Topic

Li Ka-shing is Hong Kong's richest person. He is chairman of the board of conglomerate CK Hutchison Holdings.

As the city’s second richest man retires, and another tycoon leaves jail to hand business over to his son, local developers are being eclipsed by the inflow of red capital from the connections they enjoyed

The city’s first generation of high-powered billionaires had lifelong friendships with top men north of the border. With ‘superman’ stepping down and a new style of leader in Xi Jinping, that looks to have changed.

- Solina Chau, co-founder of venture capital firm backed by tycoon Li Ka-shing, to give HK$60 million in total to female students sitting Diploma of Secondary Education

- Initiative comes after government says it will stop paying exam fees for candidates in 2025 due to budget deficit

The third price list covers 174 units and is 1.73 per cent higher than the first price list. CK Asset released the first price list for 138 units last Friday and a second one for 110 units last Saturday.

Second price list for Wong Chuk Hang project includes two- and three-bedroom flats priced from HK$9.05 million (US$1.16 million) to HK$24.7 million.

The developer has priced its closely-watched new project in Wong Chuk Hang well below cost and cheaper than neighbouring developments in a sign it may be trying to ensure the first batch of flats sells out in the hopes of drumming up interest in the remaining units.

Li and Fok will stay on as co-executive directors, while Fok will serve as deputy chairman and chairman of its telecoms arm.

‘There are only a few [international financial centres], and Hong Kong is one of them. It is hard-won. We must not lose this place,’ CK Hutchison and CK Asset chairman says.

The market will be keen to see how it prices its new project in Wong Chuk Hang, as this could give ‘direction’ to Hong Kong’s recovering housing sector, analysts said.

Billionaire, 95, praises university institute championing new generation of entrepreneurs and backs research of two prominent scholars to fight diseases

Hong Kong developers have joined a chorus urging the government to remove all the remaining cooling measures to revive the property sector.

‘Conditions precedent to closing of the transaction were not satisfied,’ CK Hutchison says in exchange filing. The deal, which was announced last May, had set an enterprise value for the joint venture of US$3.7 billion.

Bobobox, Indonesia’s largest outdoor accommodation operator, is looking to expand into either Japan or the US this year, as it seeks to deploy its sleeping pods and cabins in two of the world’s most developed lodging markets, according to its president.

Innovations in synthetic biology and alternative materials can improve the lives and livelihoods of many people, says Horizons Ventures co-founder Solina Chau.

Arrest brings back memories of gunfights on the streets between police and armed gangs in 1980s-90s.

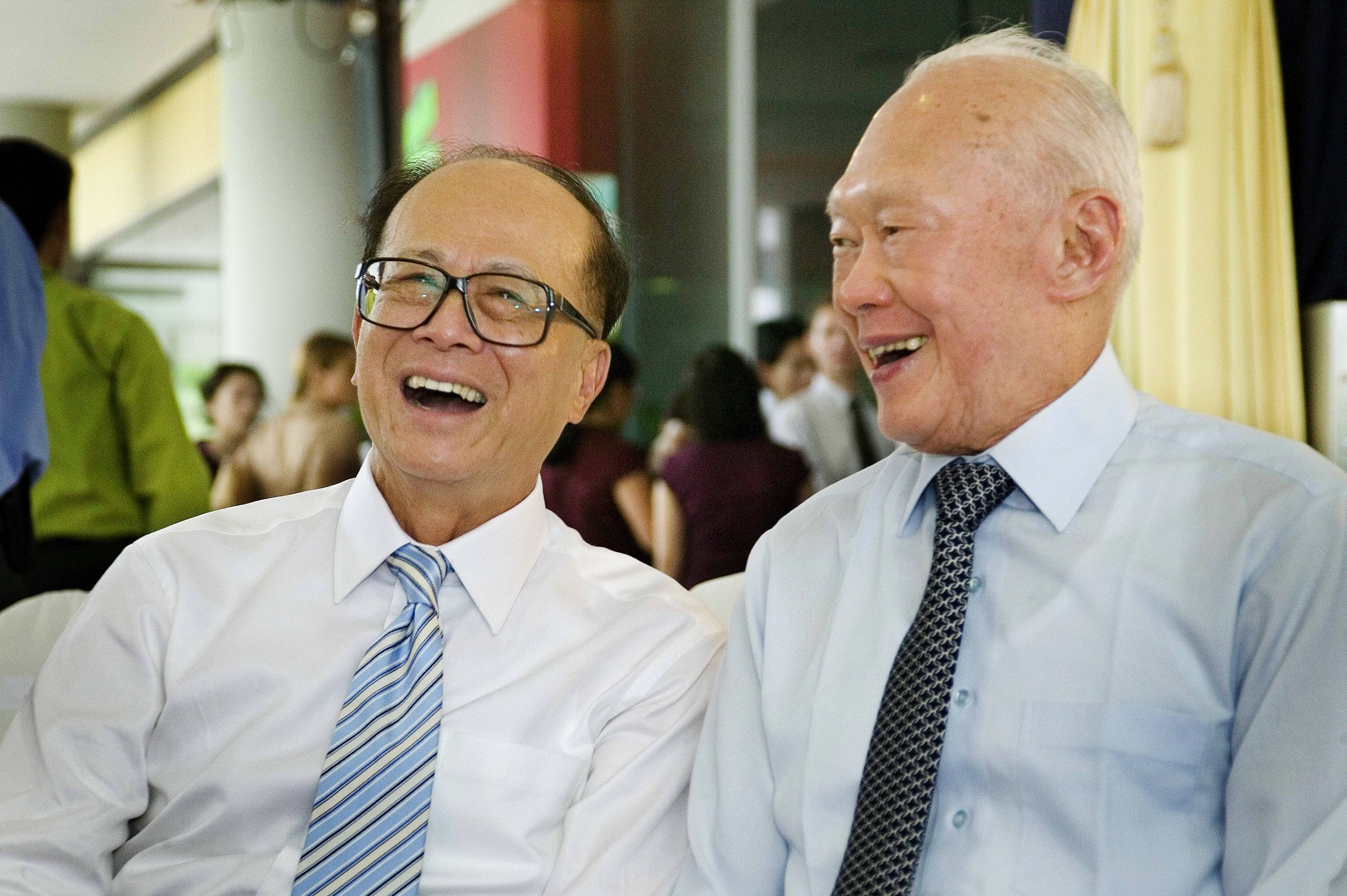

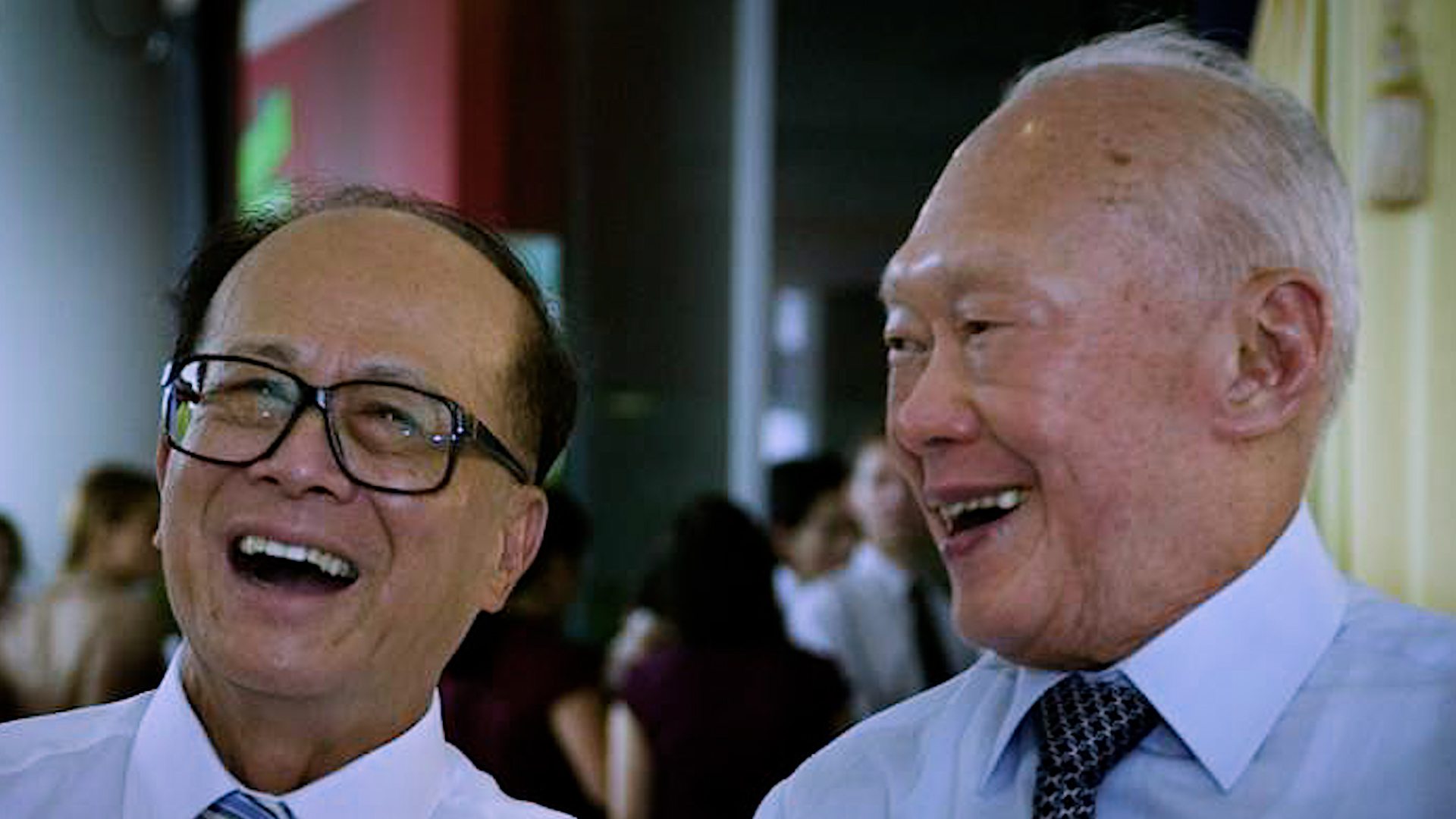

Hong Kong’s richest man commended Lee’s commitment to the people in his video message, adding he missed his ‘old friend’.

Hong Kong tycoons Li Ka-shing and Lee Shau-kee are among those who have extended warm wishes to Malaysia’s richest man on his centenary.

The 23-minute National Day show will start and end with breathtaking effects, pyrotechnics expert Wilson Mao pledges.

Homebuyers in Hong Kong have continued to flock to projects that offer them best value for their money, with CK Asset Holding selling almost all units in the latest batch of its Coastline project on Sunday.

Some of Hong Kong’s biggest developers have lined up sales of residential projects with revised price lists, using CK Asset’s Coast Line as a benchmark to attract cautious buyers.

The developers behind Villa Garda III housing project in Hong Kong have hastened its sales campaign, releasing its first price list at discounts in response to the renewed buying interest sparked by CK Asset’s successful launch.

Hong Kong property developer CK Asset Holdings has released the price list for the first 50 units at its Coast Line I project just two days after homebuyers snapped up all 626 apartments in Coast Line II on Saturday.

Exclusive | How FWD married two of Richard Li’s ‘loves’ to create only home-grown, pan-Asian insurer

A serendipitous meeting more than 10 years ago between a telecoms titan and a former Vietnamese refugee sowed the seeds for an insurance company that today covers against risks in seven countries along the ancient Silk Road.

‘As a developer you want your money back as soon as possible, and also to get a profit,’ an expert says. It’s advice the flagship developer of billionaire Li Ka-shing has long held close to its heart.

Developer dismisses claims of price war as experts say seven-year-low prices for Kowloon flats are not a dire omen for the market.

CK Asset expanded the Coast Line II sale from 254 to 626 flats, and analysts say the low average price of HK$14,686 (US$1,880) per square foot will pressure other developers to cut prices in future launches.

Developer cuts prices at Coast Line II in Kowloon to US$1,921 per square foot – 16 per cent below other recent launches – in a bid to boost buyer sentiment in a slumping market.

Citi and Jefferies, which have lowered their target prices for the developer’s stock, see more buy-backs as likely given that the company has ‘limited positive catalysts’ to drive its stock price in the near term.

CK Hutchison Holdings and CK Asset Holdings, the two flagship companies of Hong Kong’s richest man Li Ka-shing, reported a drop in their first-half earnings, as the high interest rate environment continued to pile pressure on businesses in the city.

CK Asset cited high interest rates as a factor in the collapse of the deal for 148 units in the 21 Borrett Road development, after buyer LC Vision Capital 1 failed to make a US$133 million payment.

CK Asset Holdings will soon launch its The Coast Line residential project in Yau Tong, becoming the latest company to offer a new development in the city’s weakening housing market.