Topic

- FII, which makes communication, mobile network and cloud computing equipment, shared a plan with state officials to initially invest up to US$200 million in the facility

- Foxconn already has a sprawling campus near Chennai, capital of Tamil Nadu, where it assembles Apple’s iPhones

Hackers targeted mining, food, water, electrical and natural gas sectors, according to a report from cybersecurity firm Dragos.

Chiang Shang-yi, 76, who helped TSMC and SMIC become leading wafer foundries, has come out of retirement to join iPhone assembler Foxconn as an adviser to help with its push into semiconductors.

Apple is preparing to begin sourcing chips for its devices from a TSMC plant under construction in Arizona, marking a major step toward reducing the company’s reliance on Asian production.

US investor Warren Buffett, who long shied away from the tech industry because he said he did not understand it, has made a US$5 billion bet on chipmaking with a stake in TSMC.

Netherlands-based ASML Holding, a key supplier of chip manufacturing equipment, said it would launch a US$12.2 billion share buy-back programme to run through 2025.

Japan will invest up to US$500 million in a new semiconductor company led by Sony Group and NEC, as the country rushes to re-establish itself as a lead maker of advanced chips.

Instead of being filled with air, a web of spokes gives the tyres a see-through look. The ride is smooth but the grip is not as good as on conventional tyres – and they are noisier.

Beijing has repeatedly said that China would ‘maintain normal trade relations’ with Russia, but the situation on the ground paints a different picture, with a massive drop-off in Russia-bound goods.

Source also urges Chinese companies to ‘maintain normal export channels to the US’ and not abandon the critical market amid geopolitical disputes.

The world’s supply chains have taken a battering this year from China’s zero-Covid policy, which has hampered the production and delivery of everything from bathroom taps to Apple iPhones.

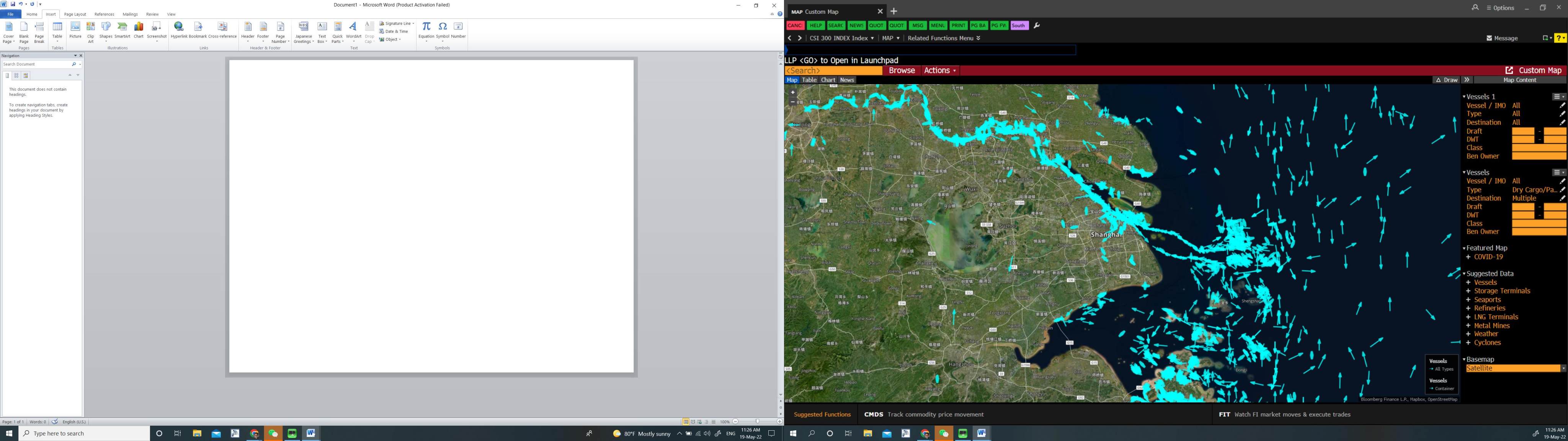

The end is in sight for one of the largest mass population lockdowns ever undertaken in China, after stop works and standstill orders upended daily lives and strained global supply chains close to breaking point.

Japan’s government was already supporting relocation of domestic companies’ production bases back to the country. Then the yen took a major tumble.

Chinese exports in ‘grave situation’, with dwindling cash flow weighing on their bottom line while domestic demand falls amid coronavirus lockdowns.

Shrinking deliveries at Nio, Li Auto and Xpeng are dragging on their attempts to catch up with the industry’s bellwether Tesla for supremacy in the world’s largest market for automobiles and smart EVs.

One in four of the 161 Taiwan-listed companies that suspended production amid ongoing Covid-19 lockdowns in Shanghai and in the neighbouring city of Kunshan in Jiangsu province are in electronics

China’s manufacturers are increasingly struggling to recruit workers, as young people turn up their noses at the low wages and lack of advancement opportunities in factory work.

Even major chip equipment makers are struggling to get enough components to fulfil orders, potentially making it more difficult for semiconductor fabs to significantly increase their capacity in the near term.

Local municipal authorities in the economic circle are implored to establish a task force, address labour-supply problems and be more open and transparent.

Shanghai has been trying to resume production at 666 key manufacturers, including Tesla and the country’s largest chip maker Semiconductor Manufacturing International Corp oration (SMIC).

Concerned with lost production and struggling to tamp down seething public anger, Shanghai authorities are kicking the restoration of economic order in China’s financial and commercial centre into high gear.

As many as 390,000 residents in Shanghai – out of a total population of 25 million -have been infected by the highly transmissible Omicron variant since March 1, with 27,200 showing symptoms.

By allowing key producers to function as normally as possible, China is aiming to reduce the impact of strict lockdown measures.

If China’s disruptive lockdowns persist, they could fuel global inflation, slow the pace of exports shipped from the ‘world’s factory’, and weaken demand in the world’s largest consumer market, economists say.

While some manufacturers in affected areas are still operating in ‘factory bubbles’, interruptions tend to be more on the logistics side, and hundreds of thousands of automobiles may not be sold this month.

Analysts say it is important that Chinese suppliers to Apple diversify their client base in the future to mitigate over-reliance concerns.

Most countries will face headwinds in two ways: higher commodity prices and therefore sustained inflation, and slower demand for manufactured goods from troubled economies like Europe.

Some Chinese manufacturers fear losses could mount if the yuan further appreciates to 6.25 against the US dollar, as it would make their exports less competitive.