A new operating model enabling Hongkongers to use the services of multiple credit reference agencies for the first time will start on April 26, the Hong Kong Association of Banks and two other industry groups announced.

Property agents have raised sales forecasts for the year amid project launches at discounted prices, but say a lack of a rate cut could pare those estimates.

Scam operators seemingly thumb their noses at the regulator, which recently launched a campaign warning the public about financial frauds.

Tokenisation has proved to be cheaper, more efficient and better than ‘the old-fashioned way of trading’, Noel Quinn says, but HSBC will stay ‘away from crypto’.

Police say 505,000 scam alerts sent to users of Faster Payment System (FPS) between launch of warning system in November and March.

The numbers do not lie, Hong Kong’s financial regulators told the HSBC Global Investment Summit on Tuesday. The city’s market has shown resilience and competence through several years of economic headwinds.

Hong Kong property sales rose to a 10-month high in March, surpassing 5,000 deals a month after the government lifted all property cooling measures, data from the government shows.

Monetary authority announces a nine-point plan that offers reassurance about access to credit relief amid market rumours of loans being called early.

HSBC Gold Token, which will be available on the lender’s online banking and mobile app, is the first such retail product to be issued by a bank, according to HSBC, as the government pushes for more digital assets to be rolled out for public use.

New home sales in Hong Kong stuttered slightly on Friday, with buyers giving a lukewarm response to Henderson Land Development’s latest project in Tai Kok Tsui.

‘There are only a few [international financial centres], and Hong Kong is one of them. It is hard-won. We must not lose this place,’ CK Hutchison and CK Asset chairman says.

Hong Kong’s monetary authority cautioned borrowers to carefully assess interest-rate risks before buying property as it remains uncertain when the Fed will cut interest rates.

The HKMA has held its base rate at current level after raising it 11 times from March 2022 to July 2023 to the highest level since December 2007.

Hong Kong’s Global Shipping Business Network has finished a prototype of its first electronic bill of lading in collaboration with Ant Group’s ZAN blockchain unit.

City’s biggest bank and start-up hub aim to build ‘international fintech corridor’ to further Hong Kong’s goal of being an international hub for such technology.

Chan says new or expanded firms, together with 30 companies that made similar moves last year, will invest more than HK$40 billion in the city and create 13,000 jobs.

The HKMA’s new wholesale central bank digital currency project aims to enhance interbank settlements for tokenised money. A planned sandbox will test settlement of tokenised real-world assets.

The Hong Kong Monetary Authority has launched the second phase of a pilot programme to explore ‘innovative’ uses for a central bank digital currency (CBDC) for public use, five months after it unveiled the results of the first trial run.

The Hong Kong Monetary Authority launched a plan to trial stablecoins, announced in December, for companies with a ‘genuine interest’ in fiat-backed crypto.

‘We’ve always been at the cutting edge of the whole blockchain evolution, including CBDCs,’ Yue, CEO of the Hong Kong Monetary Authority, the city’s de facto central bank, tells the Post.

The Hong Kong Monetary Authority is testing an ecosystem that includes digital forms of deposits, blockchain-based financial products and central bank money for settlement purposes.

The Hong Kong Monetary Authority has advised banks to take extra care when lending to property speculators, in an indirect attempt to clamp down on asset flipping a week after the city abandoned decade-old curbs for the real estate industry.

Hong Kong’s largest developer by market capitalisation is being tipped by analysts to emerge as the ‘prime beneficiary’ of the city’s removal of all property cooling measures.

Hong Kong property sales dropped to a four-month low in February, but analysts expect the market will bounce back in the coming months after the government removed all market-cooling curbs this week.

‘It’s not just about addressing a global issue that might affect everybody, it’s also about protecting our people in our own land,’ Eddie Yue says.