Abacus | Who learned the lessons of Thai baht crisis: China or Europe?

Twenty years on from the speculative assault on Thailand’s currency, some policymakers seem to have forgotten what went wrong

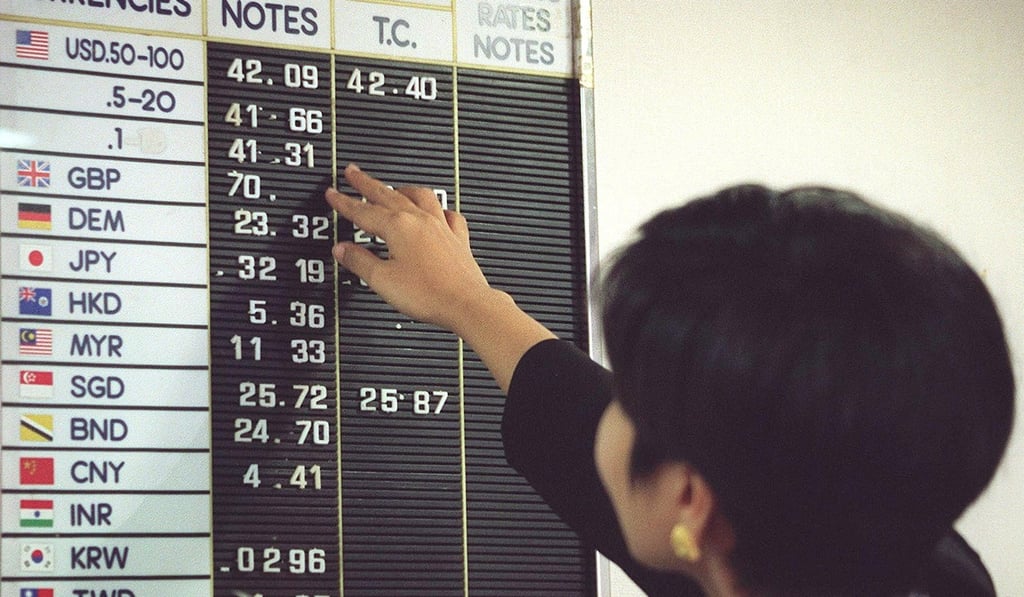

It was the pebble that started a landslide. This month marks the 20th anniversary of the May 1997 speculative assault on the Thai baht. To most people the initial attack passed unnoticed. It was only six weeks later, when the Thai authorities were forced to admit defeat and devalue their currency, that the world sat up and took notice. But from that point the crisis rapidly gathered momentum, spreading by contagion throughout Asia, toppling currencies and governments across the region, rocking emerging economies from Brazil to Russia, and threatening the integrity of some of Wall Street’s biggest institutions.

Now, 20 years on, it is instructive to look back at what happened and see what lessons have been learned, what have been ignored, and what were once learned but have since been forgotten.

As with other, more recent financial upheavals, most observers utterly failed to see the baht crisis coming. At the time, Thailand was widely regarded as the poster child of Asia’s fast-industrialising tiger economies. Analysts were smitten by its fast growth, sound fundamentals, and sky-high returns on investment.

Nevertheless, the warning signs were there. Southeast Asia’s economies, including Thailand, had done well in the early 1990s. By pegging their currencies to the US dollar, which was going through a protracted soft patch at the time, opening their economies to inward investment, and steering capital into favoured sectors, Asian governments rapidly built up export industries whose international competitiveness propelled enviable double-digit growth.

More than one regional leader boasted about a new economic model based on “Asian values” that would displace the flawed systems of the developed world. But behind their braggadocio, problems were emerging. In early 1995, the US dollar bottomed out and began strengthening again, notably against the yen. In Thailand, the initial effects of this turning point were twofold. First, the resulting trade-weighted appreciation of the baht began to undermine the competitiveness of Thailand’s export industries. Second, the central bank was forced to keep interest rates relatively high to maintain its US dollar peg.