Advertisement

iPhone sales are down in China as people buy cheaper handsets

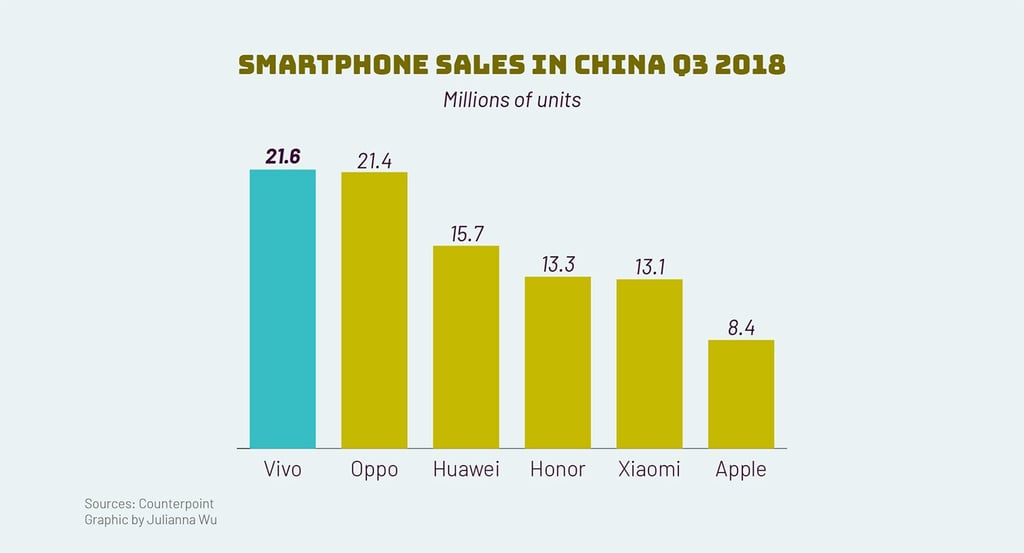

Vivo nabs top spot as rivals see sales slump

Reading Time:2 minutes

Why you can trust SCMP

This article originally appeared on ABACUS

Vivo’s smartphone with a pop-up selfie camera attracted a lot of attention. But it was its budget handsets that saw it snag the top spot in China’s smartphone market in the third quarter of this year.

Counterpoint Research says Vivo sold 21.6 million handsets in that period, up 2% from the previous year. The research firm credited a lineup of handsets that pack flagship-quality features into budget devices. A report by Jiguang Data says Vivo’s most popular model was the X21, which packs a fingerprint sensor under the screen -- something even Samsung doesn’t have.

Right behind Vivo was sister brand Oppo, which sold only marginally fewer handsets -- but that 21.4 million is down 11% from the year before.

Advertisement

The same strategy -- high-end features in cheap handsets -- helped Huawei and Honor (a sub-brand of Huawei) grow rapidly, Counterpoint says. Both of them had a 14% year-on-year growth in Q3, claiming the third and fourth spot and squeezing Xiaomi to the fifth spot, who ranked the third in Q3 last year.

Advertisement

Counterpoint says Xiaomi’s decline in this quarter is largely due to the poor sales performance of its latest flagship Mi 8. But despite the sharp decline, Xiaomi’s actually doing pretty well right now: Its smartphone revenue has actually been growing, based on its latest earnings report.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x