Topic

Stories about how technology is used to enhance all aspects of the insurance industry, including life and general insurance

- The move means that different regulators in Hong Kong will work to build an ecosystem for banks, insurance companies, financial firms and other tech start-ups, virtual insurer Bowtie’s Fred Ngan says

- Securities brokers can use tech to improve risk management and enhance payments to clients: financial services sector lawmaker Robert Lee Wai-wang

Currently, five such digital players – four were issued licences by the Insurance Authority over the past two years and one, Blue, turned into a digital insurer from a traditional firm in 2018 – must compete in Hong Kong’s crowded market with 160 tradition insurance companies.

From faster payments to Wealth Management Connect, Hong Kong has adopted a number of measures in recent years to bolster its bona fides as a fintech hub.

Hong Kong faces a mortality protection gap of HK$6.9 trillion (US$884.6 billion), which could cause many families undue financial trouble in the event of the death of the main earner, according to an Insurance Authority study.

OneDegree, Hong Kong’s only online pet insurer, has raised US$28 million in its latest funding round, it said on Monday.

DrGo is the first of a growing number of telemedicine services in Hong Kong that are sprouting up to bring accessibility and convenience to customers via a combination of technology and health care, delivered with social distancing in mind as the coronavirus spreads.

Ant Financial’s e-payment platform can identify pets by their unique nose prints.

OneDegree has received a virtual insurance licence from Hong Kong regulator, with the aim of providing medical coverage for dogs and cats.

In the fourth in a five-part series, Enoch Yiu looks how technology firms like Ant Financial and Tencent Holdings are using their innovative powers to create insurtech and mutual aid platforms that make health care coverage affordable to more people.

The British insurer needs to break up into two publicly listed companies focused on the US and Asia to boost shareholder value, said activist investor Third Point.

Xiang Hu Bao, an online mutual-aid platform owned by Ant Financial, has attracted 100 million users since its launch a year ago and helped insurers on the platform increase their health policy revenues by 60 per cent.

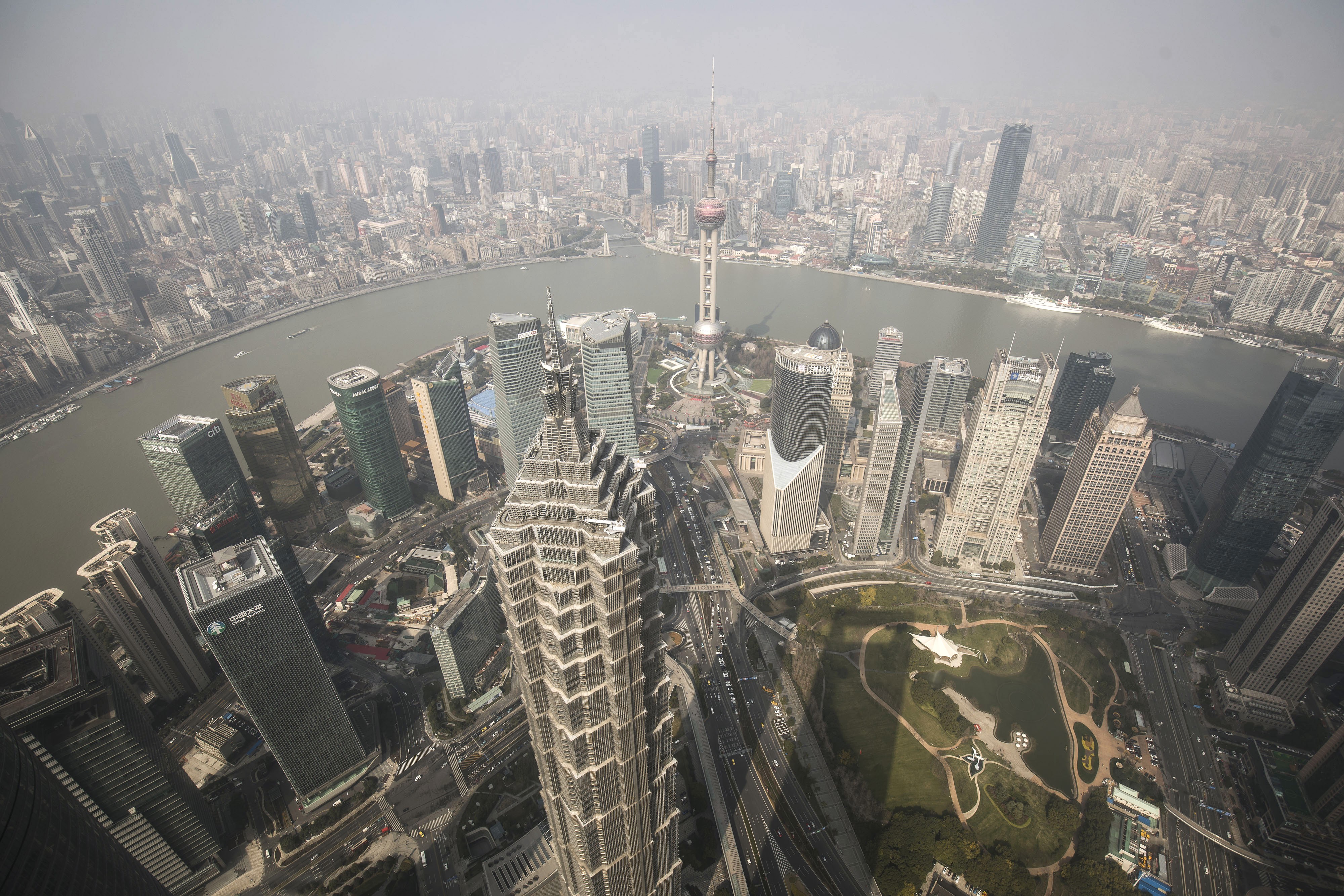

Shanghai-based insurance technology start-up The CareVoice has raised US$10 million in a funding round led by Chinese investment management company Lun Partners Group, it said on Thursday.

The insurer, established three decades ago in China’s technology hub of Shenzhen, is also one of China’s largest financial conglomerates, involved in a range of businesses on top of insurance, including banking, wealth management, technology and health care.

Analysts believe a big name like Tsang could help the digital start-up to compete with traditional insurers.

China’s ageing population expected to mean more sales of annuity and health insurance products as parents try relieve burdens on sole child.

Global investment in financial technology companies more than doubled to US$55.3 billion last year, driven by US$14 billion fundraising by Ant Financial Services

Its expansion will see it take on Alibaba and Tencent, which control 50 per cent and 10 per cent of China’s public cloud market respectively

Report by Insurance Society of China and Fudan University urges industry ‘to get better prepared for a changing landscape as many jobs could be replaced’

But Hong Kong’s insurance regulator is yet to give licences to any of the 40 plus companies that have made enquiries so far