Topic

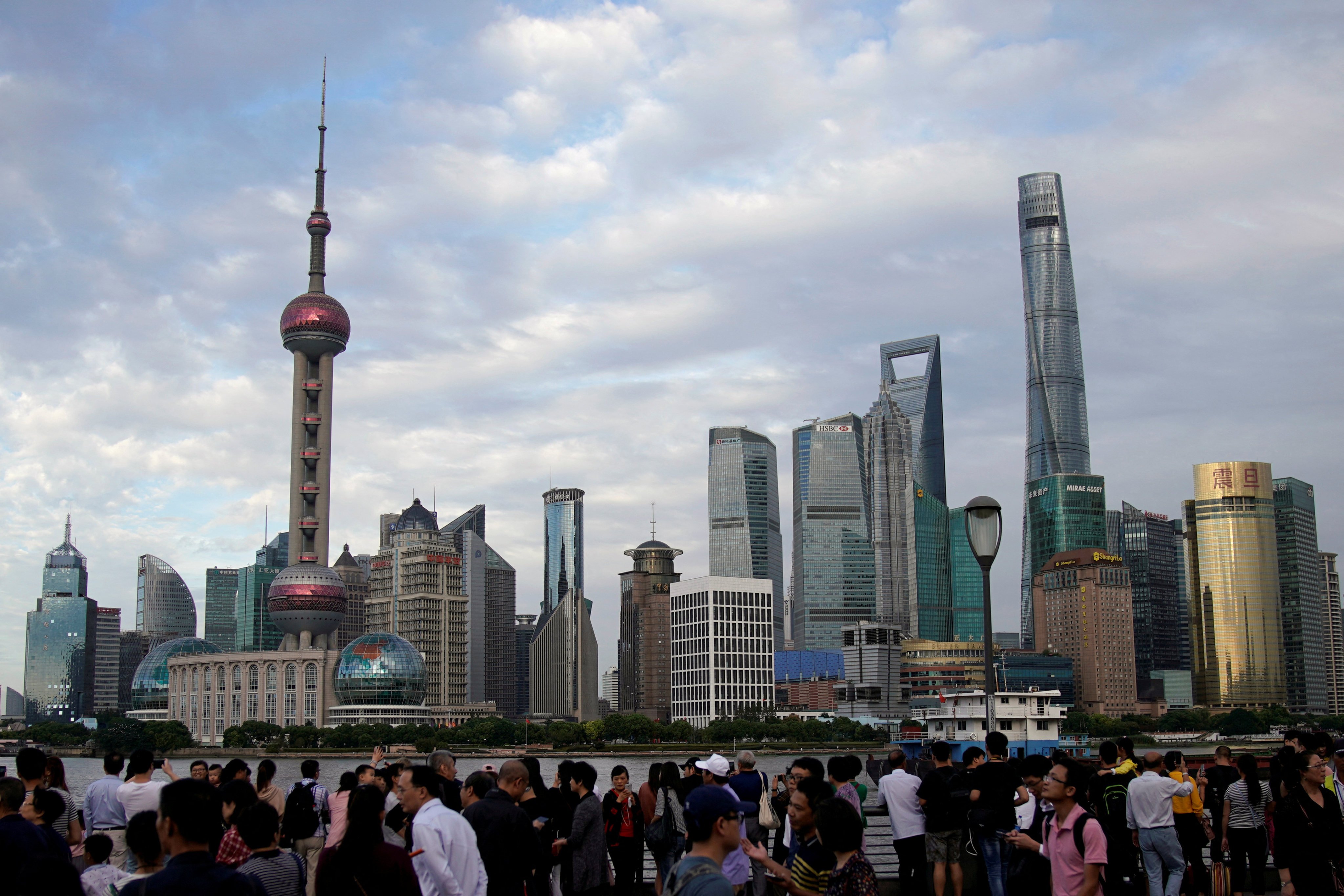

Link Real Estate Investment Trust (Link Reit) is the largest REIT in Asia by market capitalisation. It is managed by Link Asset Management, which owns and manages a portfolio including retail facilities, car parks, offices and logistics assets from Beijing, Shanghai and the Greater Bay Area, to Singapore, Melbourne and London. It was listed in 2005 as the first REIT in Hong Kong.

In this day and age where retail giants are conquering markets and malls start to look the same, perhaps we should think about the ‘fair dollar’ and protecting precious small businesses.

There are no practical solutions when it comes to the Link Reit, MTR fares and the Mandatory Provident Fund, and politicians who claim otherwise are posturing

- Link Reit, which bought a 50 per cent interest in Qibao Vanke Plaza in April 2021, plans to acquire the remaining stake from the indebted Chinese developer

- The five-storey shopping centre in Minhang district has a gross retail area of 148,853 square metres and 1,477 car parking spaces

Hong Kong-listed Link Reit opened the newly renovated mall in Guangzhou’s Tianhe district in September, with CEO George Hongchoy denying rumours that the company plans to sell some assets in China.

Readers discuss efforts to retain independent stores in shopping malls, and Hong Kong’s storm water drainage system

Businessman Choi Kai-yip says he was told he would not be paid compensation after floods inundated his ground-floor store

Hong Kong’s heaviest rainfall since records began in 1884 forces several malls to close on Friday as several parts of the city are paralysed by widespread flooding.

Readers discuss an ESG report on a real estate investment trust, how the Hong Kong stock exchange can boost liquidity, and the city’s next generation of medical professionals.

Hong Kong fell to ninth place in a global ranking of IPO venues, but analysts are optimistic the city can repeat last year’s performance and make a strong comeback in the second half of 2023.

Mall operators including Link Reit, Swire Properties, Henderson Land and Sun Hung Kai Properties believe EV chargers will help attract wealthy local shoppers as tourist spending continues to lag.

Green certified buildings are giving developers and landlords a competitive edge as occupiers demand sustainability features, essential to meet a host of business and environmental goals.

Link Reit, Asia’s biggest real estate investment trust, is asking US$2.4 billion from unit holders to help repay debt. Investors surprised by the cash call dumped the stock and other Hong Kong developers.

Asia’s largest real estate trust is seeking to raise about HK$18.8 billion (US$2.39 billion) in capital by way of a rights issue, an announcement that took some market observers by surprise.

The real estate investment trust has made a foray into Singapore by agreeing to buy two suburban shopping malls there in what may be the biggest property deal in Southeast Asia this year.

As in the years from 1997 to 2003, a struggling housing market, slowing economy and surging interest rates are making the debt levels of the city’s home builders a cause for concern.

Rising interest rates are creating more potential investment opportunities for Asia’s largest real estate trust as it pursues greater international diversification.

Link Reit, Yuexiu Reit and SF Reit have joined hands to co-found the Hong Kong Reits Association and build a collaborative platform for the city’s HK$210 billion (US$26.7 billion) Reit sector, and strengthen Hong Kong’s status as an international financial centre.

Link Reit, Asia’s largest real estate investment trust, said it would not immediately take legal action against tenants who owe rent following the end of a Hong Kong government enforced three-month ‘protection period’.

Art made from Hong Kong’s plastic waste – think styrofoam supermarket fruit wrappers and plastic egg cartons – is the hallmark of eco-artist Agnes Pang.

Rent waivers for retail tenants at Cityplaza and Pacific Place to run from the beginning of government-ordered closures until April 20 and are part of an ongoing tailored approach to assisting tenants affected by pandemic measures, Swire Properties said.

Hong Kong’s property developers and hotel owners are stepping up to offer their help, after Chinese President Xi Jinping instructed Hong Kong’s authorities to take the “main responsibility” in containing the so-called fifth wave of infections in the city.

Hong Kong’s uncompromising measures to contain the virus are likely to hurt retail sales in malls across the city, derailing a nice rebound in 2021.

Investors are snapping up commercial properties despite lingering Canberra-Beijing tensions. Singapore and US funds have rushed in while Hong Kong-based investors have made their presence felt.

Australia is reopening its borders to global visitors, a policy which may spur “sales and leasing activity in the hospitality, large-format retail and defensive industrial segments,” according to Colliers.

The size of a typical phone kiosk, these booths or studios come equipped with a desk, bar stool, power sockets and Wi-fi access. And, as part of a pilot programme, access is free as of now.

The nine Reits, which are linked to underlying infrastructure project, rose above their offer price on the first day of trading on the mainland’s exchanges.

Link Reit reported its second-lowest annual revenue growth ever because of the coronavirus pandemic, but expects outlook to improve amid the ongoing recovery.

S.F. Holding’s Reit set the final offer price at HK$4.98 per unit, with the logistics provider expecting to book a one-off gain of not less than HK$800 million from the spin-off.

Hong Kong-based Link Reit, Asia’s largest real estate investment trust, has announced its entry into Europe with a £380 million (US$487.5 million) deal for an office complex housing Morgan Stanley’s headquarters in London.

Over the past two weeks, Link Reit, Wheelock and Company and Emperor International have all said they expect to report considerable losses.