Topic

Wheelock and Co is a Hong Kong-based company that is primarily involved in property investment, property development, property management and agency, and investment holding. It is also involved in the distribution and retail businesses, including Lane Crawford, Joyce and City'Super, with operations in Hong Kong, the British Virgin Islands, the People's Republic of China and Singapore.

- When the South China Morning Post made its first print run in November 1903, Hong Kong was already a bustling entrepot teeming with a vibrant business community

- AS Watson, founded in Guangzhou in 1828 and established in Hong Kong formally in 1841, is the oldest surviving business the city

Buyers snapped up about a quarter of the 112 units at Wheelock’s Monaco Marine residential project in Kai Tak within an hour of the launch on Thursday.

Sino Land and Wheelock both priced hundreds of new flats roughly 12 per cent below comparable projects launched last year, as restrictions that made house sales all-but impossible are loosened.

Wheelock Properties priced the first 112 units at Monaco Marine in Kai Tak at an average HK$24,833 (US$3,167) per sq ft, 12 per cent below a development sold in the same area last summer.

Hong Kong developer Wheelock Properties expects to shrug off headwinds and remains optimistic about the city’s home prices recovering 5 per cent this year if Covid-19 eases.

The flop, in contrast to Henderson Land Development’s sell-out weekend a week earlier, showed how Hong Kong’s property buyers are becoming picky amid a flood of new apartments expected in the market.

Hong Kong’s land border with mainland China will reopen fully to quarantine-free travel by June at the latest, official sources have revealed, signalling a significant breakthrough after months of the city’s intense lobbying to fight the debilitating impact of the checkpoint closures on its economy.

The outlook for the property market has brightened, and transactions of both new and second-hand homes are expected to quicken, sales agents said.

The supply of car parking places has lagged far behind the growth in vehicle ownership, as developers built homes with higher profit margins at the expense of allocating space for vehicles.

The resurgent sales of luxury homes underscores how the Covid-19 pandemic has not impeded the fortunes or spending habits of the wealthy class.

At HK$8,499 per square foot, Wheelock Properties paid 18.3 per cent more than Sun Hung Kai Properties did for an adjacent plot in April.

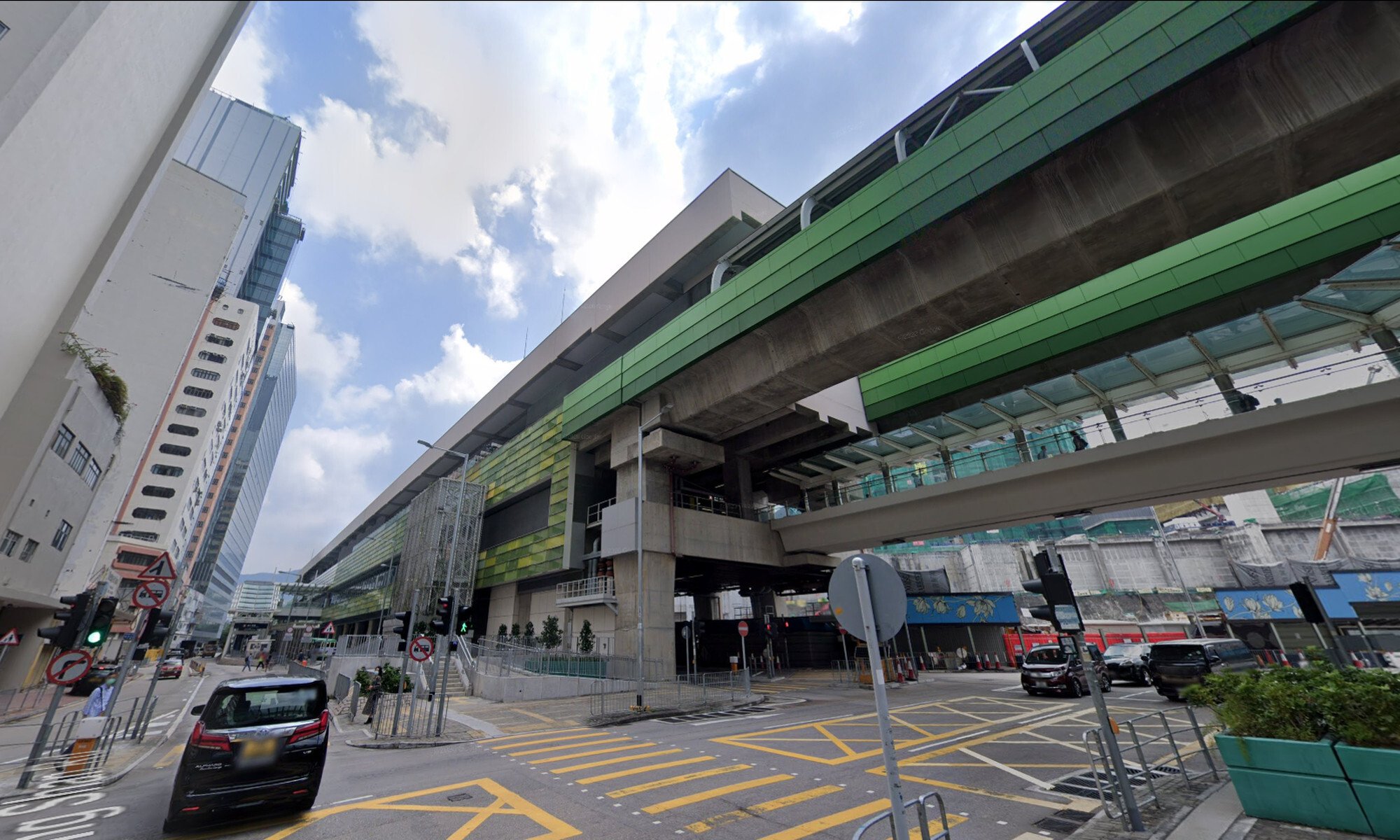

Government board members were absent from meetings related to the discussion and decision to bid for prime site in Central, MTR Corp said to allay public concerns about conflict of interest.

The 286,140 sq ft site on Caroline Hill Road, the first to be offered in the area for tender since 1997, can yield a gross floor area of around 1.1 million sq ft.

Wheelock’s winning bid gives it the last remaining plots of land around the city’s mass transport network.

The brisk sales at Grand Victoria underscore the growing confidence among investors of the of Hong Kong’s economic prospects, as the city claws its way out of its worst recession on record.

Wharf REIC, owner of Times Square and Harbour City luxury malls, says the Covid-19 pandemic might continue to weigh on its retail and hotel operations in Hong Kong this year.

The 10,804 square feet house on 11 Plantation Road requires potential tenants to lodge a HK$1 million deposit.

The dismal result followed a surge in coronavirus pandemic infections in Hong Kong, which kept more potential buyers at home and away from the sales venue, sales agents said.

Companies have already announced US$26 billion of transactions to be taken private by a related party this year, up about 2,500 per cent from the same period in 2019, according to data compiled by Bloomberg.

CK Asset kicked off the current run when it launched its project with the highest price in Lohas Park two weekends ago. Encouraged by strong response to CK Asset’s launch, Wheelock priced Koko Hills project higher than prevailing prices in the neighbourhood.

The first batch of 83 flats could go on sale as early as next week, with prices starting at HK$19,264 (US$2,485) per square foot.

The curtains are coming down on yet another Hong Kong corporate titan as Wheelock and Company prepares to go private after a year-long stock slump.

Mainland developer manages to sell only five flats, or 1.5 per cent, of the 338 units on offer on Sunday.

The mixed results underscore how Hong Kong’s previous residential property bull run has given way to a buyers’ market, as investors now get to have the pick of the best locations with the biggest discounts in an economy mired in its worst recession o record.

Asia’s third-largest equity bourse is trading at the third-lowest valuation across the region’s 14 markets, weighed down by a recession mired in the coronavirus pandemic and almost a year of anti-government protests, creating the perfect conditions for more take-private proposals.

The reversal of fortune for Wheelock’s Grand Marini over two months underscores how Hong Kong’s residential property is becoming a buyers’ market, as investors and owner-occupiers hold out for the best deals amid a glut of choices.

New World Development, Wheelock and Co, and a joint venture owned by Li Ka-shing and Victor Li Tzar-kuoi buy nearly HK$1.5 billion worth of shares last month.

The shaky sentiment shows how Hong Kong’s property market is still struggling to find a footing, amid a combination of the ongoing coronavirus pandemic, and a global stock market rout that are pushing the city’s economy into its first recession in a decade.

The brisk sale by Wheelock, one of Hong Kong’s largest developers, is a much-needed shot in the arm for a city deep in its first technical recession in more than a decade.