Topic

Stories about the insurance industry, including life, general, property and casualty insurance

As city goes on disaster alert for super typhoon, the warning is to be prepared and remain vigilant.

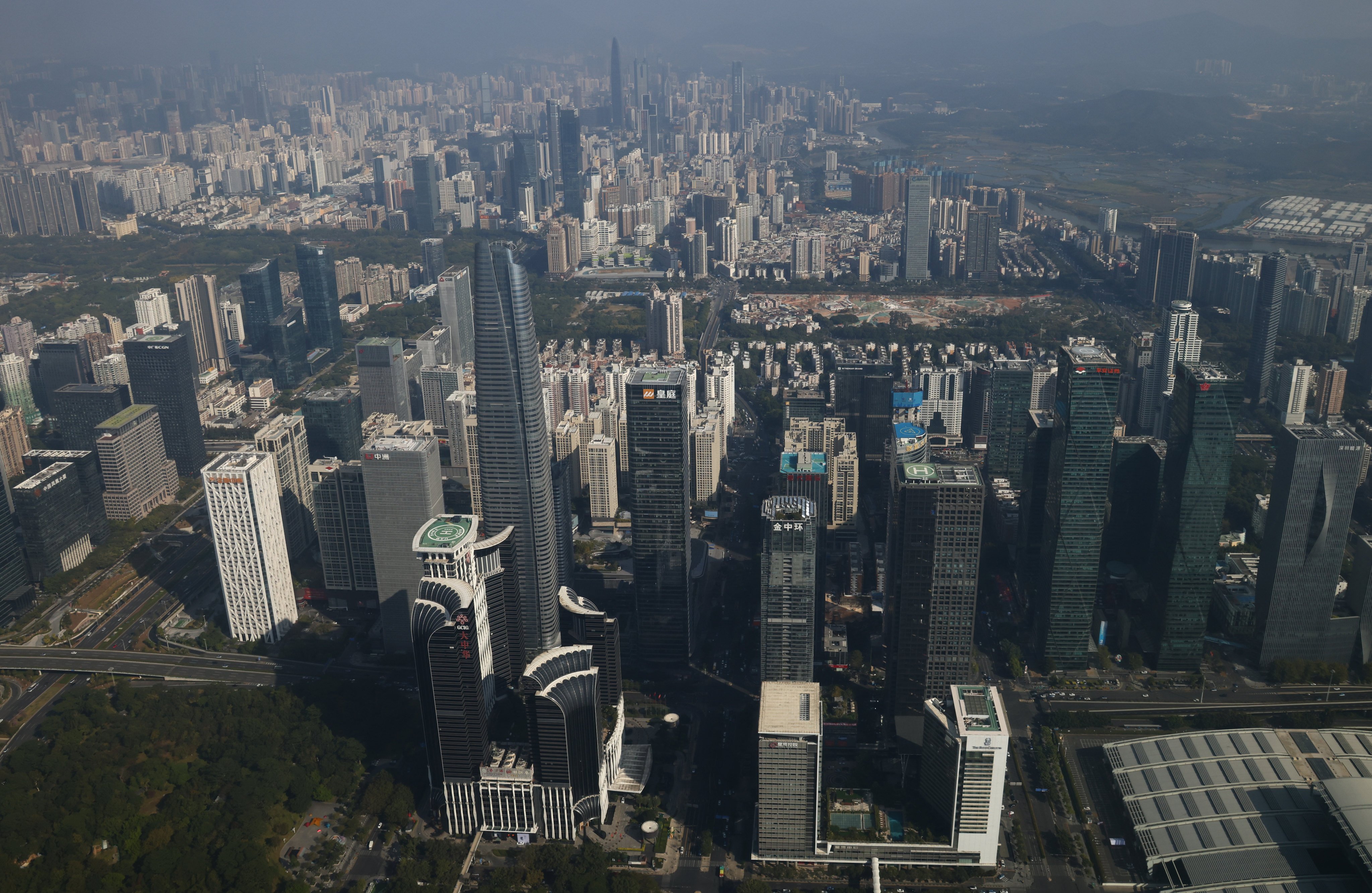

The provision of services essential to the management of business risk at a regional level can only bolster city’s status as an international financial hub.

- The company, one of China’s largest private-sector firms, agreed to sell an 8.2 per cent stake in Ageas for about €670 million (US$714 million)

- More divestments to come, analyst says, as conglomerate aims to cut debts by US$1.38 billion annually in the next two to three years

Hong Kong is building an arsenal to assist the world with raising funds for managing losses from natural disasters, the Insurance Authority said. It is discovering more issuers, investors and data, as well as cultivating its modelling capabilities and talent.

There is a growing need for advanced climate modelling and risk-assessment analytics for better disaster preparedness, as well as planning to reduce risk, protect lives and promote resilience, according to Aon.

Hong Kong’s revamped investment-migration scheme is paying off for insurers such as Prudential Hong Kong, which is planning to expand its product line to appeal to wealthy would-be Hongkongers.

The bridge collapsed on Tuesday after being struck by a container ship, the Singapore-flagged Dali, sending vehicles into the water and threatening chaos at one of the most important ports on the US East Coast.

China’s state health insurance system regulator plays down concerns over a fall in the number of participants in the voluntary urban and rural residents’ scheme.

Ping An, China’s largest insurer by market capitalisation, is exploring ways to further expand operations in Hong Kong and the Greater Bay Area, its newly appointed co-CEO said.

Ping An, China’s largest insurer by market capitalisation, said its earnings fell for 2023 to their lowest level in five years, as strong sales of new policies were offset by setbacks in its asset management and technology investment businesses.

UK insurer Prudential reported a strong set of results for 2023 driven by higher sales to mainland Chinese visitors as they returned to Hong Kong for better life policies and investment returns.

AIA Group’s new sales in Hong Kong and mainland China continued to grow in the first two months of the year, indicating strong momentum from last year is carrying over in its two major markets, according to its top boss.

The pets market in mainland China has seen steady growth in recent years, driven by a shift in ‘lifestyles and mentality’ among pet owners, while Hongkongers too are more willing to increase their spending on the health and well-being of their animal friends, analysts said.

Financial firms have been flooded with inquiries after the government started accepting applications under the revamped investment migration programme, under which clients need to invest at least US$3.8 million.

Such incidents in Japan, ranging from staff wiping fingers in pizza dough to customers licking tea cups, have gone viral in the past year.

The sale to an Asian customer handily surpasses the US$201 million cover bought by a tech billionaire in California in March 2014. It was certified by Guinness World Records.

Microsoft has extended its partnership with Hong Kong insurance provider FWD, with a four-year agreement, as companies race to integrate cutting-edge artificial intelligence technology into their products and services.

Policy sales have been boosted by the reopening of the mainland border, a weakening yuan and the interest rate gap between China and the United States, the Insurance Authority says.

Hong Kong billionaire Richard Li Tzar-kai will retain control of Hong Kong-based insurer FWD Group amid speculation about a potential stake sale. A stock offering will be considered at an opportune time, its major shareholder says.

In the third of a four-part series on the Greater Bay Area’s fifth anniversary, we look at how Hong Kong has become the de facto wealth management hub for the wealthy. Enhancements to cross-border payments and investments will only add to the city’s lustre.

Jobseekers as well as employers are anxiously waiting for the market to stabilise after a challenging year as the city enters its busiest hiring season following the Lunar New Year holiday and bonus payouts.

China could see robust growth in catastrophe bonds, or cat bonds, as policymakers seek more financial tools to share the risks from losses from natural disasters, as climate change increases their frequency and severity.

The policies and incentives followed the pledge made earlier during the day by Li Yunze, the minister of the National Financial Regulatory Administration (NFRA) in his keynote address to the AFF.

Over 25 million people in China dropped out of the voluntary urban and rural residents’ health insurance scheme in 2022 due to rising premiums, lower incomes and a lack of awareness.

The catastrophe was the second-costliest disaster worldwide in 2023, according to German reinsurance firm Munich Re, which said insurance coverage in China lags far behind the global average.

Enrolment in China’s state health insurance system fell by about 17 million subscribers last year, with social security and rural affairs experts pointing to a number of factors.

OneDegree’s move to expand insurance business in UAE comes as Hong Kong ramps up efforts to deepen its business ties with the Middle East.

Consumer Council says study of four virtual firms shows some hold onto policyholders’ personal data for undefined time period.

Hong Kong is in a strong position to realise opportunities for the insurance sector in response to the climate crisis, Chief Executive John Lee says. ‘There is growing demand for alternative risk-transfer tools.’

The ‘unrecognised providers in Hong Kong’ list included nephrologist, dermatologist, orthopaedist, general practitioner and clinic.

Hong Kong’s insurance industry received a total of HK$1.9 billion (US$243.6 million) in claims related to damage caused by a devastating black rainstorm and Typhoon Saola in September, making them the second-highest on record.