Topic

Latest news and analysis on initial public offerings (IPOs), with a particular focus on companies raising funds on the Hong Kong Stock Exchange.

Bonnie Chan will need a little more luck than the Hong Kong bourse’s current CEO when she takes over in May next year

Wrongful claims from social media users in mainland China about city’s bourse and its position as a financial hub have drawn a response from leaders.

While China’s rainmakers have been essential to the country’s great market opening, corruption concerns and a changing geopolitical balance have seen them pushed to the sidelines.

Allowing the resumption of cross-border data transfers in day-to-day business shows pragmatism can still prevail in Chinese policymaking.

In 1993, Tsingtao Brewery celebrated an unusual Hong Kong initial public offering and a gigantic step for the nation’s capital markets with glasses of beer.

New rules from the China Securities Regulatory Commission aim to bring transparency and end chaotic process that left such offerings mostly unregulated.

- HKICPA, the industry body representing the city’s 47,000 qualified accountants, has grown by 10 per cent since 2018, new president says

- ESG reporting and the Greater Bay Area offer opportunities for young accountants, and the IPO market is set to recover, says Roy Leung

Chabaidao’s stock ended the day 27 per cent lower after slumping as much as 38 per cent. It raised about HK$2.6 billion (US$331.7 million) from the sale of 147.8 million shares at HK$17.50 each.

Many Chinese firms are expected to shift their fundraising plans to Hong Kong following measures by the mainland’s market regulator to support initial public offerings in the city, analysts say.

BNP Paribas marks its re-entry into China’s market with hires, at a time when Morgan Stanley, Goldman Sachs and JPMorgan have all made rounds of job cuts in Hong Kong and China

Hesai, which released new products based on its ATX technology on Friday, is seriously considering building plants outside mainland China to capitalise on the growing use of the technology, CEO Li says.

China’s capital market regulators have announced a package of measures to boost liquidity, attract international investors and enhance competitiveness between the mainland and Hong Kong.

It is only a matter of time before the currently depressed market stages a rebound, according to Fred Hu of private-equity firm Primavera Capital.

More than 40 of the 50 jobs the Wall Street firm plans to cut will be from Hong Kong and mainland China. Morgan Stanley joins a host of banks that have laid off bankers this year.

Chinese tea shop giant Sichuan Baicha Baidao Industrial aims to raise HK$2.5 billion (US$330 million) in a Hong Kong initial public offering, set to be the city’s largest new-share sale of the year, regulatory filings show.

Philippine chain Hotel101 Global targets 1 million rooms and a presence in more than 100 countries after signing an agreement to merge with a Hong Kong company, which aims to list on Nasdaq in New York.

Amid rising geopolitical tensions, most of the top 30 investors that invested in Chinese unicorns are based within the country.

There is nothing to fear from missteps because nobody is error-free, Ma wrote, after his co-founder Joe Tsai touched on Alibaba’s mistakes in a podcast interview, generating a frenzy on China’s social media.

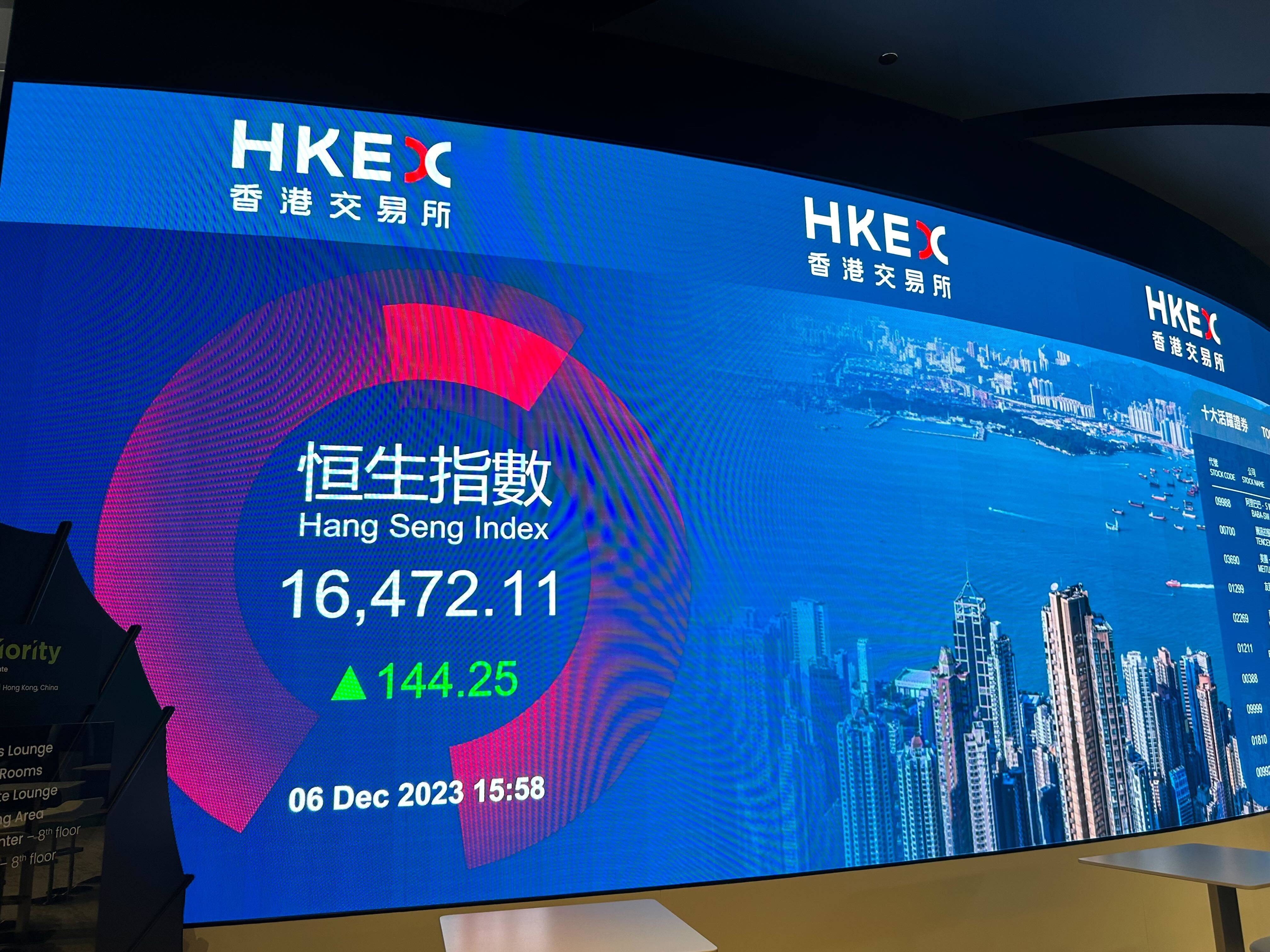

The numbers do not lie, Hong Kong’s financial regulators told the HSBC Global Investment Summit on Tuesday. The city’s market has shown resilience and competence through several years of economic headwinds.

First-time stock offerings in Hong Kong are expected to improve after a dismal first quarter, according to Deloitte China. Tighter regulatory oversight could hinder bourses in mainland China.

Companies in Saudi Arabis and Indonesia have shown a genuine interest in Hong Kong’s IPO market, Bonnie Chan Yiting, CEO of Hong Kong Exchanges and Clearing, says at a Legislative Council meeting on Monday.

Lack of interest has more to do with lacklustre IPO activity than the reform per se, which will draw more interest when listings pick up, analysts say.

‘The slowdown in IPOs will carry on, and the listing process for mega IPOs is expected to be lengthened,’ an analyst says, as the market watchdog has pledged to improve listing quality.

Swiss agrichemicals and seeds giant Syngenta Group has withdrawn its application for a listing in Shanghai amid China’s slowing equities market.

The increased bonus programme shows the lengths taken by TikTok owner ByteDance to retain and attract talent, even as the company continues to restructure its operations this year.

China’s major stock exchanges are facing a tough start to the year as proceeds from initial public offerings in Hong Kong, Shanghai and Shenzhen shrink. US exchanges are strengthening their lead and ranking.

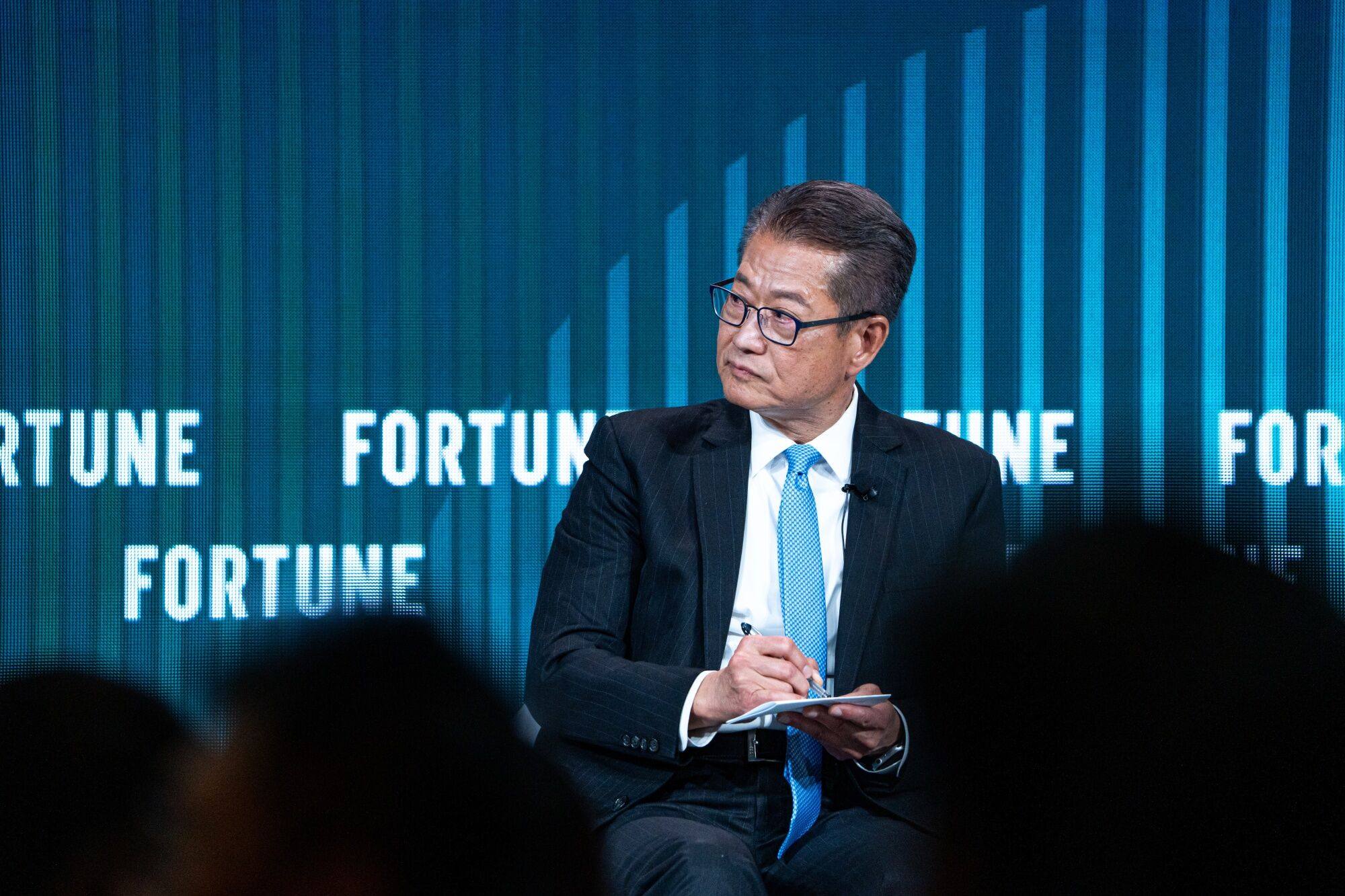

Paul Chan, Hong Kong’s financial secretary, and Bonnie Chan, the CEO of bourse operator Hong Kong Exchanges and Clearing, were speaking at Fortune Innovation Forum 2024.

E-commerce logistics giant Cainiao will launch an ‘entrepreneurship incentive plan’ that will double the bonus pool allocated for its financial year ending March 31, 2025.

Alibaba has scrapped the planned Hong Kong IPO for its logistics unit Cainiao, deciding to double down on its investment in the strategically important unit.

The sell-off follows Shenzhen exchange’s statement that it would take action against Citic for failing to fully clarify issues regarding Liangang Optoelectronic’s IPO prospectus.

Samsonite is exploring a dual listing plan for its shares, a surprise move that tempered market speculation about a potential offer to take the luggage maker private.

LianLian DigiTech aims for a fifth of the US$500 million it originally sought a year ago, as market conditions continue to dampen investor sentiment.

China is tightening the screws on new domestic stock offerings, issuing four documents at once laying out some of the harshest rules, checks and penalties yet to crack down on fake accounting and restore confidence.

The New York-based bank will continue to invest in Hong Kong, betting that the city where it has been doing business for a century can recover when the economic cycle turns, and live up to its potential as the financial centre of the world’s second largest economy.

Economic growth and ‘de-risking’ from China are driving investors to Southeast Asia, but just four companies accounted for nearly half of exit values since 2015.

DreamSmart, the start-up behind smartphone brand Meizu, may seek a valuation of more than US$2 billion for a potential Hong Kong share sale this year, sources say.