Topic

- Seven-day tour includes closed-door forums in Beijing, Shanghai and Hong Kong to seek potential partners for the ambitious project

- Launched in 2017 by crown prince Mohammed bin Salman, 26,500 sq km project is part of oil-rich nation’s attempt to diversify its economy

The defendants, from PetroSaudi, are accused of having created a scheme in 2009 under which 1MDB, would set up a joint venture based on false premises.

Sheikh Ali Al Maktoum, the nephew of Dubai ruler, is opening a family office in Hong Kong, one of the first high-profile global investors to respond to the city’s campaign to lure the ultra-rich.

Hong Kong will enhance several measures aimed at attracting foreign funds and family offices, and host more financial conferences to improve the city’s ‘branding’ and economic appeal, Financial Secretary Paul Chan says.

The US investment bank and the Abu Dhabi sovereign wealth fund will extend long-term capital to ‘high-quality companies and sponsors’ across Asia-Pacific to capitalise on private-credit opportunities.

Saudi Aramco is poised to issue bonds this year with tenures of 15 to 50 years in a bid to optimise its capital structure, Ziad Al-Murshed, the company’s CFO, said at the Saudi Capital Market Forum in Riyadh on Monday.

The private conglomerate headquartered in Riyadh aims to make strategic investments by acquiring equity stakes, providing financial expertise, and offering legal advice to leading players in these industries.

Ex-1MDB general counsel Jasmine Loo told Malaysia’s High Court she would prepare documents for Jho Low, who would hand-deliver them to Najib Razak’s home in Kuala Lumpur.

GIC reshuffled the roles of some senior executives as part of a broader leadership overhaul, as current deputy chief operating officer Sam Kim will be appointed as COO.

Tesla became the fund’s 11th biggest holding in 2023 as it increased its stake to 0.98 per cent, or about US$7.7 billion. The fund held 0.57 per cent of BYD at the end of last year, up from 0.38 per cent.

Singapore’s InnoVen Capital Group completes a US$130 million first close for its second China fund, as it eyes financing China’s fund-starved start-ups.

Blackstone joins a growing of list of global asset managers expanding or setting up offices in Singapore as investors seek alternative bases to China.

Electric cars, batteries and energy storage will be areas of focus in the first half of 2024, with consumer segments to follow, says Deutsche Bank Middle East CEO.

The Public Investment Fund was the world’s most active sovereign investor last year, deploying US$31.6 billion in 2023 versus US$20.7 billion the previous year, according to research consultancy Global SWF

Finance minister points to Northern Metropolis as prime example of ‘long-term stable investments’ sought by Middle Eastern nations.

A unit of Saudi Arabia’s sovereign wealth fund has injected fresh capital into eWTP Arabia Capital, a Riyadh-based venture firm focused on easing Chinese business expansion into the Middle East.

Like many of its global peers, China’s sovereign wealth fund went through a bad patch in 2022 as a trilemma of higher interest rates, inflation and volatility rocked stock and bond returns.

As part of the 2020 settlement with Malaysia, Goldman made an initial US$2.5 billion payment, but lawyers involved in that deal are now under scrutiny.

Financial Secretary Paul Chan says Priority Asia Summit in Hong Kong by Saudi-backed think tank sign of growing ties between country and city.

As China’s economic expansion slows, mainland companies are eyeing the Middle East as an attractive alternative, with countries in the region seeking to develop tech-driven start-up ecosystems to reduce reliance on fossil fuels as a growth driver.

The Saudi public fund would join existing owners including Qatar, which holds 20 per cent, and smaller investors including Singapore’s GIC sovereign wealth fund, which has an 11.2 per cent stake.

CICC and China Galaxy Securities, controlled by Central Huijin Investment, issue statements to the Hong Kong stock exchange denying the merger rumours.

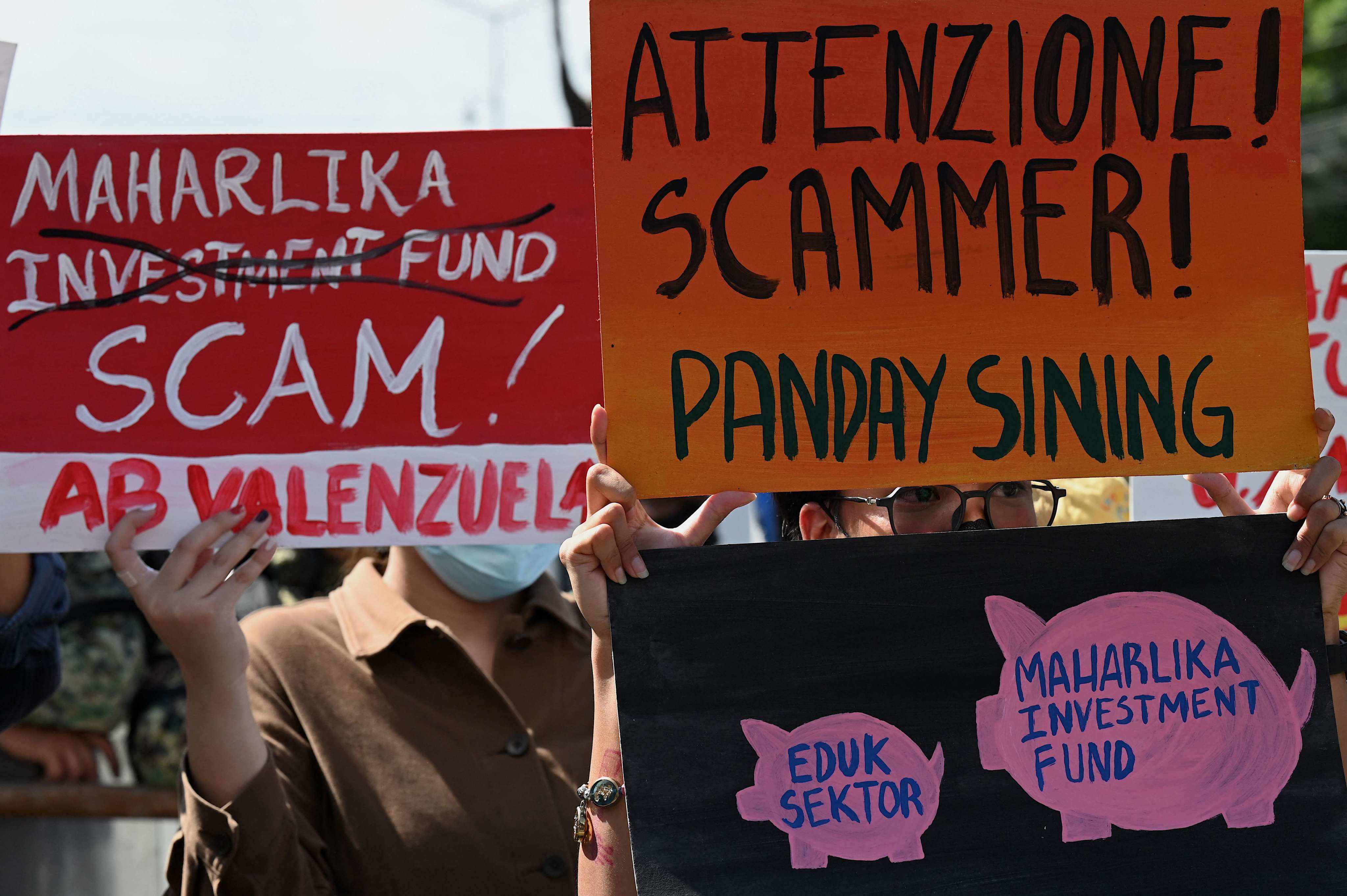

Revised rules empower President Ferdinand Marcos Jnr to accept or reject nominees for top officials of the firm managing the Maharlika Investment Fund.

Filipinos have been warned against investing in schemes claiming to be linked to Philippine President Ferdinand Marcos Jnr’s proposed state fund.

Leaders from the world of finance and business convened in Riyadh issued a warning on Tuesday about the many perils the world currently faces, including geopolitical conflicts, economic uncertainties, high inflation and climate issues.

Central Huijin Investment bought ETFs in yet another bid to bolster the ailing equity market. This follows an investment of US$65.4 million to increase its stake in China’s big four banks two weeks ago.

The factors cited for suspension of the US8.81 billion fund were the same reasons critics cited when they opposed it – that it had no “transparency and accountability” safeguards.

StartmeupHK, which will mark its first full return to physical events since the Covid-19 pandemic, is seen as a bellwether for sentiment in the Hong Kong tech industry.

It is unclear how long the former Goldman Sachs banker will be in the country of his birth. Ng has been sentenced to serve a 10-year term in the US for his role in the 1MDB scandal.