Topic

- Private equity firm’s new US$6.8 billion fund was oversubscribed despite geopolitical uncertainties

- CVC’s new Asia fund will invest primarily in the consumer and services sectors across the region

Global and domestic private-equity investors are making a comeback to the Chinese M&A market following three straight years of decline, as they look to profit from an economic recovery, Bain & Co says.

Many of mainland China’s 220 million retail investors are not convinced the government’s recent efforts aimed at reviving the stock market go far enough to set equities on a path to long-term recovery.

Zhang Kun, who oversees US$13 billion for Guangzhou-based E Fund Management, bought more shares in online delivery giant Meituan and TSMC in the first quarter, betting the worst of a regulatory crackdown was over and that an AI boom would bolster demand for processing chips.

Investors and fund managers want to see an increase in the individual investment quota, a wider choice of products and more financial firms joining the bay area’s cross-border channel.

Hillhouse Capital, China’s top private equity firm, has denied it is undergoing large-scale lay-offs after facing earlier rumours this year about its portfolio amid a tech stock sell-off.

They call each other ‘fam’, cheer those making money and commiserate with those who get ‘rekt’ by losses – they belong to communities on social media that are driving cryptocurrencies.

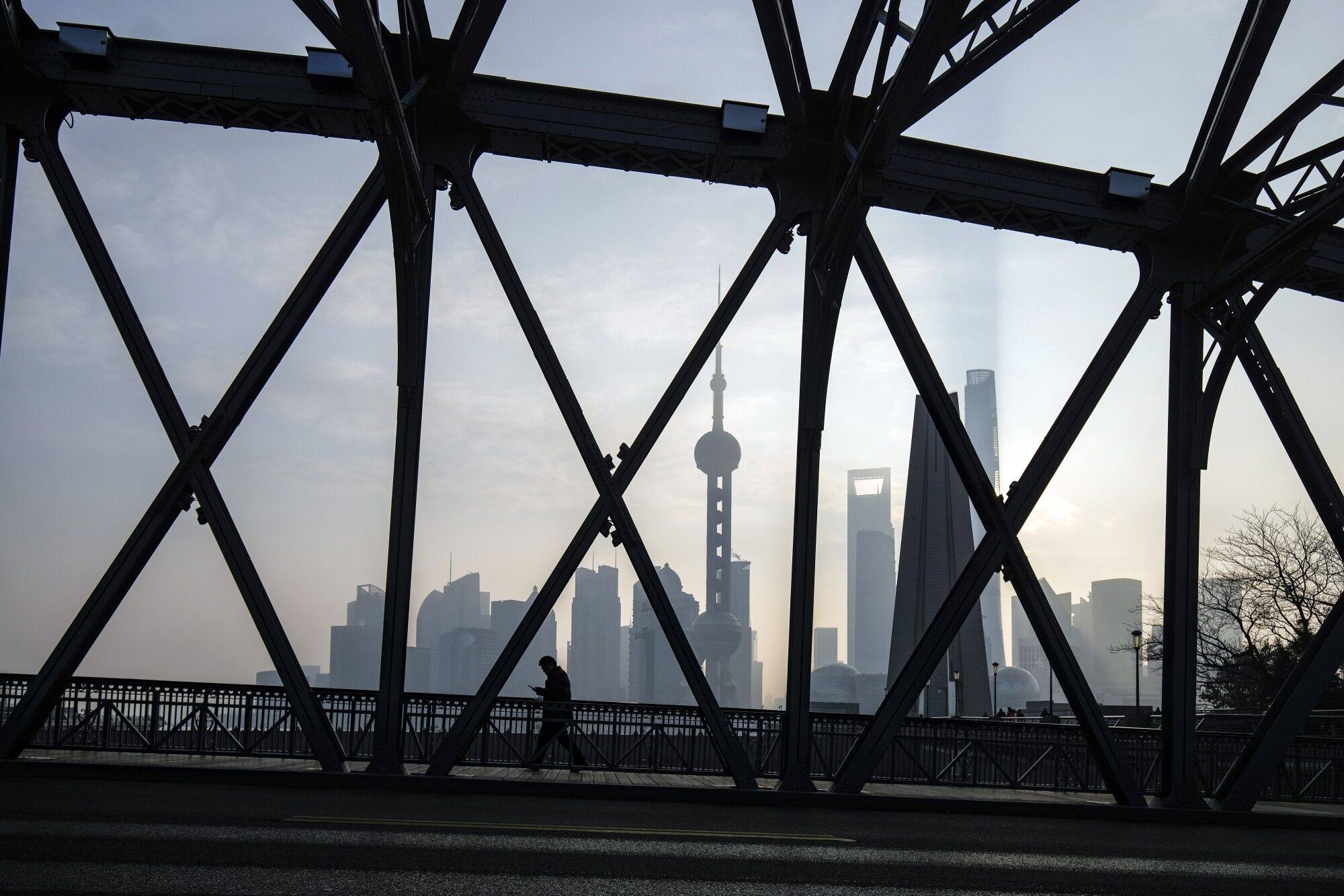

The US effort to crimp foreign investment into China, combined with the coronavirus pandemic, is weighing on capital flows.

China Investment Corp is looking for more resilient assets in markets battered by the coronavirus pandemic to improve returns, Executive Vice President Zhao Haiying said in an interview.

China Investment Corporation (CIC) saw a 2.35 per cent negative return on its overseas investment portfolio in 2018 in contrast to the gain of 17.6 per cent in 2017.