Why Chinese investors think India’s tech sector is the next big thing

Tech sector start-ups find saviour in Chinese investors eager to profit from ‘the next big market’

As venture funding in the Indian tech sector slows to a trickle, anxious local start-ups may have found a new backer of their dreams – Chinese investors.

Eager to invest in a market that is home to more than 12,000 start-ups and, they believe, at the tipping point for growth, a slew of Chinese investors are committing to new Indian ventures even as their American and European peers take a step back.

Their ultimate aim? To pick a winner capable of emulating the Chinese Unicorns – firms worth more than US$1 billion.

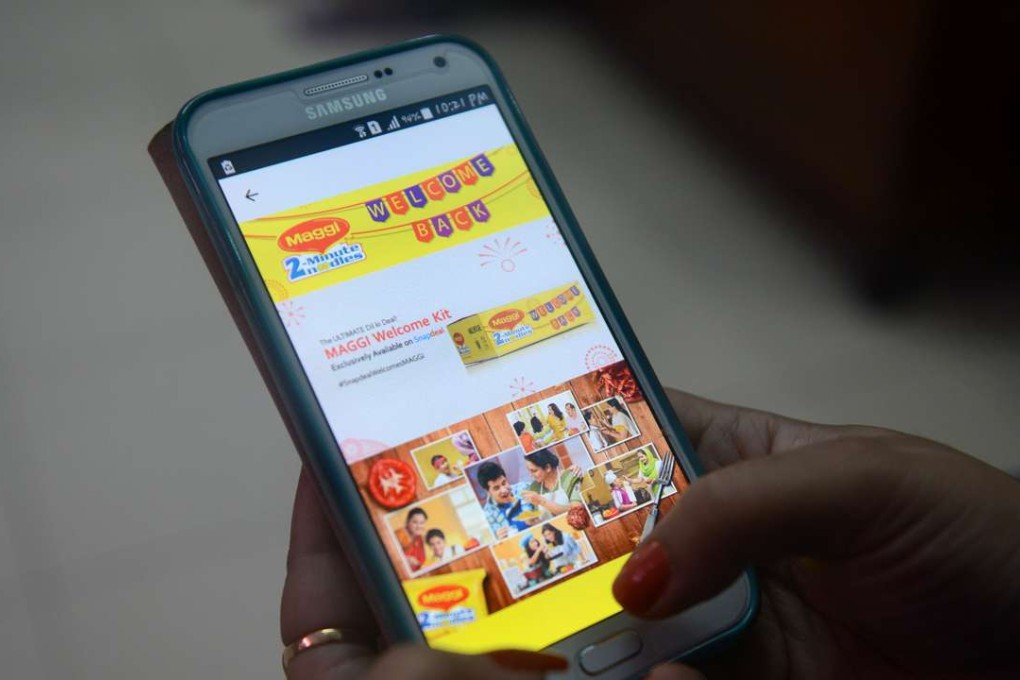

The trend started with a trickle in January last year when Hillhouse Capital invested US$50 million in the start-up CarDekho, an online automobile search engine. Soon after, press reports suggested Alibaba, owner of the South China Morning Post, and its financial-services affiliate were investing more than half a billion US dollars in Paytm, an e-commerce website that subsequently turned into a Unicorn. In August, Indian e-commerce company Snapdeal.com said it had raised US$500 million from investors including Alibaba and Foxconn.

Alibaba, Foxconn invest US$500m in Snapdeal as it targets US$22b Indian e-commerce market

In a recent meeting organised by the Internet And Mobile Association of India (IAMAI), and Onionfans, a Chinese company set up in Bengalore to “act as a bridge between Chinese investors and Indian start-ups”, nine Chinese investors met more than 125 Indian start-ups in the mobile and internet sectors, shortlisting 10 for funding.